In their seminal paper, Modigliani and Miller (1958) established that, in the absence of frictions and transaction costs, a firm’s capital structure is irrelevant. Since then, economists have developed various theories describing frictions and transaction costs that drive the choice of corporate financing decisions, including taxes, bankruptcy costs, agency problems, and informational asymmetries. All these factors can differentially affect debt and equity financing and therefore influence a firm’s optimal capital structure.

An important source of distortions in financial markets is political economy (Lambert et al. 2021). For example, Faccio et al. (2006) have shown that politically connected firms are significantly more likely to be bailed out than similar non-connected firms. Markets understand this and should therefore be more willing to provide (cheaper) credit to such firms. Indeed, this is what a recent study by Bussolo et al. (2021) finds: despite being less productive, politically connected firms borrow more than similar non-connected firms.

The ultimate form of political connections is state ownership. If governments are more likely to bail out state-owned companies than privately owned ones, then the former should make greater use of debt. However, governments may not only provide (implicit or explicit) bailout guarantees, they may also use state-owned enterprises for political purposes. For example, especially in countries with weaker institutions, state-owned enterprises may be (ab)used to maximise voting for incumbent parties and politicians rather than to maximise shareholder value and the ability to repay loans (e.g. Bircan and Saka 2019). Politicisation of state-owned enterprises’ business decisions is against creditors’ interests and can therefore result in a higher cost of credit.

Which of these countervailing forces dominates is an empirical question. The existing literature mostly supports the first argument. For example, Dewenter and Malatesta (2001) consider the 500 largest non-US firms and show that state-owned enterprises are leveraged more. They also show that leverage falls after privatisation. In a similar vein, Boubakri and Cosset (1998, 79 large companies), D'Souza and Megginson (1999, 85 large companies), and Megginson et al. (1994, 61 large companies) find that, after privatisation, companies reduce their debt ratios. Boubakri and Saffar (2019, 453 large companies) also find a positive correlation between state ownership and leverage.

These existing studies all analyse data from large and mostly listed firms. In a recent paper (De Haas et al. 2022), we consider a much broader dataset that covers 4 million firms from 89 countries. The vast majority of these firms are small or medium sized; very few of them are listed. Our data come from splicing various historical versions of Bureau Van Dijk’s Orbis dataset. They span twenty years (2000-2019) and include 20 million annual observations (thus five observations per firm on average).

The comprehensive nature of this new dataset allows us to compare state-owned and private firms while controlling not only for conventional firm-level determinants of leverage (such as size, profitability, asset tangibility, and the non-debt tax shield) but also for sector-country-year fixed effects. We find that, on average, state ownership is negatively correlated with leverage, defined as a firm’s debt-to-total assets (Villar-Burke 2013). In other words, for the vast majority of firms, the negative impact of state ownership more than offsets any benefits firms may derive (in terms of borrowing capacity) from the state as a shareholder. This effect is increasing in the degree of state ownership but is significant even if the state only has a small ownership stake. The magnitude of the effect is substantial: within the same country-sector-year, firms with any state ownership, on average, have a 5 percentage point lower debt/assets ratio. This is about one-quarter of the median leverage of 19% in our sample.

This strong negative relationship between state ownership and corporate leverage likely reflects the corporate governance risks of state ownership. Creditors may fear the state's intervention in firms' operations, and they may therefore be less willing to lend to such firms. Indeed, we find the negative effects of state ownership on leverage are much stronger in countries with a weaker rule of law, control of corruption, protection of investors, and insolvency procedures. These results are consistent with the view that state ownership is especially costly in countries with weaker political and legal institutions.

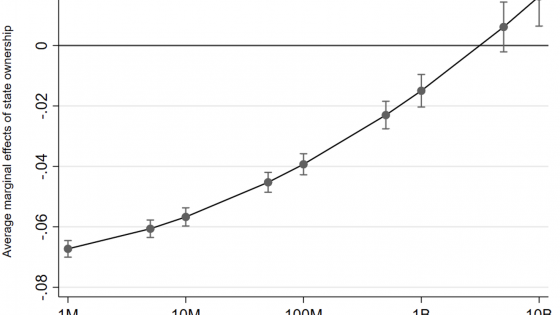

The negative relationship between state ownership and corporate leverage holds across most of the firm-size distribution – with the important exception of the (previously studied) very largest firms. In line with the earlier literature on this topic, we show that (only) among the largest firms in our sample (those with more than $3 billion of assets), state ownership is associated with higher corporate leverage (see Figure 1). In other words, only the largest firms in a country benefit from (partial) state ownership through bailout guarantees and cheaper credit. The market seems to believe that these guarantees are most credible for ‘national champions’ that the state will likely treat in a privileged manner.

