The common view is that when the share of adjustable-rate mortgages (ARMs) in an economy increases, monetary policy transmission becomes stronger.

At the current juncture, for instance, where inflation rose and the central banks responded by hiking monetary policy rates, mortgage payments for borrowers with ARMs have been increasing. For borrowers with fixed-rate mortgages (FRMs), however, payments have stayed the same.

The increase in mortgage payments in the case of ARMs reduces borrowers' disposable income, which might lower their demand, and hence inflation. It is because of such inherent difference between ARMs and FRMs that the common view has been that a higher share of ARMs in an economy makes the monetary policy transmission stronger (Mishkin 2007, Kermani et al. 2014, Di Maggio et al. 2017).

In our recent study, we argue that this common view is incomplete (Altunok et al. 2023). The reason is that an increase in mortgage payments, while bad for borrowers, implies higher interest income for lenders (banks). As banks with higher ARM shares face a favourable interest income outlook when monetary policy tightens, they can increase credit supply more than banks with lower ARM shares. This bank credit channel mutes the contractionary effects of interest rates, hence less effective monetary policy.

Our results build on US banking and mortgage data, which feature several important characteristics. First, adjustable-rate mortgages account for about 25% of residential mortgages. This is relatively low compared with other countries where the ARM share reaches up to 100%. Second, mortgages are extensively securitised and traded among investors. Fannie Mae and Freddie Mac, two prominent government-supported entities, purchase mortgages that meet specific criteria from issuers, subsequently packaging and selling them to investors. Nevertheless, banks, to different degrees, continue to retain a substantial portion of mortgages on their balance sheets. This cross-sectional variation in the ARM holdings across banks is crucial for identifying the role of ARMs in monetary policy transmission. In other countries, however, banks generally hold mortgages on their balance sheets. Third, ARM payments are tied to an ‘index’ that follows an interest rate in the economy such as the US prime rate and the Constant Maturity Treasury rate. And finally, in the US, a typical ARM entails an initial fixed term period ranging from three to five years, after which an adjustable period commences.

We provide three sets of results to quantify the importance of ARMs on monetary policy transmission via banks. We first analyse the role of banks' ARM share in the response of their equity prices to changes in monetary policy stance. We follow a strategy similar to English et al. (2018) and find that the equity prices of banks with higher ARM shares perform better than banks with lower ARM shares when monetary policy tightens. This finding is consistent with the mechanism that banks with a higher share of ARMs would face a better interest income outlook, which increases their valuation.

Next, we analyse whether bank adjustable-rate mortgage shares affect bank lending in response to changes in monetary policy, where we extend the framework used by Gomez et al. (2021). We expect that the credit supply of banks with higher ARM shares will stay stronger than the ones with lower ARM shares when monetary policy tightens since high ARM share banks will be expecting a higher interest income. Our results with bank-level data confirm this prediction.

To better identify the credit supply channel, we use loan-level DealScan data, which allows us to control for loan demand. In particular, we compare credit to the same firm from different banks, thereby controlling for observed and unobserved firm characteristics. Our results with DealScan data confirm our earlier findings, suggesting that the credit supply of banks with higher ARM shares stays stronger than the credit supply of banks with low ARM shares when the monetary policy rate increases.

