Innovation and entrepreneurship have traditionally been concentrated in a handful of wealthy nations. For example, in 2001 nearly 40% of global investment in research and development (R&D) took place in the US alone, with the vast majority of the remainder in other high-income countries.

Meanwhile, the limited global adoption of modern technology is a prominent explanation for low levels of productivity and income in large parts of the world (Keller 2004).

Is the concentration of innovation partly to blame for limited international technology diffusion?

One school of thought suggests that the two are unrelated. In this view, technology is broadly applicable and productivity-enhancing, regardless of where its developed. Barriers to the adoption of existing technology, which may be especially high in low-income countries, are the true obstacles to technology diffusion and productivity convergence (e.g. Parente and Prescott 1994, 2002). In fact, ‘leapfrogging’ to rich-country technology (e.g. the use of smartphones without ever building telephone lines) could allow developing countries to grow even faster, skipping intermediate ‘stages’ of development (e.g. Lee and Lim 2001).

A second school of thought, however, suggests that the structure of innovation itself is critical. In this view, the concentration of innovation has led to the development of technologies that are productivity-enhancing in the high-income countries where they are developed but often ‘inappropriate’ (and less productive) elsewhere (Basu and Weil 1998, Acemoglu and Zilibotti 2001). For example, innovators in high-income countries tend to develop agricultural technologies that are well-suited to their own ecological conditions (Moscona and Sastry 2023) and medical technologies that are well-suited to their own disease environments (Kremer 2002). These advances are far less beneficial in other parts of the world, where the main challenges to agricultural production and human health are different. Beyond these examples, there are a range of differences across countries – from culture and taste to geography and infrastructural development – that might shape the ‘fit’ of any given technology of business idea. According to this perspective, shifting the direction of innovation or entrepreneurship could have major consequences for who benefits from it and hence who chooses to adopt it.

Increased venture capital investment in China

In a recent paper, we study the global consequences of a major shift in the global distribution of innovation and entrepreneurship by exploiting the recent and dramatic rise of China (Lerner et al. 2024). We focus on high-growth entrepreneurship and venture capital (VC) investment, responsible for $340 billion of investment in young companies worldwide in 2021. While VC investment was almost entirely concentrated in the US for much of its history, accounting for 88% of global investment in 2001, it rose dramatically in China in the 2010s. By 2019, roughly 40% of global venture dollars were invested in Chinese firms. This provides a unique opportunity to study the consequences of the rise of entrepreneurial investment outside of the traditional set of innovating countries.

Anecdotally, and consistent with the ‘appropriate technology’ view, new Chinese firms began to tackle problems that had not been historically the focus of US entrepreneurs, and firms in other developing countries were quick to adopt these new ideas. For example, while start-ups geared toward online primary and secondary education never took off in the US, perhaps because of greater access to brick-and-mortar schools, major investments in these start-ups were made in China. The success of the first Chinese companies was followed by greater investment in other developing countries, most notably India. The managing director of one local venture capital firm noted that “it would be safe to say that the traits of the Chinese economy which helped its EdTech industry boom find their parallels in India”. A similar story could be told about the rise of social commerce start-ups – which are uniquely useful in low-income contexts where food spending shares are high and food delivery logistics are complex – and innovation in last-mile delivery.

