The media and the Federal Reserve Board of Washington (‘the Fed’) are obsessed with the negative side of inflation – its effect on real incomes. On the basis of the Consumer Price Index,

the annual inflation rate reached a peak of 9.1% in June 2022, the highest level since June 1982, though it has since fallen to 3.1% in November 2023. On the current account front, this means that real income has eroded. This is the ‘income effect’ of inflation.

However, there is an upside to inflation as well. Indeed, inflation has been a boon to the middle class in terms of its balance sheet. It is also a factor that has helped to promote real wealth growth and reduce overall wealth inequality.

A simple example can illustrate this point. Suppose a person holds $100.00 in assets and has a debt of $20.00. Her net worth is then $80.00. Suppose inflation is running at 5% per year and the value of her assets also goes up by 5% over the year. Then, in real terms the value of her assets remains unchanged over the year. But what about her debt? In real terms her outstanding debt is now down by 5% and the real value of her net worth rises to $81.00 (100 – 20 x 0.95). In other words, the person’s real net worth is now up by 1.25% (81/80). It should be clear that the higher the ratio of debt to assets, the greater the percentage increase in net worth. (This, by the way, is the principle of leverage). For example, if the debt is $40.00 instead of $20.00, then net worth would grow by 3.33% (62/60).

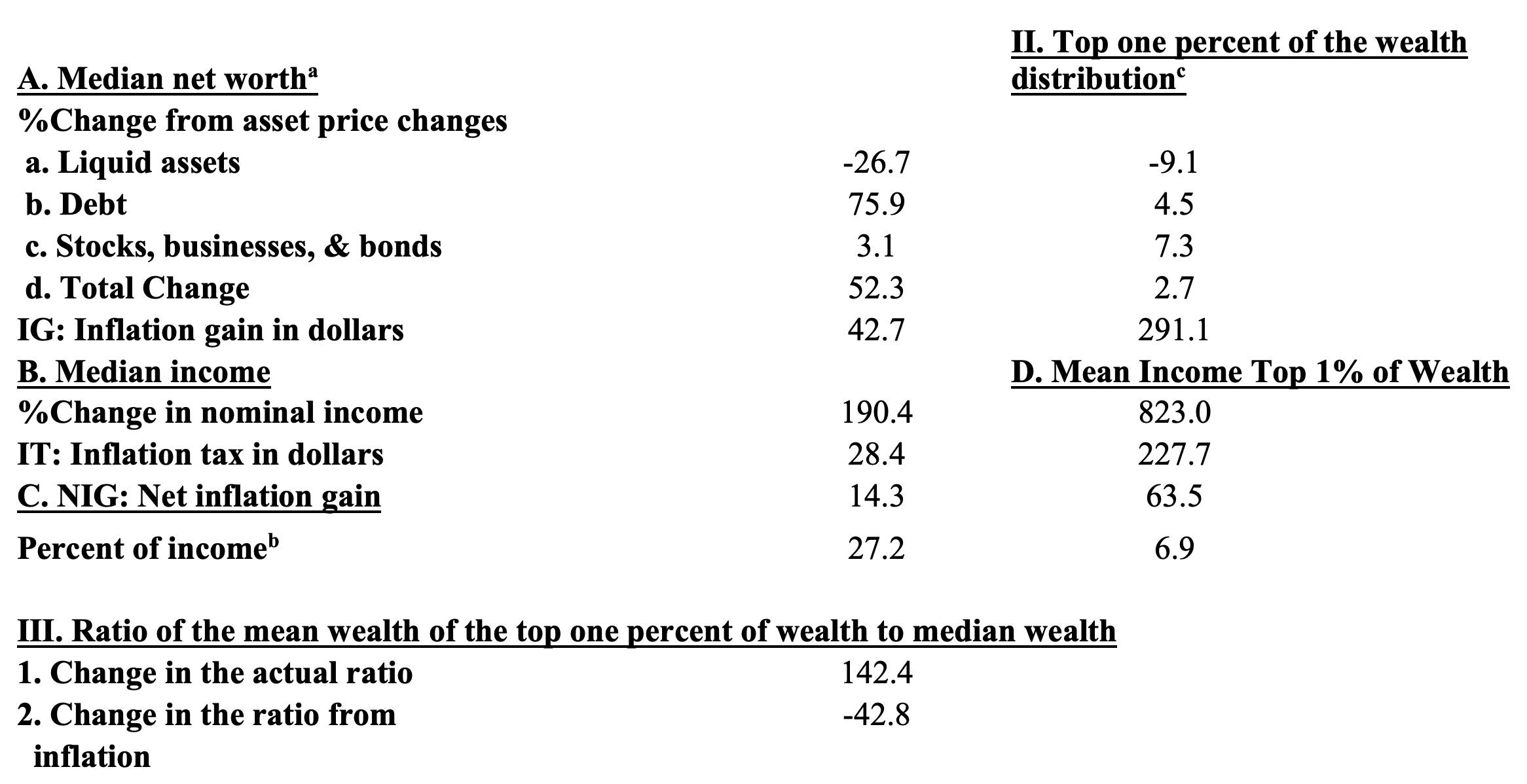

What is the net effect of inflation? The best way to decide on this issue is to compare the income effect of inflation with the wealth effect. If the income effect (which is always negative as long as inflation is positive) is greater, then the net effect is a loss. However, if the wealth effect is greater, then the net effect is a gain. Now, at least until recently, inflation has been quite moderate. Indeed, based on Current Population Survey data, real median household income actually rose by 34.4% from 1983 through 2019. However, without any inflation, median income would have grown by 229%. In dollar terms this amounts to a loss of $30,200 (in 2019 dollars) over these years. On the other hand, inflation by my calculations bolstered median wealth by 52.3% over these same years and this equals $42,700 in 2019 dollars (see Table 3). That is quite a bit greater than the income loss from inflation and here the wealth effect dominates the income effect. So, in terms of household well-being, inflation on net has been a boon to the middle class.

