Between the 1950s and 1980s, many developing countries engaged in restrictive trade policies with the aims of achieving industrialisation and reducing economic fragility. This was predicated upon the belief that trade, by increasing specialisation, would expose countries to sectoral shocks, hence increasing volatility. This is what we term the ‘fragility’ hypothesis. Roll forward several decades and, with the current retrenchment of globalisation (e.g. Financial Times 2022) and backlash against trade, it is ever more pressing to understand the evidence on how trade impacts macroeconomic volatility.

The way trade shapes volatility, however, is a more complex picture than the old macro-development arguments. It will depend on the types of shocks that drive risk in open economies and how trade affects the exposure to these risks. This argument is a central aspect of previous contributions by Caselli et al. (2015) and Kramarz et al. (2019).1 Take a closed economy with no specialisation as an extreme example. If the main sources of risk are sectoral shocks, this economy would be better at coping with risks and hence reduce volatility as in the fragility argument. However, if the main sources of shocks were national macro-level policies, the lack of diversification would imply that this economy is more exposed to aggregate risks, because all sales are domestic. Likewise, a highly specialised open economy may face lower volatility by diversifying away from the domestic market. The effect of trade on volatility depends on the complex interaction between shocks, the covariance between these shocks, the sectoral composition of output (specialisation), the geographical spread of sector sales (diversification), and the co-movement between sectors and between destination markets.

New research

In a recent paper (Ardelean et al. 2022), we unpack these complex interactions using a multi-country, multi-sector, multi-destination framework which we then apply to a database of 34 countries, 19 sectors, and 85 destination markets. Because we can observe sales of every industry in a country to all of its destination markets (including the home market), we can decompose the growth of these sales into three types of shocks:2

- Destination shocks: shocks to the destination markets where products are sold (including the home market) independently of the country where they are produced.

- Origin shocks: shocks that are specific to the producing country/industry independent of the destination of sales.

- Idiosyncratic shocks: residual shocks not explained by the two above.

The growth rate of aggregate gross output is a weighted average of the growth rate of industry sales to each destination market. These weights will depend on two things: (1) the industry shares in total output and, (2) the shares of different destination markets for each industry. The level of concentration of the former tells us about the degree of specialisation of the economy, whereas the latter tells us about the degree of market diversification.

We then show that the variability of the growth rate of aggregate output can be decomposed into destination risk, origin risk, idiosyncratic risk, and the co-movement (covariance) between the sources of those risks. Each risk will be determined by the frequency and size of the shocks as well as by the weights. Since these weights depend on specialisation and diversification, and these are directly related to trade, we can then analyse how changing the specialisation and diversification structure of a country would impact aggregate volatility. That is, the sectoral and destination market structure determines the exposure to the three types of risk.

One advantage of this approach is that it allows us to look at intricate ways in which trade can affect aggregate volatility. Consider destination risk: this risk depends not only on whether a country’s sales are concentrated in markets with high volatility. It also depends on whether the country’s output is concentrated in industries whose sales across destinations are subject to positively correlated shocks, and whether sales are concentrated in markets with positively correlated shocks across industries. That is, where you sell your output matters not only because demand shocks in destination markets matter. It also depends on how these shocks generate correlation across different destinations and across different industries. Likewise, origin risk depends not only on whether the country is specialised in volatile sectors, but also on how the sectors co-move. It turns out that some of these ‘indirect’ effects will dominate the direct effects.

With this at hand, we can then run counterfactual scenarios about trade that allow us to measure how the structure of trade affects volatility. Specifically, we run three counterfactuals:

- Full diversification counterfactual: keeping sectoral shares constant, we change the degree of destination market diversification and make it proportional to the trading partner’s GDP.

- Home diversification counterfactual: similar to the previous one, but we allow only for diversification of the sales away from the home market.

- Specialisation counterfactual: keeping destination market shares constant, we reduce the level of industry specialisation to make it consistent with a closed economy. The benchmark we use is the sectoral composition of the world economy.

With increased trade, we would expect an increase in destination market diversification and an increase in specialisation. Thus, comparing actual and counterfactual volatility allows us to measure the potential volatility effects of trade.

