The sharp increase in earnings and income inequality observed in the US in the late 20th century sparked a heated policy debate and large academic literature on the causes of distributional change. The vast majority of existing analyses provide snapshots of the distribution of income or earnings at a given point in time, without considering the trajectories of individual earnings over their lifecycle. Recent work has been able to exploit social security or earnings data that follow individuals over their entire careers in order to construct measures of individuals’ lifetime earnings and ask how their median and distribution have varied over time.

In a recent paper, Guvenen et al. (2022) use panel data on individual labour income histories to construct individual lifetime earnings (LTE) for the cohorts entering the labour market between 1957 and 1983. Their findings indicate that median lifetime earnings declined for men while increasing sharply for women. Inequality in LTE rose markedly for both groups, although overall inequality remained roughly flat as women’s earnings caught up with men’s and offset rising within-group inequality.

These results raise the question of to what extent the patterns found for the US are observed elsewhere. Cross-sectional analyses, such as Pistaferri et al. (2022), show that high-income countries have displayed a variety of experiences rather than following a common pattern of rising inequality, as is sometimes asserted. Do the same differences appear when we look at lifetime earnings?

Different trends in median lifetime earnings in France and the US

In Garbinti et al. (2023), we construct series for lifetime earnings in France. France provides an interesting comparison. Existing work indicates that, compared to the US, France is characterised both by a low level of cross-sectional inequality (Alvaredo et al. 2018, Goupille-Lebret et al. 2018, Piketty et al. 2020), and by limited income mobility (Aghion et al. 2023, Kramarz et al. 2022). Knowing how these two features translate into lifetime earnings remains an open question.

Our methodological setting follows Guvenen et al. (2022) in order to provide meaningful comparisons. We compute lifetime earnings based on the Permanent Demographic Sample for France. This large socio-demographic panel includes administrative payroll data from firms over the period 1967–2017. For each individual, we define lifetime earnings as the average of annual earnings between ages 25 and 55. This 31-year period, the ‘lifetime’, is available for those born between 1942 and 1962, with the latest cohort reaching age 55 in 2017.