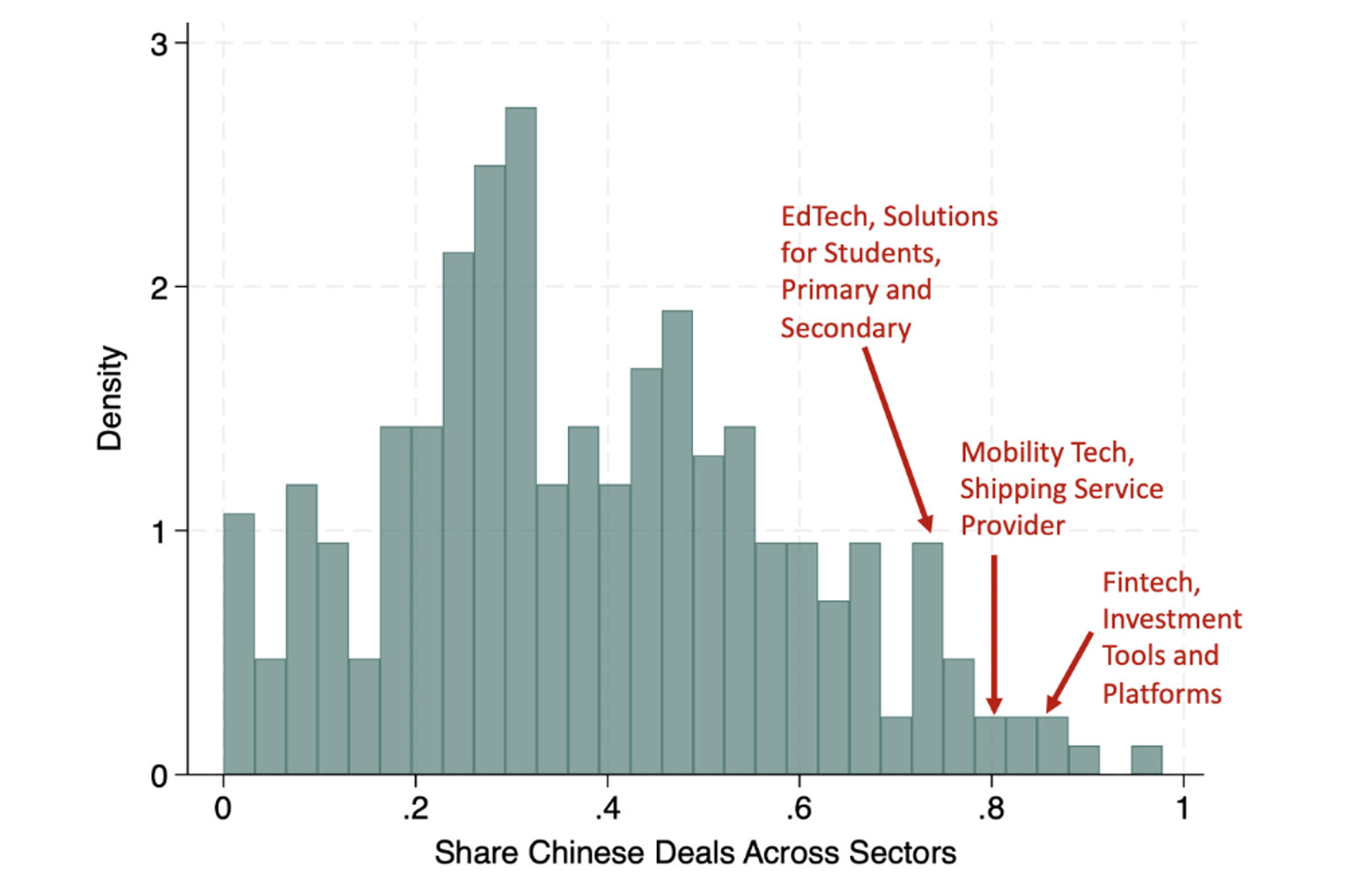

To systematically investigate how the rise of VC investment in China affected global patterns of entrepreneurship, we compiled comprehensive records on venture deals around the world from 2001-2019 using Pitchbook, a venture capital database designed from the outset to have global coverage. Using neural network tools combined with analyst-curated information for a subset of the companies, we divide all of the roughly 90,000 firms into 15 ‘macro sectors’ (e.g. EdTech) and 266 sectors (e.g. Solutions for Primary and Secondary Students). Consistent with the rise of China shifting the global focus of entrepreneurship, the cross-sector distribution of Chinese companies is very different from that of US companies. Figure 1 shows that some sectors have no Chinese companies, while others are almost entirely dominated by China. Throughout our analysis, we define the sectors in the top half of the distribution in Figure 1 as sectors that are led by China.

Figure 1 China’s share of venture deals across sectors

Notes: This figure plots a histogram of the ratio of the number of venture deals for Chinese companies to the total number of venture deals for Chinese and US companies in each sector from 2015 to 2019. Values for three example sectors are marked in red.