Key results

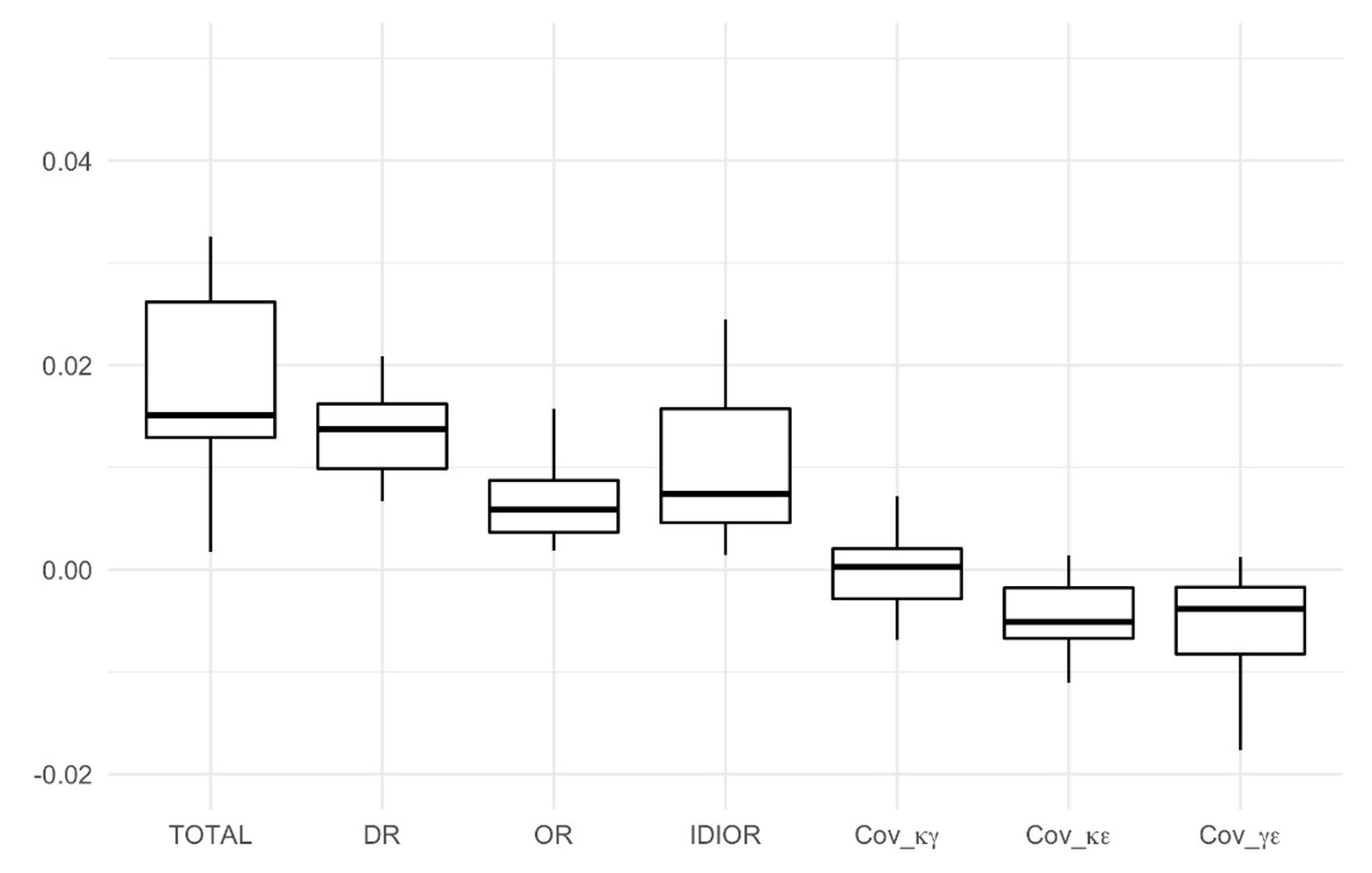

We assemble a database of production and bilateral trade for 19 sectors in 34 countries selling to 85 destination markets for the 1981-2011 period.3 Figure 1 shows total risk across the 34 countries and the contribution of each risk component in 2011. Clearly, destination risk dominates for most countries, followed by idiosyncratic risk. Origin risk is smaller. Importantly, the covariances between shocks are negative.

