China’s industrialisation is unprecedented: China is now the world’s only manufacturing superpower (Baldwin 2024). Its exports to the EU, which have grown substantially since China joined the WTO in 2001, have become much more sophisticated over time. Chinese export dominance is no longer confined to low-tech, low-wage sectors, as was the case in the 1990s and early 2000s. Chinese firms have become direct competitors to firms in advanced economies and have entered into active competition with those firms in their domestic markets (Bergeaud and Verluise 2022).

The large and still growing body of research that has examined the impact of this ‘China shock’ has so far produced contrasting results, especially for the US and other economies. The US has experienced significant negative effects on industrial employment that have not (yet) been observed in Europe (Autor et al. 2013, Dauth et al. 2014). Moreover, an influential paper by Bloom et al. (2016) demonstrated the prevalence of an innovation- and productivity-enhancing effect of Chinese imports for a sample of EU firms over the period 1996–2007.

The rapid catching-up of China’s manufacturing sector was facilitated by China’s post-2001 WTO membership and is also the result of industrial policies aimed at developing a large domestic industrial base through technology transfer from foreign firms, public investment, and subsidies. China intensified these policies after the global financial crisis. With its ‘second displacement strategy’ between 2009 and 2016, the Chinese government began actively pursuing industrial leadership and self-sufficiency in strategic industries while providing strong financial support to enterprises (Doshi 2021).

According to Branstetter et al. (2023), total direct government subsidies to Chinese listed companies increased more than sevenfold between 2007 and 2018, from $4 billion to $29 billion. Chimits et al. (2023) estimate that since the introduction of the Government Guidance Funds in 2012, public support for state-owned enterprises has increased from USD $7.9 billion to around USD $418 billion in 2016, reaching USD $850 billion in 2022. These developments sparked controversy both domestically and internationally (Mavroidis and Sapir 2021b, 2021a). China has been accused by its trading partners of unfairly favouring its domestic companies with subsidies, putting foreign companies at a disadvantage in the competition for future technologies.

From a growth-enhancing to a growth-dampening relationship

In our recent paper (Friesenbichler et al. 2023), we re-examine the impact of import competition from China on firm-level productivity growth in the EU for the period 2003–2016. This includes the aftermath of the global financial crisis and overlaps with the period of the ‘second displacement strategy’. We split the sample into industries that did not import from China (the non-treated group), and industries that reported imports from China (the treated group). In the treatment group, the average import intensity increased from 6.1% in 2004 to 11.7% in 2016. This corresponds to an average annual increase of about 0.5 percentage points.