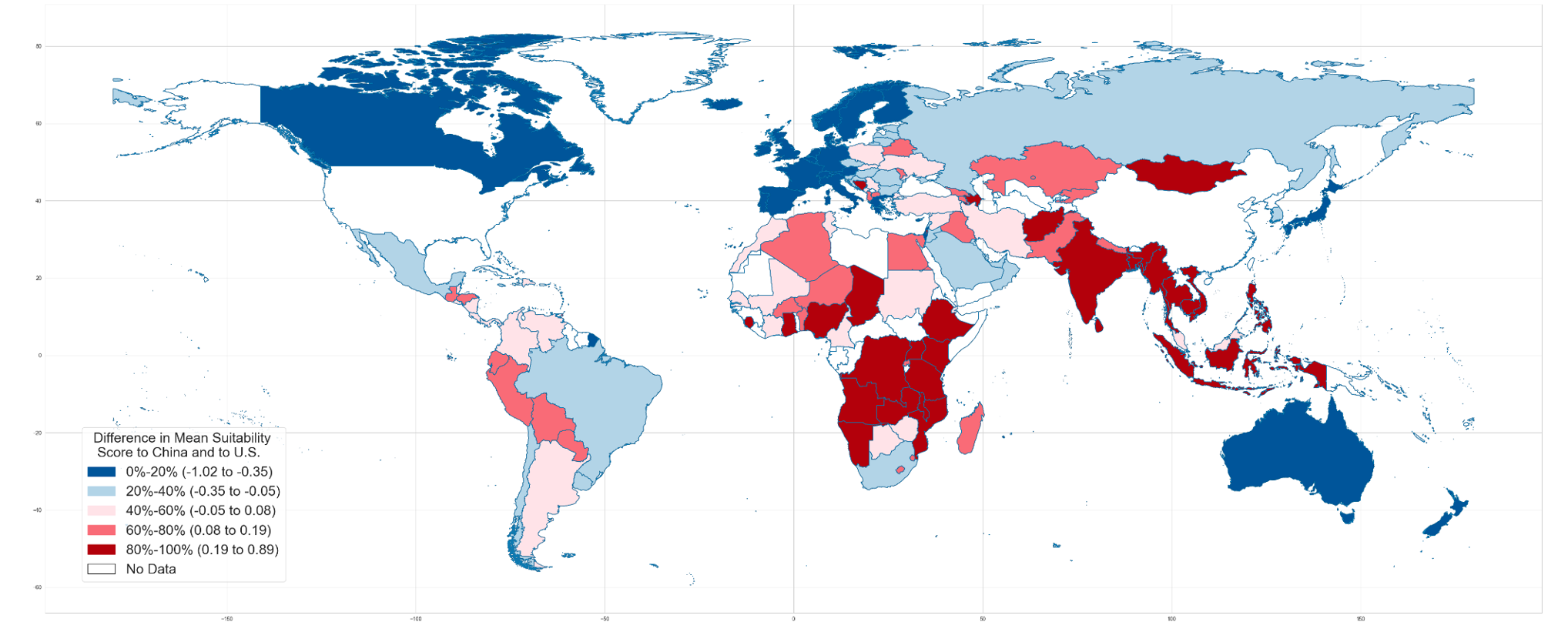

Finally, we develop a measure of the ‘appropriateness’ of Chinese entrepreneurship in each country-sector pair using a broad set of country-level characteristics measured from the World Bank Development Indicators (WDI) database. We link each variable in the WDI to the macro-sector(s) in the Pitchbook data that is most relevant. For example, school enrollment rates are linked to the EdTech macro-sector, measures of agricultural productivity and employment are linked to the AgTech sector, and so on. For each country-by-macro-sector pair, we then measure the average similarity across indicators to the corresponding macro-sector in China. We interpret this as a measure of the ‘potential appropriateness’ of entrepreneurship in China.

On average, the measure is higher in developing compared to developed countries (defined here as countries that were part of the OECD in 1980). Figure 2 shows the difference between the country-level average measure of appropriateness relative to China with an analogously constructed measure of appropriateness relative to the US. There is a large set of countries that are much more ‘similar’ to China than to the US and that – if the ‘appropriate technology’ story is true – would stand to gain from the rise of entrepreneurship in China. There is also substantial variation across sectors within countries, which we exploit in our analysis.

Figure 2 Socioeconomic similarity to China vs the US

Notes: This figure displays a world map in which each country is color-coded based on the difference between average socioeconomic similarity to China and average socioeconomic similarity to the US. To compute the value for each country, we take an un-weighted average across the similarity score for all 15 macro-sectors. Dark blue countries are those that are most similar to the US (compared to China) and dark red countries are those that are most similar to China (compared to the US).