These aggregate results hide some of the detail. For instance, the most important driver of destination risk is the term related to covariance of destination shocks within market across industries. Put another way, destination risk is large mainly because countries sell intensively to markets with positively correlated destination shocks across industries. This is consistent with the dominance of country-specific shocks found in the empirical international business cycles literature (i.e. Kose et al. 2003). For origin shocks, the largest component is the output co-movement between sectors.

Figure 1

Note: The figure displays the total output volatility across the 34 countries and the contribution of the different risks. DR, OR, and IDIOR are destination, origin, and idiosyncratic risk, respectively. The Cov terms capture the covariance between destination and origin, destination and idiosyncratic, and origin and idiosyncratic shocks in that order. Each box contains the median, inter-quartile range, and minimum and maximum without outliers.

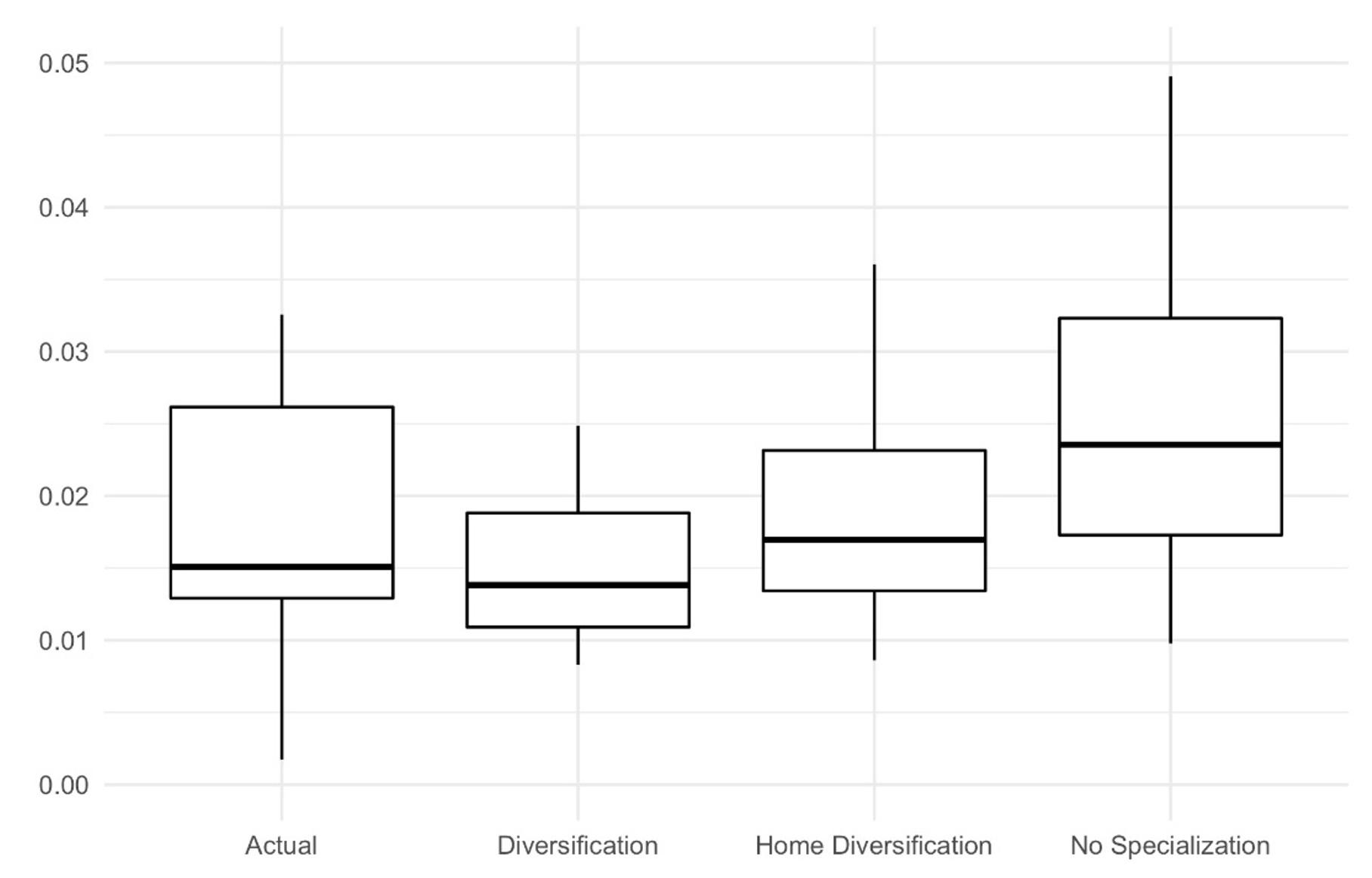

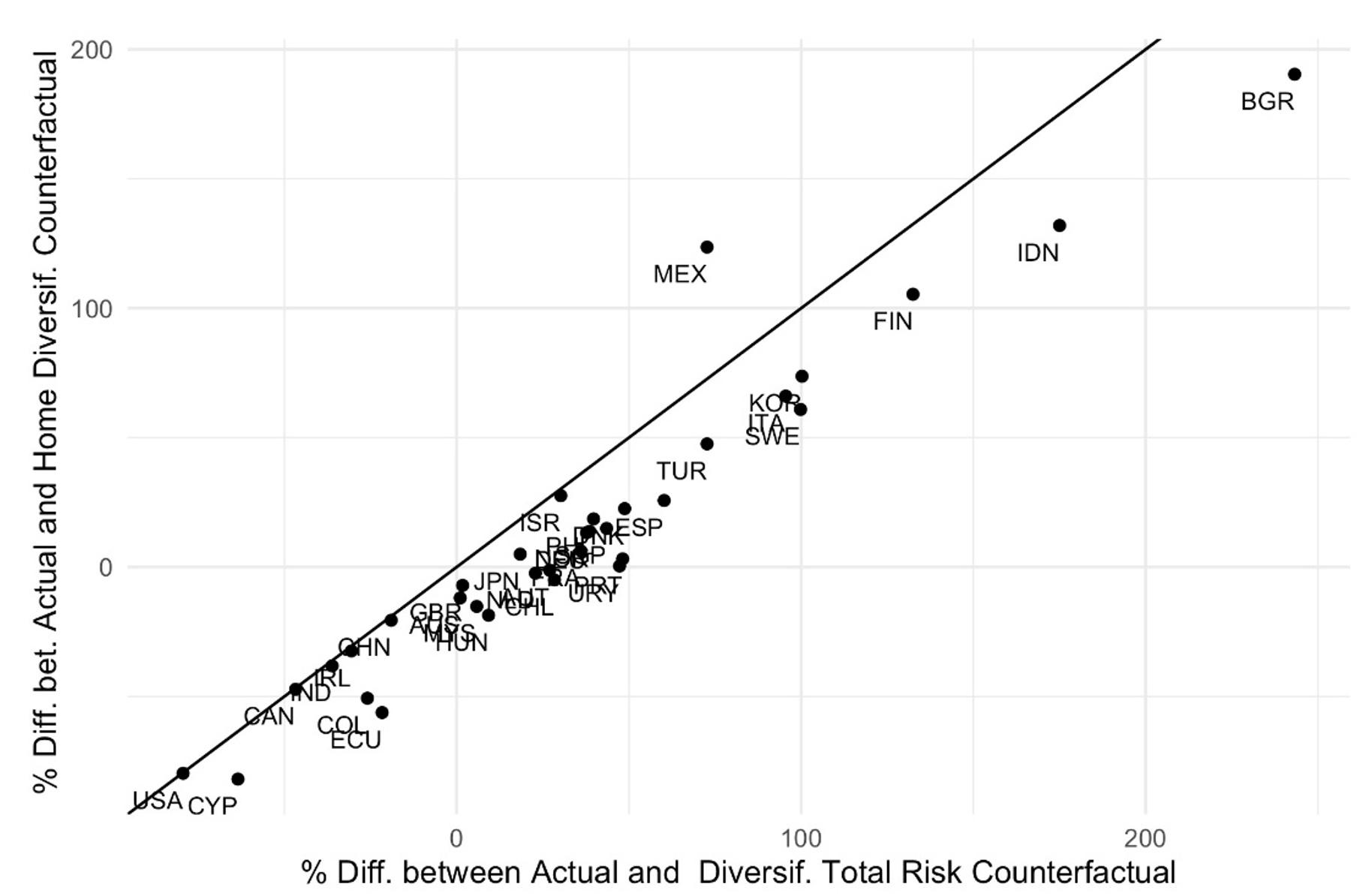

Figure 2 presents the total effects arising from the three counterfactuals. Diversification would reduce aggregate volatility. The median effect appears small. However, this hides a lot of heterogeneity. Diversification reduces risk substantially for 26 of the 34 countries in the sample. These are precisely the countries with higher output volatility. A large part of this risk reduction arises from a decline in destination market risk. As Figure 3 shows, this is highly correlated with diversifying away from the home market. Full diversification adds an extra hedging mechanism, but diversification effects are mostly driven by the home market.