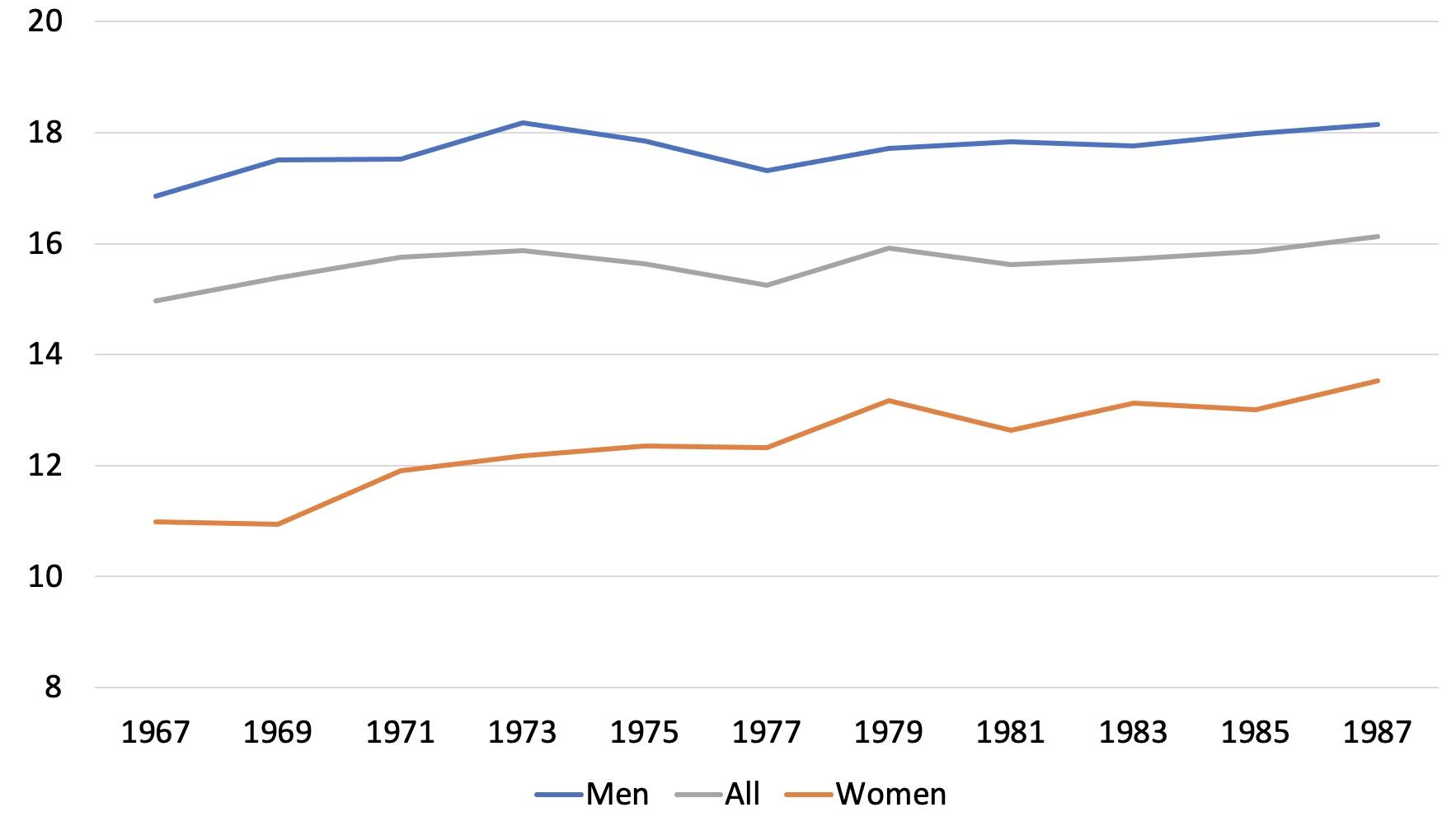

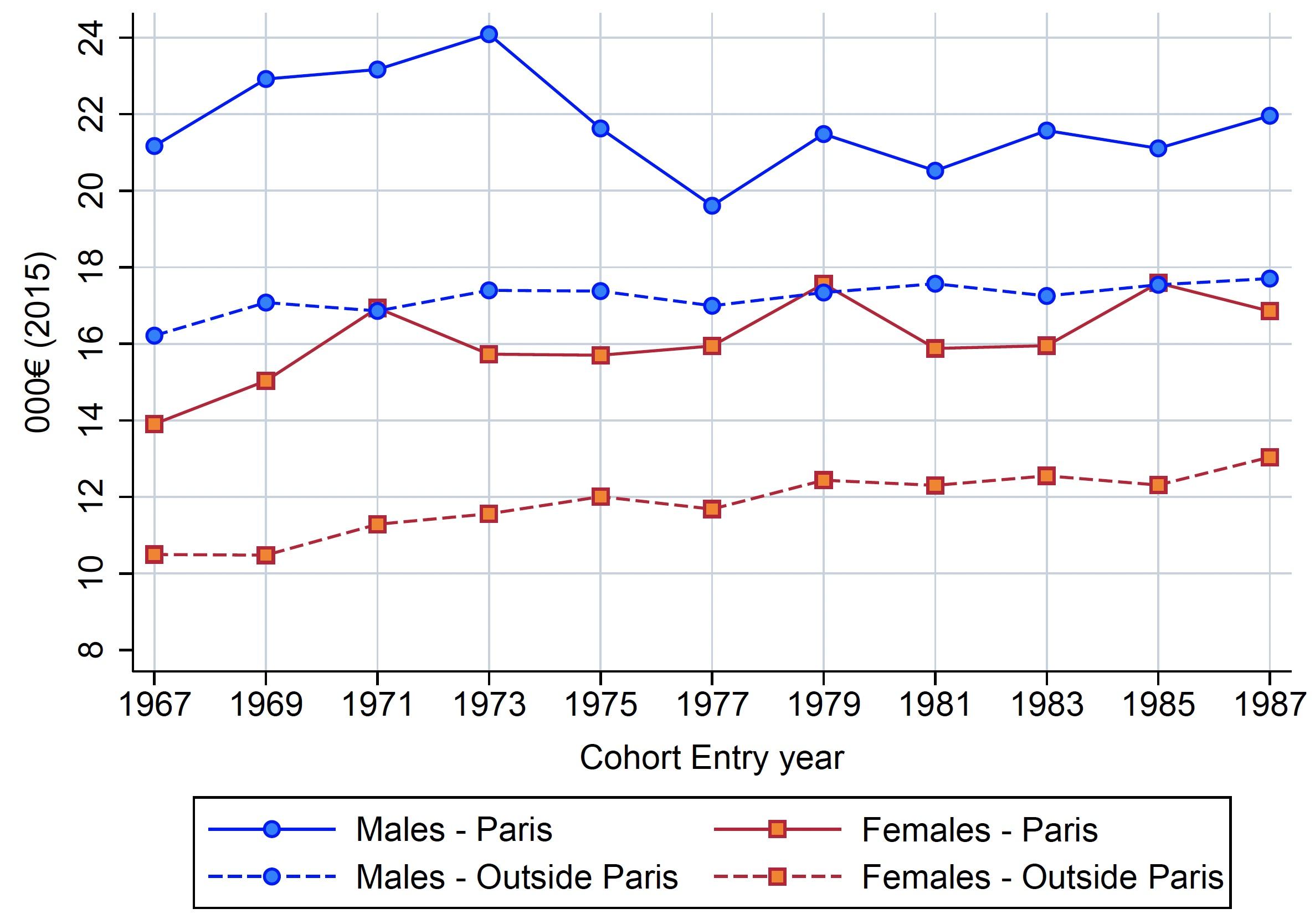

Figure 1 shows that median annualised lifetime earnings increased from €15,000 for the cohort entering the labour market in 1967 to about €16,100 for the 1987 cohort. Median lifetime earnings are lower for women, yet the trends across cohorts display a remarkable similarity, with most of the increase occurring for the first cohorts and exhibiting a flat trend from 1973 for men and 1979 for women.

Figure 1 Median lifetime earnings by cohort and gender in France

Source: Garbinti et al. (2023)

Notes: Lifetime earnings are defined as the average of annual earnings between ages 25 and 55. Thousands of 2015 euros. X-axis: year of entry into the labour market.