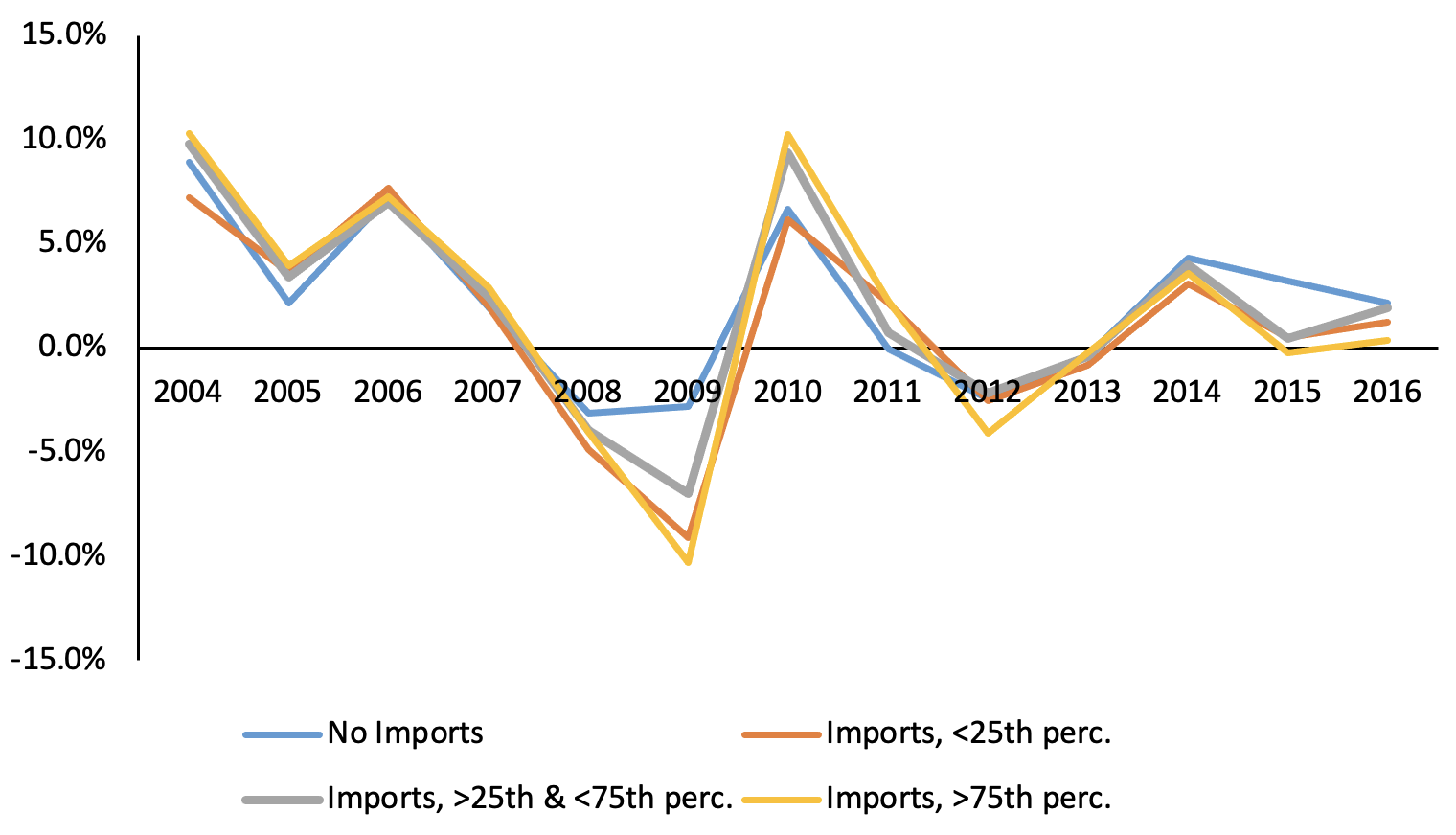

We also observed systematic differences in productivity growth rates. Firms in the non-treated group grew at an average rate of 2.2%, while firms in the treated group grew at 1.8%. We further differentiated the treated group by treatment intensity growth: industries with Chinese import intensity growth below the 25th percentile, industries between the 25th and 75th percentile, and industries above the 75th percentile. Figure 1 shows the average annual change in productivity between 2004 and 2016 for these subgroups. In the later years of the sample, the group of non-treated enterprises had higher productivity growth. Productivity growth tends to be lower the higher the exposure to Chinese imports.

Figure 1 Labour productivity growth by Chinese import intensity growth brackets

Notes: The graph splits the sample into firms in industries (i) without Chinese imports, (ii) with Chinese import intensities below the 25th percentile, (iii) industries between the 25th and 75th percentile, and (iv) industries above the 75th percentile.

The econometric results confirm that the nature of competition has changed over time. We find a positive effect of import competition on firm productivity in earlier periods, which becomes negative in more recent periods. The results are robust to firm exits. They suggest that firms in developed countries increasingly tried to absorb the import shock by reducing prices and sales revenues, which hampered productivity growth. The negative impact of Chinese import competition on the performance observed for the US appears with a time lag for EU firms. On average, the dampening effect on productivity is quite small, although it is likely to increase as the subsidy intensity of Chinese firms increases. In 2005, firms in the medium productivity segment experienced a modest growth-enhancing effect of 0.02 percentage points due to Chinese import growth. This effect turned slightly negative, reaching -0.06 percentage points in 2016. On average, the net effect of China’s increasing import intensity on the productivity growth of EU firms has been negative since 2010.

There are heterogeneous responses in firm-level productivity growth across different types of firms. Multinationals were better able to mitigate the negative impact of an increase in import intensity from China. Moreover, our results show that the negative effect is not uniform across the distribution of productivity growth. It is stronger for firms with lower and median productivity growth rates. This implies that the composition of the firm population, whether multinational or domestic, low or high growth, has an impact on the ability to cope with the increase in imports from China at the aggregate level.

So far, there is no evidence that import competition from China has had a negative impact on regional employment disparities, as has been observed for the US (Euwals et al. 2022, Jiang et al. 2022, Kügler et al. 2024). However, there is evidence that it has affected firms’ technology search and product market strategies. Previous research suggests that firms do not have time to develop and reap the benefits of technological or product market development under heightened competition, and therefore focus on exploiting their core competencies (Morandi et al. 2021). Chinese import competition appears to be having a similar effect on European firms: in response to increasing exposure to Chinese competitors, European firms reduce their exploration of new technological opportunities or product markets and diversify their geographical markets (Friesenbichler and Reinstaller 2023). This is an unsustainable competitive strategy in the long run if the competition also catches up in their core competences.