A striking feature of Figure 2 is that reducing specialisation appears to increase total risk. This is counter to the conventional wisdom of the ‘fragility’ argument. The reason that risk increases is that reducing specialisation increases the co-movement between sectors. In other words, countries tend to specialise in sectors with lower levels of synchronisation with the rest of the sectors in the economy. When this specialisation is removed, total volatility increases.

Figure 2 Total risk under different counterfactuals, 2011

Note: The figure displays the actual total average output volatility across the 34 countries and the total volatility that would obtain under the three counterfactual scenarios. Each box contains the median, inter-quartile range, and minimum and maximum without outliers.

Figure 3 Home versus full diversification, 2011

Note: The figure plots the percentage volatility change in the home diversification scenario (y-axis) versus the full diversification scenario (x-axis) by country and the 45-degree line.

Concluding remarks

Our results speak about the potential volatility effects of trade through exposure to different sources of risk. Because sales are highly concentrated in a few markets and dominated by the home market, increased diversification can have potent volatility reduction effects in countries where macroeconomic volatility is high. Furthermore, the volatility effects of specialisation do not appear to conform to the conventional view that specialisation increases fragility.

References

Ardelean, A, M León-Ledesma and L Puzzello (2022), “Growth Volatility and Trade: Market Diversification vs. Production Specialization”, CEPR Discussion Paper 17330.

di Giovanni, J and A A Levchenko (2009), “Trade openness and volatility”, Review of Economics and Statistics 91(3): 558-585.

Caselli, F, M Koren, M Lisicky and S Tenreyro (2015), “Macro-diversification through trade”, VoxEU.org, 14 October.

Financial Times (2022), “The WTO’s lonely struggle to defend global trade”, 13 June.

Koren, M and S Tenreyro (2007), “Volatility and development”, Quarterly Journal of Economics 122: 243-287.

Kose, M A, C Otrok and C H Whiteman (2003), “International business cycles: World, region, and country-specific factors”, American Economic Review 93(4): 1216-1239.

Kramarz, F, J Martin and I Mejean (2019), “Idiosyncratic risks and the volatility of trade”, VoxEU.org, 11 December.

Loayza, N and C E Raddatz (2006), “The structural determinants of external vulnerability”, World Bank Research Working Paper 4089.

Rodrik, D (1998), “Why do more open economies have bigger governments?”, Journal of Political Economy 106(5): 997-1032.

Endnotes

1 For contributions on the role of trade for volatility see, among many others, Rodrik (1998), Loayza and Raddatz (2006), and di Giovanni and Levchenko (2009).

2 This decomposition expands Koren and Tenreyro (2007) as we observe not only industries and countries but also markets.

3 For details and cross-checks see: https://l-puzzello.github.io/indstat-TPP