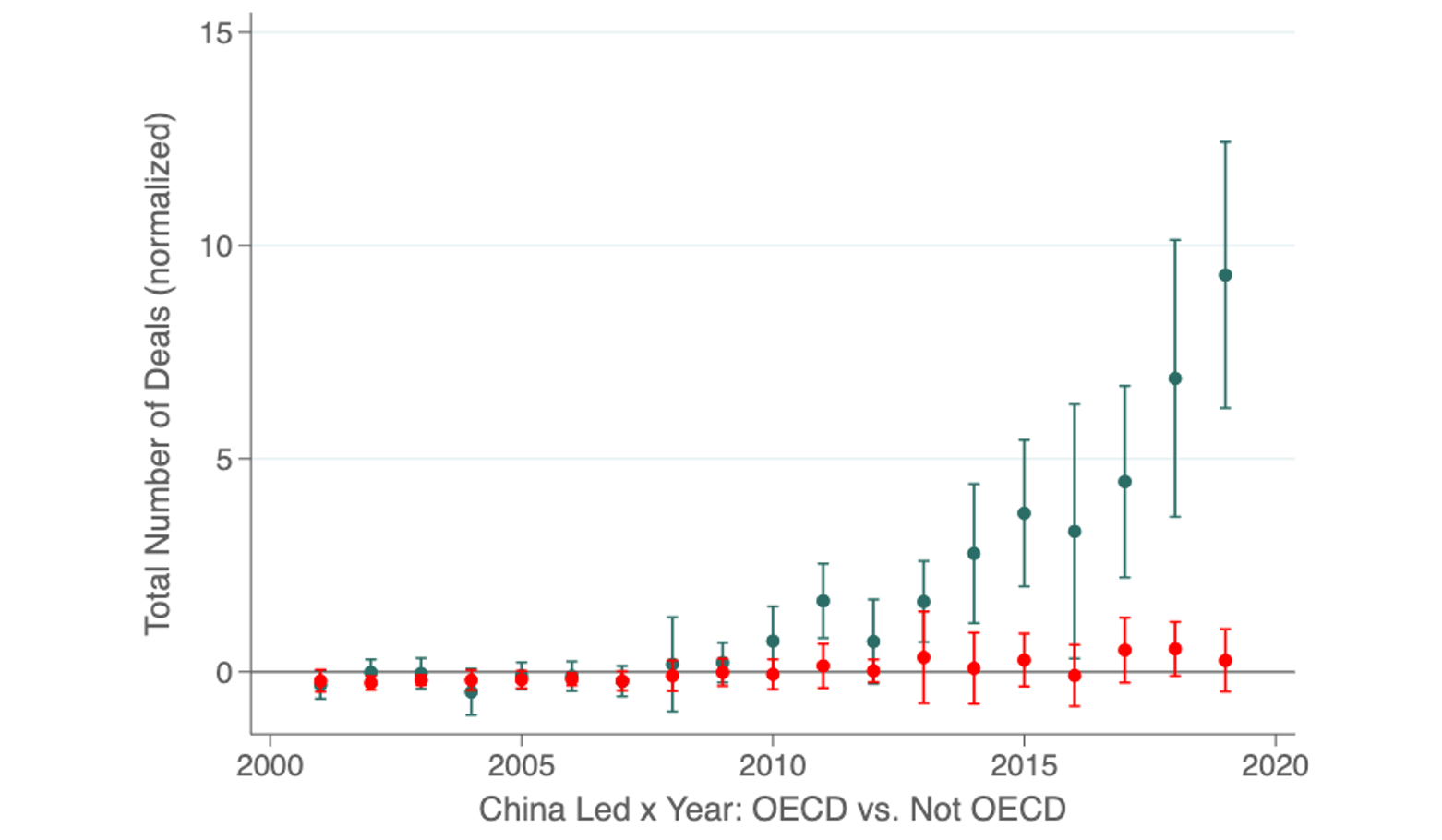

We first document that, following the rise of China, business formation in other developing countries took off in sectors led by China. Figure 3 displays the number of deals in sectors that are led by China (compared to sectors that are not), separately for developing and developed countries. While investment in developed countries remained on a similar trend throughout the period, investment in developing countries took off. This is a first indication that the rise of China led to the development of businesses that are more appropriate in many developing contexts.

We next use our country-by-sector measure of similarity to China to investigate this hypothesis directly. We find strong evidence in favour of the appropriate technology story: a one standard deviation increase in socioeconomic similarity to China across country-sector pairs is associated with a 214% increase in venture investment deals, driven in large part by local investors. If anything, the magnitude is larger when we focus on high-value deals and large investment sectors. Consistent with a causal interpretation of the findings, we find no evidence that similarity to China predicts entrepreneurship before the rise of China or in sectors where Chinese entrepreneurship is more limited. Differences in similarity to China also explain the rise in developing country investment in Figure 3: the effect is concentrated entirely in country-sector pairs that have a high similarity measure and there is no effect when the similarity measure is low.

