There are many costs of war. Compared to the loss of life and limb, the permanent physical and psychological scars, the atrocities, and the destruction of families, hopes, and dreams, the economic costs may pale in importance, yet they remain considerable. Having reliable estimates of these costs and how they affect behaviour has important implications for future recovery and reconstruction.

Many economists try to estimate and analyse the costs of Russia’s war in Ukraine for the Ukrainian economy. For example, the ‘Russia Will Pay’ initiative estimates all material damage inflicted on Ukraine’s civilian infrastructure. According to their estimates, direct damages to the physical infrastructure of Ukraine from 24 February 2022 to 24 February 2023 reached $143.8 billion. The World Bank estimates in its most recent Rapid Damage and Needs Assessment that the cost of reconstruction and recovery in Ukraine has grown to $411 billion as of March 2023, and keeps rising (World Bank 2023). Numerous analytical contributions to the Vox debate on the economic consequences of war also provide assessments of damages to Ukraine’s economy. For example, Blinov and Djankov (2022) estimate that 7.5% of Ukraine’s productive capacity has been lost since the start of the war in 2022. De Groot and Skok (2022) focus on the growing risk of inflation following Russia’s invasion, as well as its causes and consequences. Artuc et al. (2022) find that the lower-bound welfare loss of Russia’s aggression from 2014 to 2019 for residents of Donetsk is equivalent to an income loss of up to 38% over a period of ten years.

In an article forthcoming in a special issue of the Journal of Comparative Economics on Russia’s war in Ukraine (Shpak et al. 2023), we add to this conversation by focusing on the cost of the war to Ukrainian firms arising from damage to collateral and thereby reduced access to finance. Our research is directly related to previous studies of the ‘collateral channel’ through which a shock to collateral value can generate multiplier effects by affecting borrowing ability (Barro 1976, Bernanke and Gertler 1989, Chaney et al. 2012, Gan 2007). The small empirical literature on this topic focuses on ‘shocks’ represented by changes in real estate prices associated with macroeconomic fluctuations. Our work is also related to studies of figurative ‘collateral damage’, which mostly focus on how war reduces international trade (Glick and Taylor 2010). To our knowledge, however, no previous research has studied the damage to collateral value that takes place during a war, and the effects of that damage on financial markets.

Our empirical analysis relies on a remarkable dataset we have assembled using information on all large corporate loans in Ukraine outstanding from February to November 2022. The data include the value and location of different types of collateral posted for each loan, information from summer 2022 on the loss of or damage to collateral, and basic characteristics of corporate borrowers and loan terms. With these data, we can assess how damage to collateral reduces collateral value, and how that in turn affects the firm-level incidence of default, probability of default, and access to new borrowing.

We find that reductions in collateral value induced by damage to collateral have been substantial and that this has damaged firms’ and banks’ financial performance. Loan defaults and banks’ assessments of expected default probabilities both increased, while firm borrowing decreased in association with the decline in collateral value. The impact is greater on actual defaults than on default probability, and we speculate that banks’ assessments may lag the true default probability due to the relaxation of credit risk assessment and lack of information, which would suggest increasing defaults in the future.