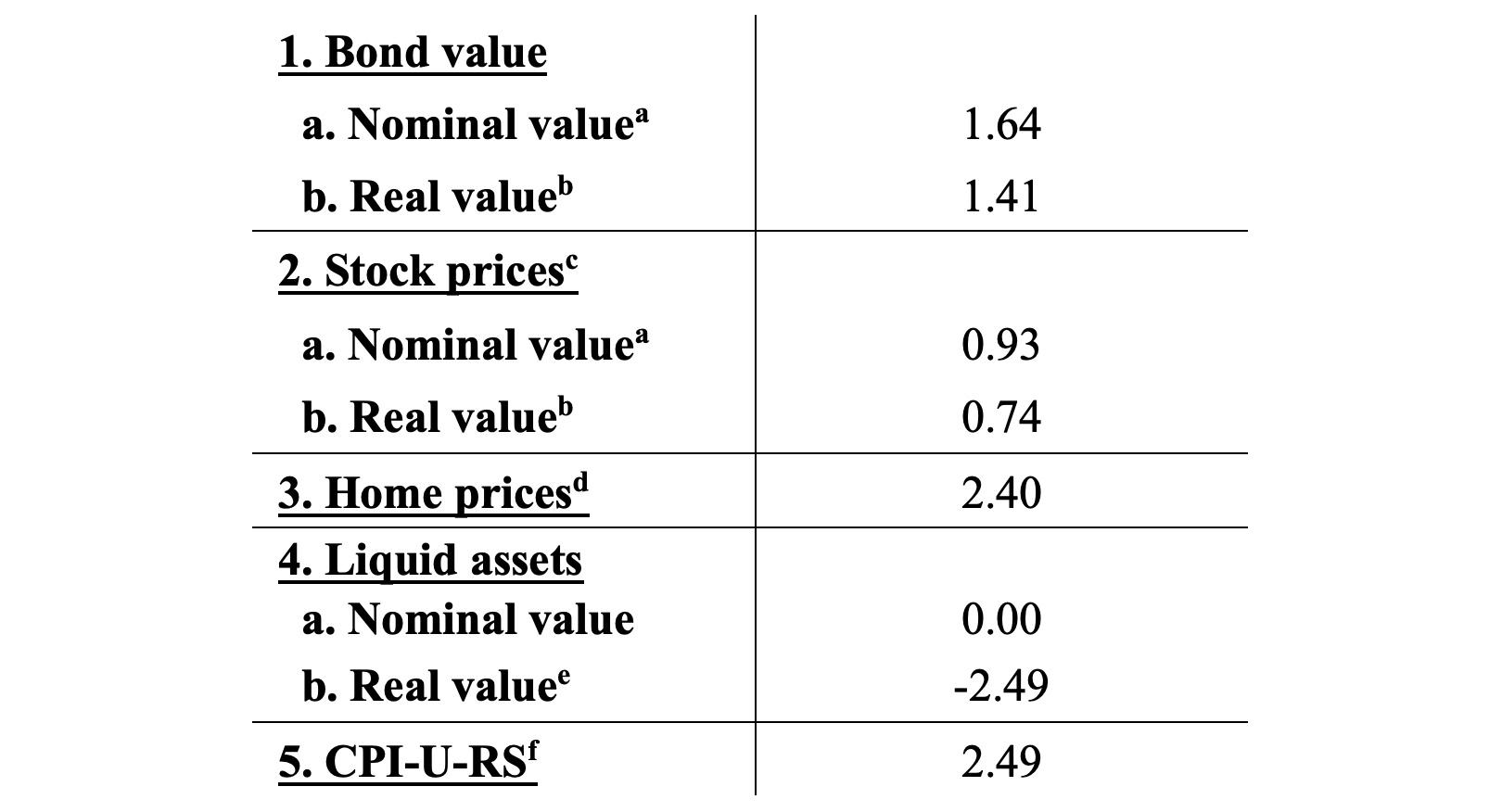

The effect of inflation on the household balance sheet is more than just leverage. There are also impacts on bond values, stock values, and the value of liquid assets. Table 1 shows the time trends in the key ingredients for the analysis of the net inflation gain for years 1983-2019. By far the fastest rate of increase occurred for home prices and debt, 2.40% and 2.49% per year, respectively. This was followed by real bond values, at 1.64% per year, and then stock prices at 0.74% per year. In contrast, the real value of liquid assets declined at an average annual rate of 2.49%, mirroring that of the CPI-U-RS index.

Table 1 Annual rate of change by asset type and debt, 1983-2019 (percentage)

Note: a. Based on US Treasury Securities (Constant Maturity): Ten-year nominal bond rate for ten-year period. b. Based on US Treasury Securities (Constant Maturity): Ten-year real bond rate for ten-year period c. This is based on my calculation of the present value of future profits. See Wolff (2023) for details. d. Based on 30-Year Fixed Rate Mortgage Average in the US, Percent, Weekly, Not Seasonally Adjusted Equivalent monthly payments: 30-year mortgage and 20% down payment. e. The CPI-U-RS is used as the deflator. f. Source: https://www.bls.gov/regions/mid-atlantic/data/consumerpriceindexhistorical_us_table.htm.

It is also of note that when comparing real and nominal trends, differences are relatively small. The annual rate of change in the nominal value of bonds was 1.64%, compared to 1.41% for real values, and those in stocks were 0.93% and 0.74%, respectively. The higher values for the nominal series are due to the fact that the differential between the nominal and real rate of change narrowed over these years because inflation fell.