Figure 3 Developing country entrepreneurship follows China

Notes: This figure reports estimates of year indicators interacted with an indicator that equals one if a sector is led by China, separately for countries in the OECD by 1980 (red) and countries outside the OECD in 1980 (green). Country-sector and country-time fixed effects are included in the regression specification . 95% confidence intervals are reported.

Together, this evidence suggests the rise of China re-shaped entrepreneurship well beyond its borders. It led to a dramatic rise in investment and business development around the world, especially in places where new ideas coming out of China would be most appropriate. But did this new diffusion of business ideas have broader economic consequences? Or did it just mean that venture dollars were shifted from one place to another, with few implications beyond making new entrepreneurs flush with cash (e.g. Ueda and Hirukawa 2009)?

The positive impact of increased venture capital investment

In the final part of our paper, we show that the rise in VC investment documented in the main results had a broad set of positive consequences. First, at the firm level, we show that the effects are not driven by firms that ended up failing, and find large, positive effects on the number of firms that are acquired or go public. Second, we show that there was an increase in the number of serial entrepreneurs – entrepreneurs who found multiple start-ups and are particularly important for the development of local innovation ecosystems (e.g. Mallaby 2022). Moreover, these serial entrepreneurs are more likely start their subsequent companies in sectors that are not led by China, branching out beyond the areas where they could build directly on a model from China. Third, we find that the rise in VC investment was accompanied by an increase in patenting activity, suggesting that it may have had broader positive consequences for innovation (consistent with other recent evidence, including Schnitzer and Watzinger 2017, and Bai et al. 2021). Finally, we provide suggestive evidence that the rise in VC investment was associated with improved socioeconomic development.

Our study is a first step toward understanding the consequences of ‘spreading innovation out’ more evenly across the globe. The results suggest that there could be large potential benefits, to the extent that new innovation hubs shift the focus of technology toward applications that are ignored in the existing innovation ecosystem. While parts of the world benefited from US innovation prior to the rise of China – and we show evidence of this in the paper as well – other parts, particularly developing countries, did not. This hypothesis is not unique to China. As innovation rises in India, for example, it may start to develop technologies that are suited to yet a greater number of firms and individuals. Nor is it specific to changes in R&D at the country-level. There could be benefits to building new centers of innovation within countries, exploiting human resources that are currently laying fallow (Gruber and Johnson 2019).

A key challenge will be accomplishing this ‘spreading out’ without sacrificing the benefits of economies of scale and well-aligned incentives between entrepreneurs, investors, and the ultimate asset owners that exist in current centers of innovation. How entrepreneurship can help realise the wealth of yet untapped human and social capital is a trillion-dollar question, with much of the humanity’s growth potential on the line.

References

Acemoglu, D and F Zilibotti (2001), "Productivity differences", Quarterly Journal of Economics 116(2): 563-606.

Bai, J, S Bernstein, A Dev and J Lerner (2021), "The government as an (effective) venture capitalist", VoxEU.org, 14 May.

Basu, S and D N Weil (1998), "Appropriate technology and growth", Quarterly Journal of Economics 113(4): 1025-1054.

Boroush, M (2020), “Research and development: US trends and international comparisons”, in National Science Board. Science and Engineering Indicators 2020, NSB-2020-3, Washington: National Science Foundation

Gruber, J and S Johnson (2019), Jump Starting America: How Breakthrough Science Can Revive Economic Growth and the American Dream, New York City: PublicAffairs.

Kremer, M (2002), "Pharmaceuticals and the developing world", Journal of Economic Perspectives 16(4): 67-90.

Lee, K and C Lim (2001), "Technological regimes, catching-up and leapfrogging: findings from the Korean industries", Research Policy 30(3): 459-483.

Lerner, J, J Liu, J Moscona and D Y Yang (2024), "Appropriate entrepreneurship? The rise of China and the developing world”, Working paper.

Mallaby, S (2022), The Power Law: Venture Capital and the Making of the New Future, New York: Penguin.

Moscona, J, and K Sastry (2024), "Inappropriate technology: Evidence from global agriculture", working paper (see also the VoxDev column here).

Parente, S L and E C Prescott (1994), "Barriers to technology adoption and development", Journal of Political Economy 102(2): 298-321.

Parente, S L and E C Prescott (2002), Barriers to Riches, Cambridge: MIT Press.

Schnitzer, M and M Watzinger (2017), "Spillovers from venture capital investment", VoxEU.org. 31 October.

Ueda, M and M Hirukawa (2009), "The tenuous relationship of venture capital and innovation", VoxEU.org, 30 January.