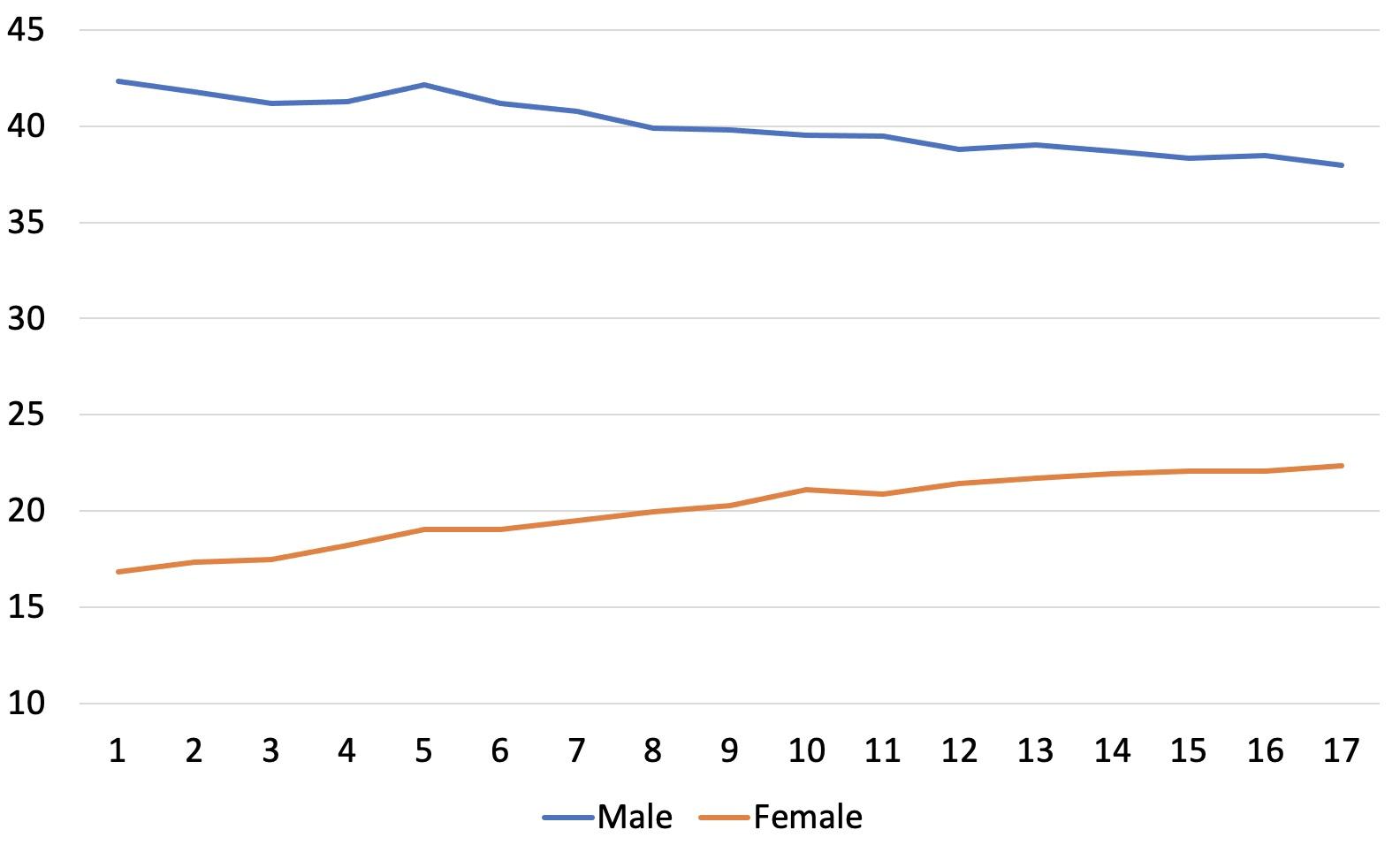

Figure 2 displays the dynamics of LTE for the US. In contrast to France, the patterns differ strongly across genders. There were considerable losses for men (-10%) and large gains for women (+33%), while in France both men and women experienced growth, by 5% and 19% respectively for the comparable cohorts (those entering between 1967 and 1983).

Figure 2 Median lifetime earnings by cohort and gender in the US (in dollars)

Source: Guvenen et al. (2022)

Note: Lifetime earnings defined as the average of earnings between ages 25 and 55. Thousands of 2013 dollars. X-axis: year of entry into the labour market.