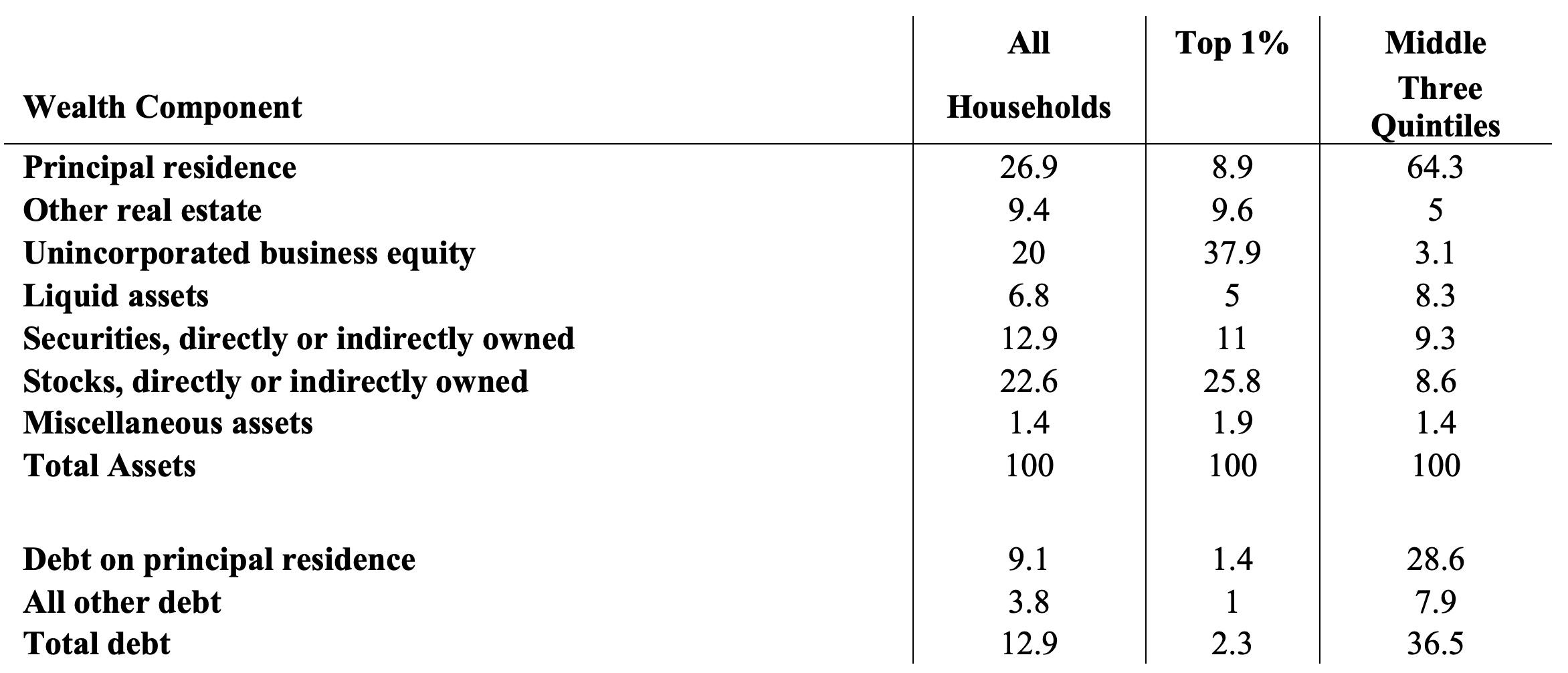

Different groups will experience inflation differently depending on the composition of their wealth. Table 2 presents the ‘consolidated’ wealth accounts in which stocks and bonds owned indirectly through defined contribution plans like 401(k)s and individual retirement accounts (IRAs), mutual funds, and trust funds are allocated to their constituent elements. In 2019 owner-occupied housing was the most important household asset among all households, accounting for 26.9% of total assets. Real estate, other than owner-occupied housing, comprised 9.4%, and business equity another 20.0%. Demand deposits, time deposits, money market funds, certificates of deposit (CDs), and life insurance (collectively, ‘liquid assets’) made up 6.8%. Financial securities, on the other hand, amounted to 12.9% and corporate stocks 22.6%. The debt-net worth ratio was 14.9% and the debt-income ratio 104.0%.

The tabulation in the first column provides a picture of the average holdings of all families in the economy, but there are marked differences in how middle-class and rich families invest their wealth. The largest asset among the richest 1% was business equity, which comprised 37.9% of their total assets. Stocks were second, at 25.8%, followed by securities and then other real estate. Housing accounted for only 8.9% and liquid assets 5.0%. Their debt-net worth ratio was only 2.4% and their debt-income ratio was 45.3%.

In contrast, 64.3% of the assets of the middle three wealth quintiles of households was invested in their own home. However, home equity amounted to only about a third of total assets, a reflection of their large mortgage debt. Another 8.3% went into monetary savings of one form or another. The remainder was split among non-home real estate, business equity, financial securities, and corporate stock. Their debt-net worth was 57.5%, and their debt-income ratio was 122.0%, both much higher than those of the top percentile.

Table 2 Composition of household wealth by wealth class, 2019

Consolidated accounts (percent of gross assets)

Source: Author's computations from the 2019 Survey of Consumer Finances.

Note: Households are classified into wealth class according to their net worth. Brackets for 2019 are: Top 1%: Net worth of $11,115,200 or more. Quintiles 2 through 4: Net worth between $20 and $471,600.

