What are the long-term economic effects of a more equal distribution of wealth? The answer to this question has become particularly relevant due to rising levels of income and wealth inequality (Piketty and Saez 2014). The debate has remained active due to the scarcity of suitable data and credible research designs that allow for an estimation of causally interpretable effects, as variations in inequality likely correlate with drivers of growth (Banerjee and Duflo 2003).

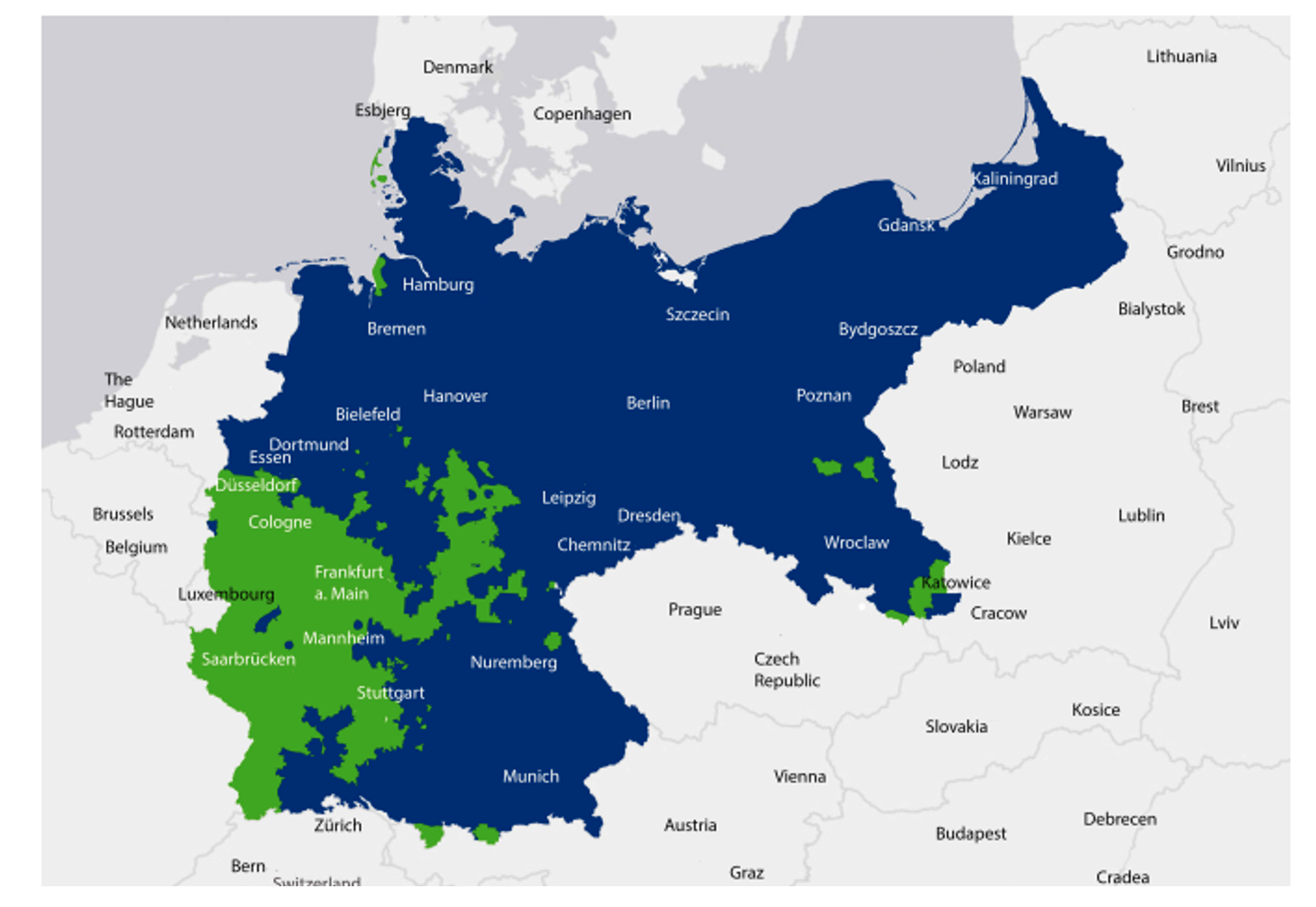

In a new paper (Bartels et al. forthcoming), we contribute to this debate by leveraging sharp geographic variation in institutions that govern how resources are passed from parents to children. In unequal division areas, agricultural property was considered indivisible and had to be passed on to a single heir. In contrast, agricultural land and other property had to be divided equally among all children in equal division areas. We digitised and geocoded data from fine-grained historical surveys to compile a map of inheritance rules across the entire German empire. Broadly speaking, equal division of agricultural land was prevalent in parts of Southern and Western Germany, as illustrated in Figure 1. However, the boundary between the two inheritance rule regimes traversed political, linguistic, geological, and religious borders. We analyse historical and long-run effects of these inheritance rules using OLS regressions with a rich set of controls and a geographic regression discontinuity (RD) design.