Figure 1 The effect of state ownership on firm leverage by firm size

Notes: This figure reports average marginal effects of state ownership on firm leverage with 95% confidence intervals.

Source: De Haas et al. (2022).

We complement our cross-firm results with a within-firm analysis based on panel data for enterprises that were privatised. We compare the change in capital structure over time in these firms to the change in leverage among observationally similar but non-privatised state-owned enterprises. The results are very similar to those from the cross-firm analysis, both qualitatively and quantitatively. We find that firms typically increase their leverage by about 5 percentage points (27% of the sample mean) in the five years after privatisation and relative to comparable (matched) non-privatised firms (see Figure 2). Interestingly, leverage starts to go up two years before the actual privatisation – likely reflecting that privatisations take time to implement and that credit markets price in the effects of future privatisations in advance.

Figure 2 Privatisation and firm leverage: Event study

Notes: This figure provides a graphic representation of an average treatment on the treated (ATT) analysis. The dots correspond to annual ATT estimates including a bias-adjustment term. The whiskers represent 95% confidence intervals.

Source: De Haas et al. (2022).

Our results can also be seen in light of a recent literature (Bento and Restuccia 2018) that underlines the substantial misallocation of capital and labour across firms – even within narrowly defined industrial sectors and within the same country. State ownership can be an important source of such allocative inefficiency and the resulting drag on total factor productivity. Our results highlight one mechanism through which state ownership can introduce distortions and resource misallocation: it interferes with the ability of all but the largest firms to access credit.

References

Bento, P and D Restuccia (2018), “Misallocation is a key determinant of average establishment size and aggregate productivity across rich and developing countries”, VoxEU.org, 22 October.

Bircan, C and O Saka (2019), “Lending cycles and real outcomes: Costs of political misalignment”, VoxEU.org, 10 May.

Borisova, G, V Fotak, K Holland and W L Megginson (2015), “Government Ownership and the Cost of Debt: Evidence from Government Investments in Publicly Traded Firms”, Journal of Financial Economics 118(1): 168-191.

Boubakri, N and J-C Cosset (1998), “The Financial and Operating Performance of Newly Privatized Firms: Evidence from Developing Countries”, Journal of Finance 53(3): 1081-1110.

Boubraki, N and W Saffar (2019), “State Ownership and Debt Choice: Evidence from Privatization”, Journal of Financial and Quantitative Analysis 54(3): 1313-1346.

Bussolo, M, F de Nicola, U Panizza and R Varghese (2022), “Politically connected firms and privileged access to credit: Evidence from Central and Eastern Europe”, European Journal of Political Economy 71: 102073.

De Haas, R, S Guriev and A Stepanov (2022), “State Ownership and Corporate Leverage Around the World”, CEPR Discussion Paper 17300.

Dewenter, K L and P H Malatesta (2001), “State-owned and Privately Owned Firms: An Empirical Analysis of Profitability, Leverage, and Labor Intensity”, American Economic Review 91(1): 320-334.

D'Souza, J and W L Megginson (1999), “The Financial and Operating Performance of Privatized Firms during the 1990s”, Journal of Finance 54(4): 1397-1438.

Faccio, M, R Masulis and J McConnell (2006), “Political Connections and Corporate Bailouts”, Journal of Finance 61(6): 2597-2635.

Lambert, T, E Perotti and M Rola-Janicka (2021), “Political economy in finance”, VoxEU.org, 6 July.

Megginson, W L, R C Nash and M Van Randenborgh (1994), “The Financial and Operating Performance of Newly Privatized Firms: An International Empirical Analysis”, Journal of Finance 49(2): 403-452.

Modigliani, F and M Miller (1958), “The Cost of Capital, Corporation Finance and the Theory of Investment”, American Economic Review 48(3): 261–297.

Villar-Burke, J (2013), “Assessing leverage in the financial sector through flow data”, VoxEU.org, 14 November.