How do asset price movements resulting from inflation affect the wealth position of these two groups? With regard to median wealth, they led to a hefty 52.3% gain in median wealth over 1983-2019, compared to the actual advance of 23.4% (see Table 3). The devaluation of debt by itself led to a 75.9% advance, while the reduction in the real value of liquid assets subtracted 26.7%. The other components of wealth were unimportant. In dollar terms, the inflation gain IG was $42,700. In contrast, the inflation tax, IT, on median income amounted to only $28,400, so that the net inflation gain, NIG, was a robust $14,300 or over a quarter of median income.

Table 3 The inflation tax on median net worth and the mean net worth of the top 1% of the wealth distribution, 1983-2019

Source: Author's computations from the Survey of Consumer Finances (SCF) based on nominal and real 10-year bond rates for 10 years.

Note: Dollar figures are in 1000s, 2019 dollars. Households are classified into wealth class according to their net worth. Wealth and income figures are deflated using the Consumer Price Index CPI-U-RS. a. The mean wealth of the middle three wealth quintiles is used to compute the composition of wealth of for the median wealth group. b. Mean value over the period. c. Results based on the mean wealth of the top one percent of the wealth distribution.

In contrast, inflation led to only a 2.7% growth in the mean wealth of the of the top wealth percentile. The main contributor to this gain, 7.3%, was the appreciation of stocks, businesses, and bonds collectively. The depreciation of debt contributed another 4.5% and this was offset by 9.1% from the loss of value of liquid assets. Overall, the mean wealth of the top percentile rose by 2.7% from asset price changes. In dollar terms, the inflation gain was $291,100. The inflation tax IT on the mean income of this group came to $227,700, so that the net inflation gain was a positive $63,500. It might seem surprising that the net inflation gain was positive since this group has very low leverage (that is, a very small debt to net worth ratio). However, the key is that this group also had an extremely high wealth/income ratio of 23.5, so that the wealth effect dominated the income effect.

The inequality analysis is based on the ratio of the mean wealth of the top 1% to median wealth. I can then determine what portion of the change in this ratio is due to asset price changes emanating from inflation. On the basis of this measure, actual wealth inequality increased over the period 1983-2019 (first row of Panel III). The next row shows what happens to the wealth ratio when asset price changes resulting from inflation only is added to initial wealth. The upshot is that inflation reduces the wealth ratio, and the effect is quite large. Over the full 1983-2019 period, the wealth ratio more than doubled, from 131.4 to 273.8. However, inflation by itself cut the wealth ratio by about a third from 131.4 to 88.6.

The middle class make out like bandits from inflation. Why is it apparently so opposed to inflation? Inflation also lowers wealth inequality and boosts real wealth growth, both mean and particularly median. Why does the Fed keep trying to squelch inflation? The reason is that people tend to feel the income effect of inflation but are not aware of the wealth effect. From a psychological point of view, people do not see the effect of inflation on their balance sheet. If they did, they might urge the Fed to promote inflation rather than dampening it. What about the recent drop in inflation? It’s bad news for the middle class.

References

Adam, K and J Zhu (2015), “Price level changes and the redistribution of nominal wealth across the euro area”, ECB Working Paper No. 1853, September.

Cao, S, C A Meh, J-V Ríos-Rull and Y Terajima (2020), “The welfare cost of inflation revisited: The role of financial innovation and household heterogeneity”, Journal of Monetary Economics 118(C): 366–380.

Doepke, M and M Schneider (2006), “Inflation and the Redistribution of Nominal Wealth”, Journal of Political Economy 114(6): 1069–1097.

Kose, M A, F Ohnsorge and J Ha (2022), “Today’s inflation and the Great Inflation of the 1970s: Similarities and differences”, VoxEU.org, 30 March.

Meh, C A, J-V Ríos-Rull and Y Terajima (2010), “Aggregate and welfare effects of redistribution of wealth under inflation and price-level targeting”, Journal of Monetary Economics 57(6): 637–652.

Sangani, K (2023), “Evidence – and an explanation – for the recent surge in inflation inequality”, VoxEU.org, 3 December.

Wolff, E N (2023), “Is There Really an Inflation Tax? Not For the Middle Class and the Ultra-Wealthy”, NBER Working Paper No. 31775, October.