Figure 1 Prevalence of inheritance rules: Equal and unequal division

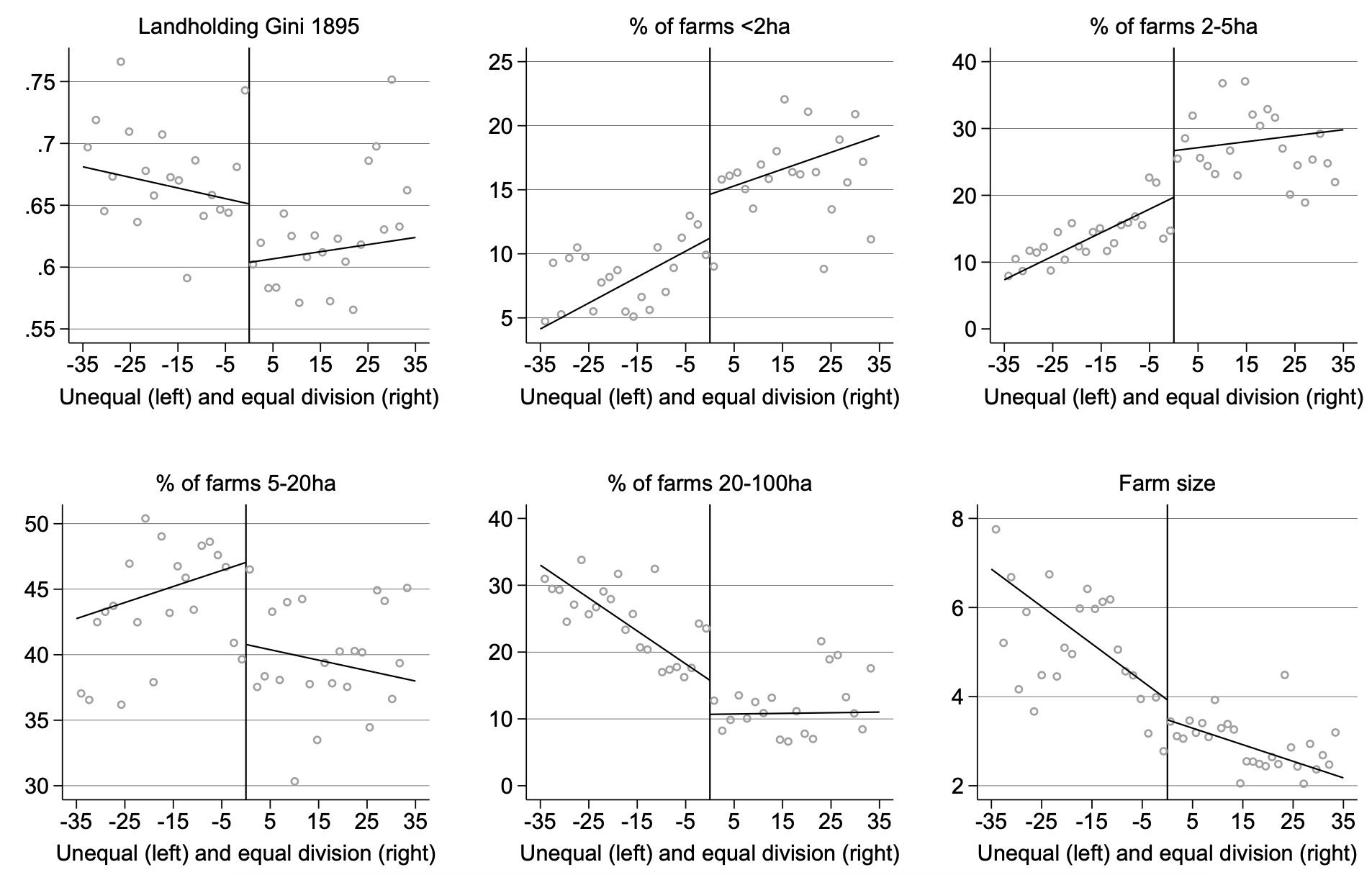

Our analysis reveals that inheritance regulations indeed influenced inequality of land – the key store of wealth in an agricultural society – during the peak of the industrialisation period (1870-1914). Equal division areas featured lower levels of landholding inequality and a larger share of small farms (see Figure 2). This finding is non-trivial: for example, by a Coasean argument, inter vivos land transactions should undo the equalising effect of equal division if transaction costs were low and concentrated ownership optimal.