The reduction in the gender gap in lifetime earnings across cohorts

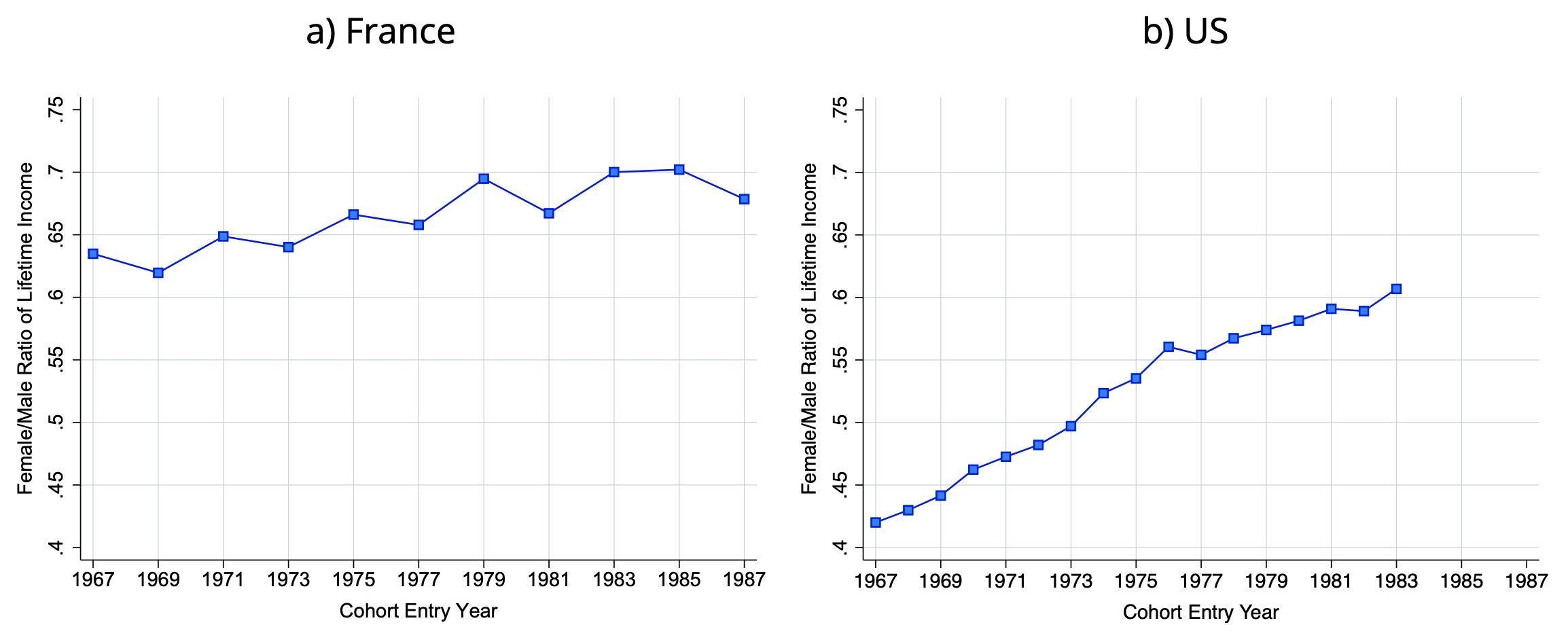

In the US and in France, the lifetime gender gap has narrowed across cohorts (Figure 3). Women’s LTE as a percentage of men’s are, however, far larger in France than in the US for all cohorts. In France, this ratio increased from 61% to 70% over the 1967 to 1983 cohorts, while in the US it soared from 41% to 60%.

Much of the change in the gender gap in France is explained by differential developments in working time and educational attainment. In particular, the contribution of differences in working time to explaining the gender gap has increased from 30% to 60% across cohorts. The number of years worked in part-time occupations has increased much more for women than for men, which has contributed to deepening the gender gap. Meanwhile, education played a considerable role in reducing the gender gap: the fast increase in women's educational attainment and a reduction in the gap between women and men in the returns to education have been key.

Figure 3 Gender lifetime earnings gap

Sources: Garbinti et al. (2023), Guvenen et al. (2022)

Note: Ratio between female and male lifetime earnings for successive entry cohorts.

Inequality in lifetime earnings

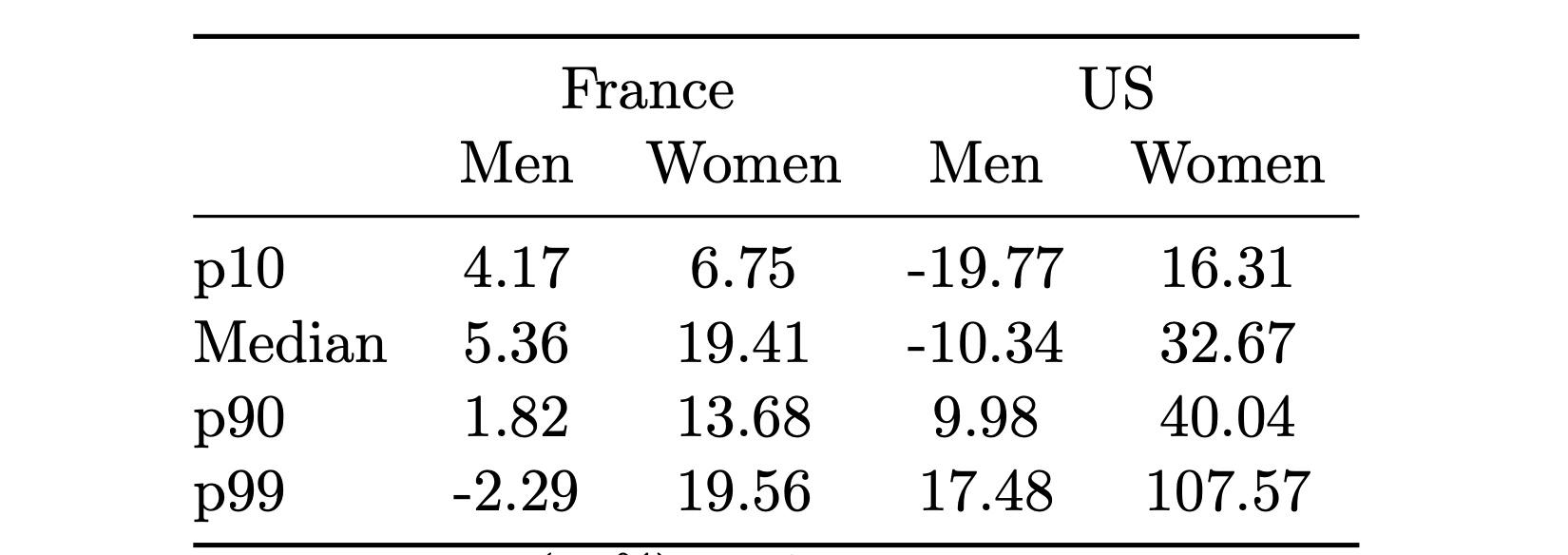

To examine inequality trends, we compute the lifetime earnings of selected percentiles. Our results indicate that the increases in median LTE in France documented above are reflected throughout the whole distribution, unlike the picture for the US. In order to compare the two countries, Table 1 reports growth rates at selected points of the distribution for France and the US.