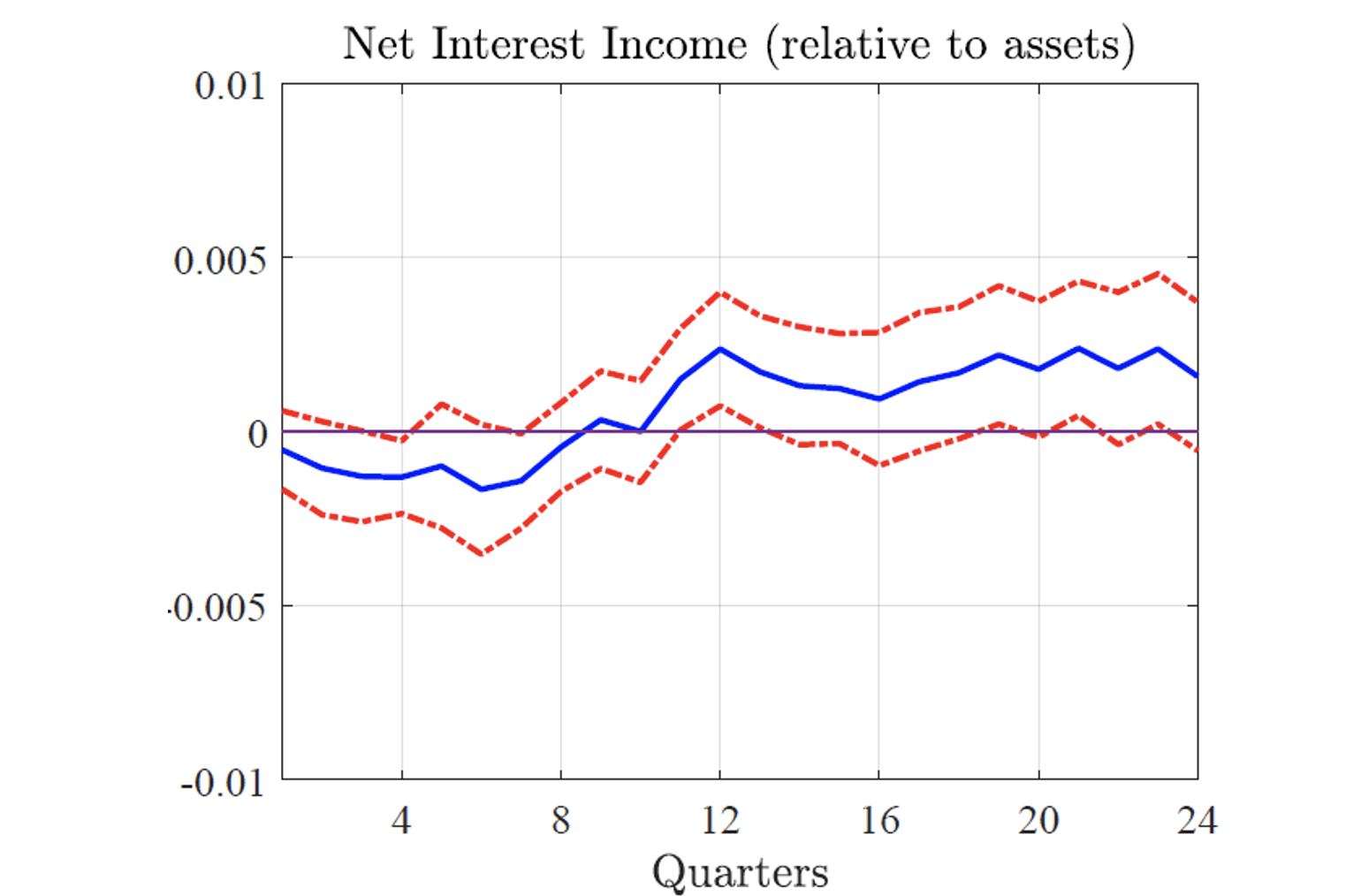

Finally, we delve into the mechanisms that explain our results. We use local projection methods (Jorda 2005) and find that banks with higher adjustable-rate mortgage shares experience higher interest income on mortgages, and eventually higher net interest income (Figure 1). We also show that nonperforming mortgage loans do not increase more for high ARM-share banks. This might be because the small response of house prices to changes in monetary policy and the cost of default.

Figure 1 Interest income of high adjustable-rate mortgage share banks increase more when monetary policy tightens

Note: This figure plots the results from a local projections model where the dependent variable is net interest income. The coefficient of interest is the interaction of bank’s adjustable-rate mortgage share and the change in federal funds rate.

Our results have important policy implications. At least since the 2008 crisis, there has been a view that higher ARM shares would have enhanced the effectiveness of monetary policy. Our findings challenge this view by examining the role of lenders. We demonstrate that banks with a higher share of ARMs mitigate the transmission of monetary policy.

Therefore, combining the borrower and banking channels, the overall impact of adjustable-rate mortgages on monetary policy transmission depends on whether the lenders or borrowers are the marginal agents at a given time. On the one hand, during a banking crisis, such as the one in 2008, a higher prevalence of ARMs may even impede economic activity and amplify risks to financial stability when monetary policy is loosened. This is because a further decline in mortgage payments might push more banks toward closure. On the other hand, during the recent rise in interest rates episode, highly indebted households with ARMs might cut demand strongly, which might dominate the bank credit channel emanating from high banks’ ARM shares. Relatedly, while households with fixed-rate mortgages might be insulated from interest rate increases, the sharp decline in valuations of FRMs in bank balance sheets due to high nominal rates, might lower credit, or even challenge financial stability (as exemplified by several bank failures), hence strengthening monetary policy transmission.

References

Altunok, F, Y Arslan and S Ongena (2023), “Monetary Policy Transmission with Adjustable and Fixed Rate Mortgages: The Role of Credit Supply”, CEPR Discussion Paper No. 18293.

Di Maggio, M, A Kermani, B J Keys, T Piskorski, R Ramcharan, A Seru and V Yao (2017), “Interest rate pass-through: Mortgage rates, household consumption, and voluntary deleveraging”, American Economic Review 107: 3550–88.

English, W B, S J Van den Heuvel and E Zakrajšek (2018), “Interest rate risk and bank equity valuations”, Journal of Monetary Economics 98: 80–97.

Ferreira, C, P Surico and J Cloyne (2016), “Household Debt and the transmission of monetary policy: New evidence”, VoxEU.org, 21 April.

Gomez, M, A Landier, D Sraer and D Thesmar (2021), “Banks exposure to interest rate risk and the transmission of monetary policy”, Journal of Monetary Economics 117: 543–570.

Jordà, Ò (2005), “Estimation and inference of impulse responses by local projections”, American Economic Review 95: 161–182.

Kermani, A, A Ramcharan and M Di Maggio (2014), “Did low interest rates boost households’ consumption?”, VoxEU.org, 5 October.

Mishkin, F S (2007), “Housing and the monetary transmission mechanism”, NBER Working Paper 13518.

Rebelo, S, A Wong and M Eichenbaum (2018), “State-dependent effects of monetary policy: The refinancing channel”, VoxEU.org, 2 December.