Concluding remarks

All this adds fuel to debates on trade policy and the impact of China’s industrial policies, such as its distortionary use of subsidies, intellectual property rights, and market regulations. China’s economy has grown remarkably in recent decades and – whether or not its technological catch-up is slowing (Fernández-Villaverde et al. 2023) – the competitive pressures it exerts are likely to continue increasing. China’s industrial strategy initiative (Li 2018) aims not only to further technologically upgrade the Chinese economy, but also to achieve independence from foreign suppliers in ‘core products’ such as IT, aerospace, and biotechnology, while further promoting Chinese exports.

EU Commission President Ursula von der Leyen has rightly spoken out about undesirable developments in competition with Chinese companies. It would be highly inefficient to try to decouple from China or reverse the situation of subsidised competition, but failing to respond can be just as dangerous for local economies. First, it seems important to maintain the ability of European exporters to technologically upgrade, diversify and, where possible, stay ahead of international competitors and protect their intellectual property from Chinese competitors. Second, the EU should encourage direct investment by Chinese technology leaders in the EU to promote reverse knowledge spill-overs. Third, it is also important to act against market-distorting practices that are prohibited by the WTO. An EU investigation into a subsidy violation, followed by the imposition of anti-dumping duties, seems appropriate. A regulatory solution would be the best way forward, but this is not on the horizon. Since 2019, the WTO has been paralysed by a lack of appellate judges, although an interim solution has been put in place and signed by both the EU and China. Strengthening the WTO is desirable but requires the cooperation of the largest trading partners. World trade is thus caught in a prisoner’s dilemma.

References

Autor, D H, D Dorn and G H Hanson (2013), “The China Syndrome: Local Labor Market Effects of Import Competition in the United States”, The American Economic Review 103 (6): 2121–68.

Baldwin, R (2024), “China is the world’s sole manufacturing superpower: A line sketch of the rise”, VoxEU.org, 17 January.

Bergeaud, A and C Verluise (2022), “The Rise of China’s Technological Power: The Perspective from Frontier Technologies”, Centre for Economic Performance, London School of Economics and Political Discussion Paper 1876, 14 October.

Bloom, N, M Draca and J Van Reenen (2016), “Trade Induced Technical Change? The Impact of Chinese Imports on Innovation, IT and Productivity”, The Review of Economic Studies 83 (1): 87–117.

Chimits, F (2023), “What Do We Know About Chinese Industrial Subsidies?”, CEPII Policy Brief, no. 2023–42.

Dauth, W, S Findeisen and J Suedekum (2014), “The Rise of the East and the Far East: German Labor Markets and Trade Integration”, Journal of the European Economic Association 12 (6): 1643–75.

Doshi, R (2021), The Long Game: China’s Grand Strategy to Displace American Order, Oxford University Press.

Euwals, R, G H van Heuvelen, G Meijerink, J Möhlmann and S Rabaté (2022), “The impact of import competition and export opportunities on the Dutch labour market”, De Economist 170(3): 343–74.

Fernandez-Villaverde, J, L Ohanian and W Yao (2023), “The neoclassical growth of China”, VoxEU.org, 29 September.

Friesenbichler, K S, A Kügler and A Reinstaller (2023), “The Impact of Import Competition from China on Firm-Level Productivity Growth in the European Union”, Oxford Bulletin of Economics and Statistics, 31 August.

Friesenbichler, K S and A Reinstaller (2023), “Small and Internationalized Firms Competing with Chinese Exporters”, Eurasian Business Review 13(1): 167–92.

Jiang, Z, C Miao, J Arreola Hernandez and S M Yoon (2022), “Effect of Increasing Import Competition from China on the Local Labor Market: Evidence from Sweden”, Sustainability 14(5): 2631.

Kügler, A, K S Friesenbichler and C Hirsch (2024), “Labour Market Effects of Trade in a Small Open Economy”, REGION, forthcoming.

Li, L (2018), “China’s manufacturing locus in 2025: With a comparison of ‘Made-in-China 2025’ and ‘Industry 4.0.’”, Technological Forecasting and Social Change 135: 66–74.

Morandi Stagni, R, A Fosfuri and J Santaló (2021), “A Bird in the Hand Is Worth Two in the Bush: Technology Search Strategies and Competition Due to Import Penetration”, Strategic Management Journal, 5 March.

Sapir, A and P C Mavroidis (2021a), “China and the WTO: An uneasy relationship”, VoxEU.org, 29 April.

Sapir, A and P C Mavroidis (2021b), “China and the WTO: Two systems meet”, VoxEU.org, 28 April.