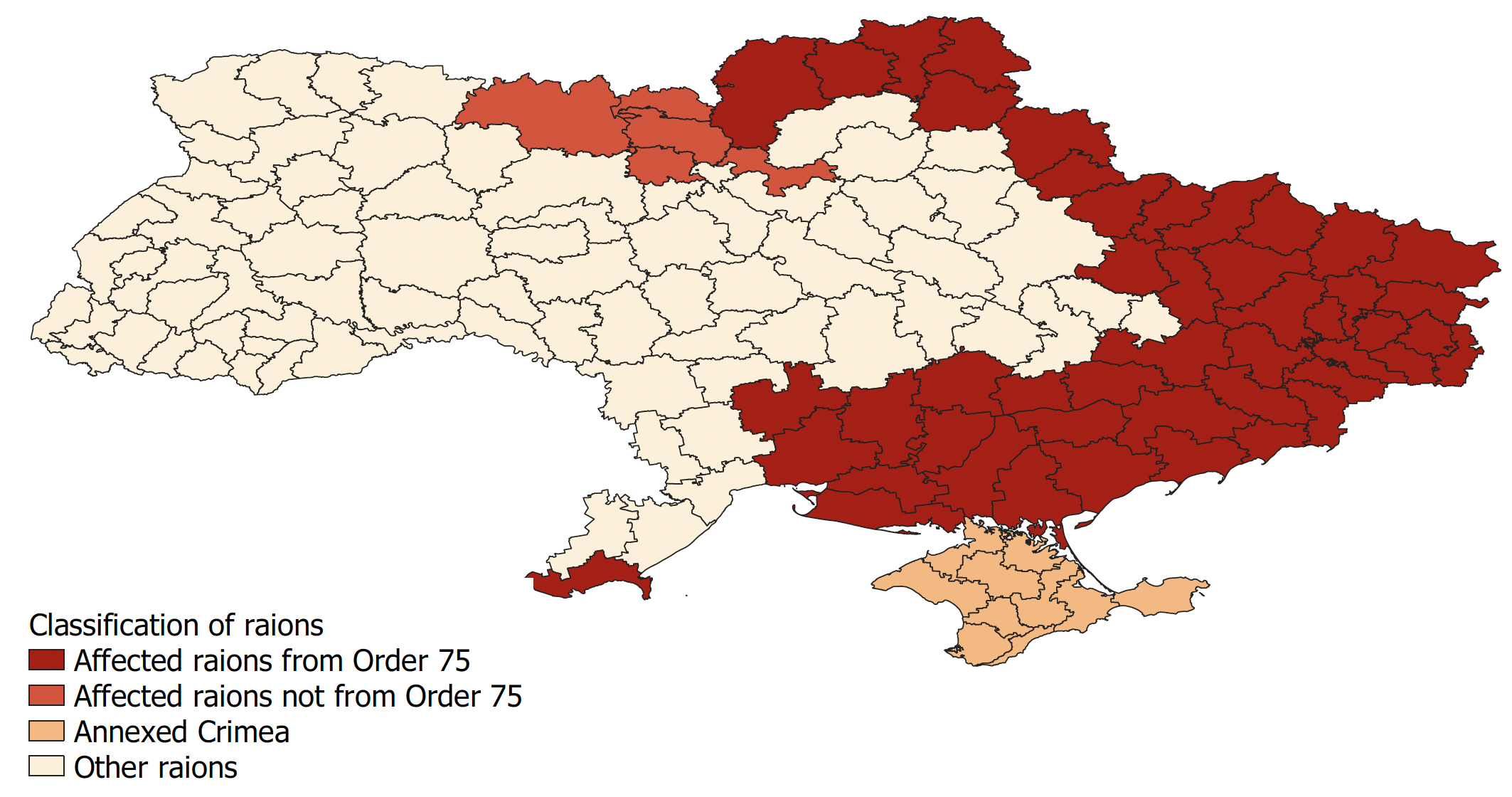

We address potential endogeneity and measurement error with an instrumental-variables (IV)/multiple-indicator strategy that exploits plausibly exogenous changes to collateral value resulting from damage to collateral, controlling for bank, industry, and macro-region fixed effects and whether collateral and borrower are located in areas directly affected by invasion and occupation (see Figure 1). Our finding of substantially larger magnitudes of the IV compared to the OLS coefficients is consistent with the presence of substantial measurement error in assessments of collateral value. Faced with uncertainty about the extent of damage and loss of control over collateral, accountants may opt to maintain the same values on the books. If so, then the full extent of damage to collateral has not yet been recognised, suggesting that defaults and capital access could worsen further.

Figure 1 Classification of raions affected by Russia’s invasion

Note: The map depicts 136 raions of Ukraine. Dark red raions are those in which at least one hromada was listed in Order 75. Light red raions were temporarily occupied and then liberated prior to April 25, 2022, and so are not listed in Order 75. The detached raion in Odesa region is Izmail, which includes Zmiinyi (Snake) Island, which was occupied from February to June 2022.

The outlook is highly uncertain. The war is ongoing and great damage still being done, with the breach of the Kakhovka Dam and all the destruction from flooding downstream a salient example at this moment of writing. The economic and environmental losses due to Kakhovka Dam destruction are estimated at $4 billion while the long-term cost (which our study suggests would include the direct and indirect consequences of damage to collateral) may amount to an additional $2 billion (Djankov 2023). Based on very recent data from the first nine months after the full-scale invasion, our study likely captures only a fraction of damage from the war. Even for damage during this period, the lack of change in collateral value recorded for many loans may simply reflect the time-consuming and uncertain process of collateral revaluation. In attempting to deal with this measurement error as well as potential endogeneity, we rely on a survey from an earlier period (July rather than November), which also creates caveats. The short lapse of time also means that data on outcomes, such as employment, output, and production are unavailable. Nor do we observe changes in firm and establishment location resulting from the war. Addressing these issues would present fruitful avenues for future research.

Nonetheless, with these caveats, the results in this column provide further evidence complementing the small empirical literature on the collateral channel in amplifying business cycles. In contrast with that literature, which generally studies the impact of changes in collateral value resulting from shocks to real estate and land prices in countries such as the US and Japan, the ‘shock’ we examine is the destruction and havoc wrought by Russia’s full-scale invasion of Ukraine. Our analysis also demonstrates the importance of indirect (‘collateral’) damage to Ukraine’s financial system resulting from the war and begins to quantify part of the massive reconstruction effort that will – soon, we hope – be possible and necessary.

References

Artuc, E, N Gomez Parra and H Onder (2022), “Estimating the true cost of war: The conflict in Eastern Ukraine (2014-2019)”, VoxEU.org, 10 December.

Barro, R J (1976), “The Loan Market, Collateral, and Rates of Interest”, Journal of Money, Credit and Banking 8(4):439–456.

Blinov, O and S Djankov (2022), “Assessment of damages to Ukraine’s productive capacity”, VoxEU.org, 21 September.

Bernanke, B and M Gertler (1989), “Agency Costs, Net Worth and Business Fluctuations”, American Economic Review 79(1): 14-31

Bernanke, B and M Gertler (1990), “Financial Fragility and Economic Performance”, Quarterly Journal of Economics 105(1): 87–114.

Chaney, T, D Sraer and D Thesmar (2012), “The Collateral Channel: How Real Estate Shocks Affect Corporate Investment”, American Economic Review 102(6): 2381–2409.

de Groot, O and Y Skok (2022), “War in Ukraine: Ukraine’s monetary-financial vulnerabilities”, VoxEU.org, 15 November.

Djankov, S (2023), “The cost of the Kakhovka Dam destruction”, VoxEU.org, 10 July.

Gan, J (2007), “Collateral, Debt Capacity, and Corporate Investment: Evidence from a Natural Experiment”, Journal of Financial Economics 85(3): 709–734.

Glick, R and A M Taylor (2010), “Collateral Damage: Trade Disruption and the Economic Impact of War”, The Review of Economics and Statistics 92(1): 102–127.

Shpak, S, J S Earle, S Gehlbach and M Panga (forthcoming), "War, Collateral Damage, and Firm-Level Consequences", Journal of Comparative Economics (forthcoming).

World Bank (2023), “Ukraine Rapid Damage and Needs Assessment: February 2022 - February 2023 (English)”, Washington, DC.