Table 1 LTE growth for various percentiles: France and the US, 1967–1983 cohorts

Sources: Garbinti et al. (2023); Guvenen et al. (2022)

For men, we observe an evolution in earnings that is more favourable to the p10 (cumulated growth of 4.2%) than to the p90 (1.8%), which reflects the decrease in labour income inequality that took place in France up to the early 1980s. This contrasts with the US, where Guvenen et al. (2022) document a strong decrease for the p10 (-20%) and an increase for the p90 (+10%).

For women, we find a larger increase at the top, where the rate of growth for lifetime earnings is about twice as large for the p90 than for the p10 over the 1967–1983 cohorts (6.7% for the p10 versus 13.7% for the p90). This pattern of faster growth for women at the top than at the bottom of the distribution is also observed in the US, although both the increases for women and the gap between the top and the bottom are much larger in the US than in France (+16% for the p10 vs. +49% for the p90).

Further analysis confirms the results implied by Table 1. In France, inequality in LTE is low and displays a mild U-shaped pattern, with lifetime earnings inequality first falling and then increasing. Such a pattern appears for men, for women, and for the population as a whole, and differs from the pattern in the US. Guvenen et al. (2022) report higher initial inequality in lifetime earnings and a steady increase across cohorts for both men and women, though the large reduction in the gender gap illustrated above implies that overall earnings inequality remained roughly flat.

One of the advantages of our dataset is that we have census information that we can exploit to explain what factors have driven the dynamics of lifetime earnings. Notably, we have information on individuals’ places of birth and education. Our analysis indicates that education plays a major role in LTE dynamics. We find a decline in the returns to all educational degrees other than masters or above. This decline was offset by increased educational attainment, one of the main factors responsible for LTE growth across cohorts.

Place of origin also plays a role. Given the importance of Paris and its surrounding region in terms of employment and labour productivity, we consider two possible birth locations: the Paris region and the provinces. Figure 4 reports median lifetime earnings for individuals born in either location. It indicates that lifetime earnings are between 20% and 35% higher for men born in the Paris region than for other men, and around 30% higher for women. The advantage conferred by being born in the Paris region is largely explained by thus being more likely to work there and having a higher educational attainment.

Figure 4 Lifetime earnings by birth location

Sources: Garbinti et al. (2023)

Note: The figure displays median lifetime earnings for men and women, with the population split between those born in the Paris region and those born elsewhere.

References

Aghion, P, V Ciornohuz, M Gravoueille and S Stantcheva (2023), “Anatomy of inequality and income dynamics in France”, mimeo.

Alvaredo, F, L Chancel, T Piketty, E Saez and G Zucman (2018), World inequality report 2018, Harvard University Press.

Garbinti, B, C García-Peñalosa, V Pecheu and F Savignac (2023), “Trends and Inequality in Lifetime Earnings in France”, CEPR Discussion Paper 18472.

Goupille-Lebret, J, T Piketty and B Garbinti (2018), “Income inequality in France: Economic growth and the gender gap”, VoxEU.org, 5 September.

Guvenen, F, G Kaplan, J Song and J Weidner (2022), “Lifetime earnings in the United States over six decades”, American Economic Journal: Applied Economics 14(4): 446–79.

Kramarz, F, E Nimier-David and T Delemotte (2022), “Inequality and earnings dynamics in France: National policies and local consequences”, Quantitative Economics 13(4): 1527–91.

Piketty, T, M Guillot, B Garbinti, J Goupille-Lebret and A Bozio (2020), “Pre-distribution versus redistribution: Evidence from France and the US”, VoxEU.org, 18 November.

Pistaferri, L, G Violante and F Guvenen (2022), “Global trends in income inequality and income dynamics: New insights from GRID”, VoxEU.org, 22 December.