Figure 2 Test of discontinuity at the border for historical outcome variables

Equal division regions became richer in the long run

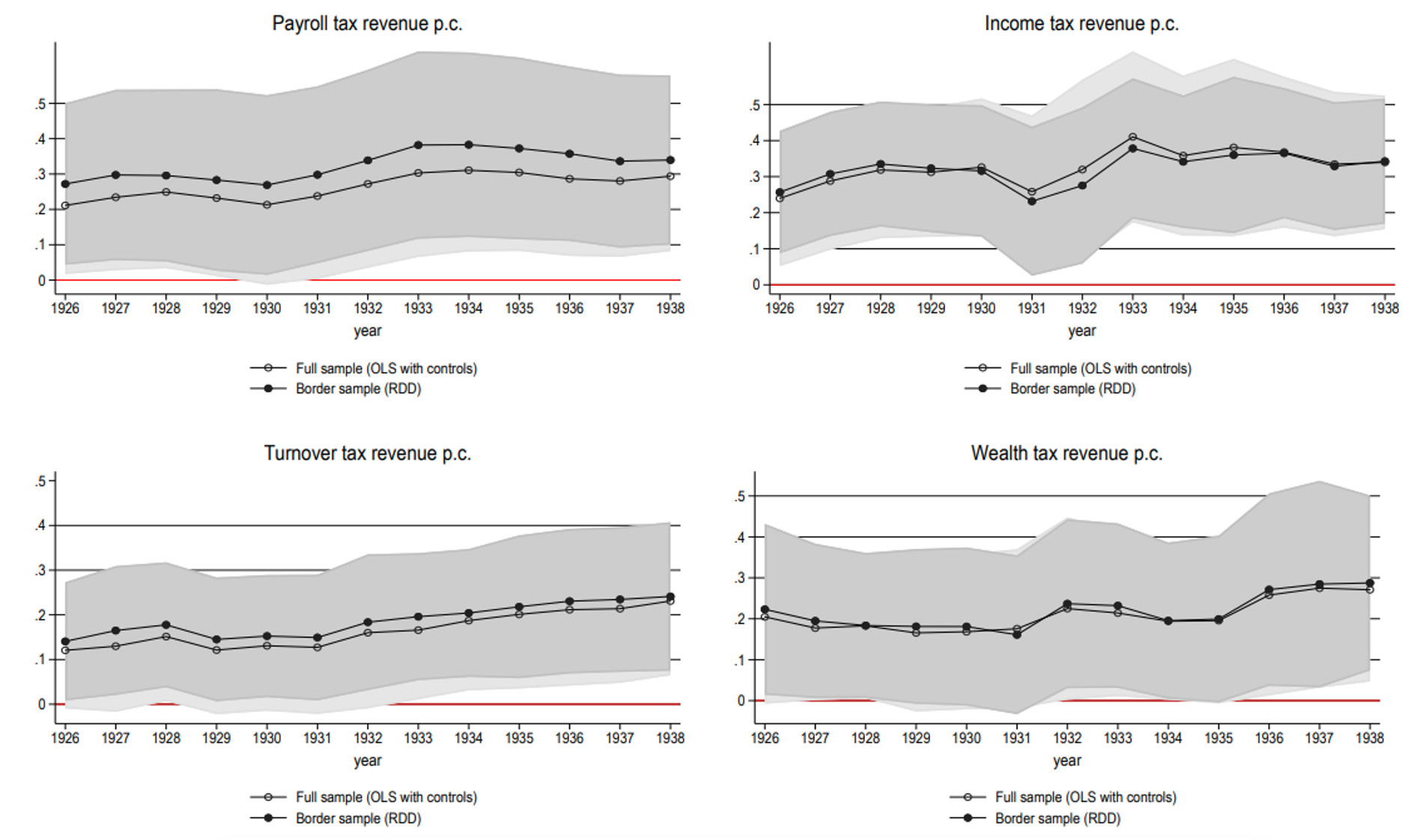

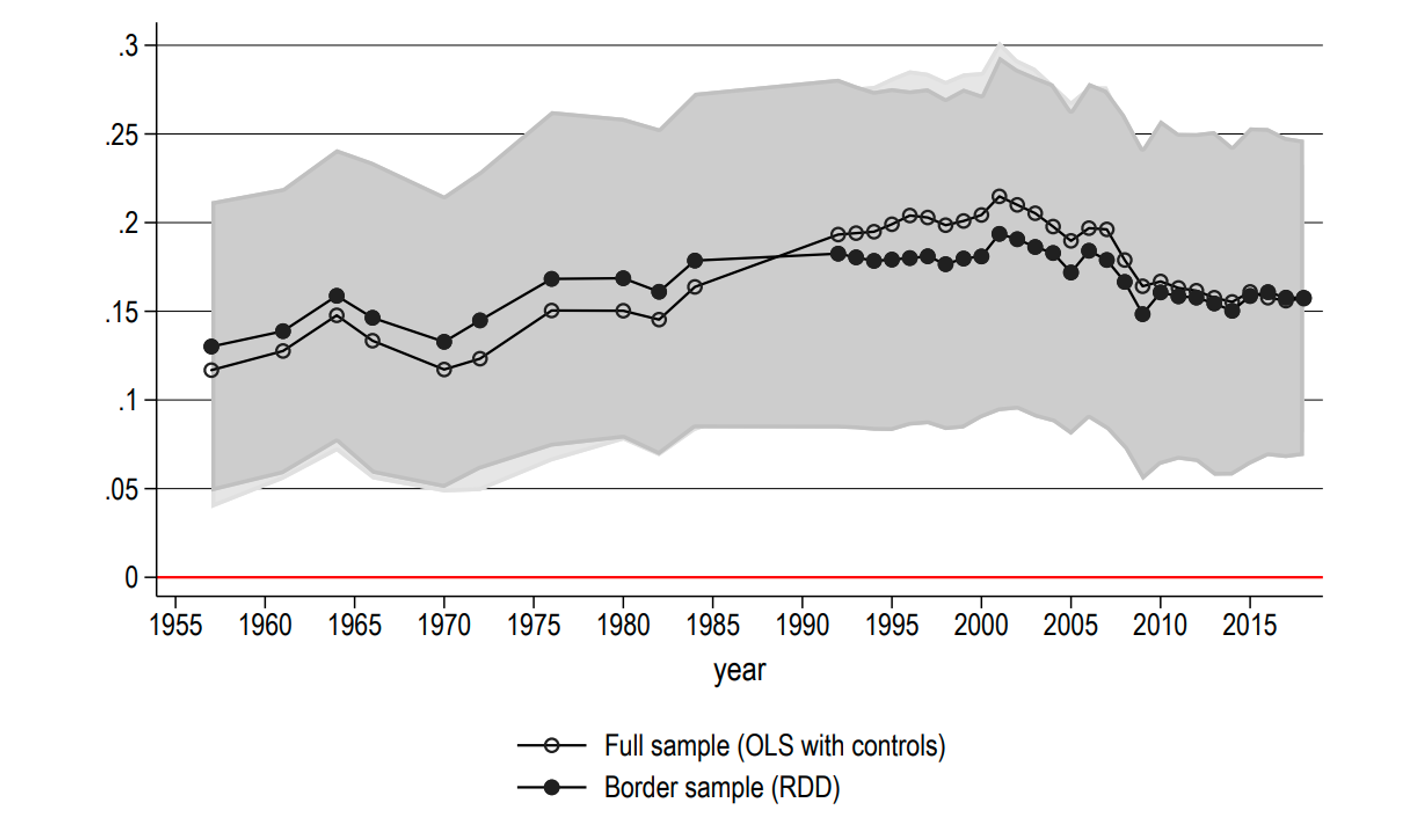

Our study unveils that equal division of land has generated higher long-term growth. Putting together a large panel data set spanning from early industrialisation to contemporary times, we delineate the trajectory of economic prosperity in equal and unequal division areas. Although income disparities were imperceptible at the turn of the century, the interwar era witnessed a notable divergence in tax revenue per capita, indicative of a widening income and wealth chasm between equal and unequal division regions (see Figure 3). During this period, the chemical and electronics industry developed further, and new industries, like the car industry and its local supply chains, also emerged more forcefully in equal division areas. This trend persisted post-war, culminating in a substantial productivity gap that stabilized at in the 2000s and 2010s (see Figure 4). Today, the income gap is around 6%. The observation that GDP is even higher than distributed income reflects that employees living in unequal division areas commute into equal division areas for work.

Figure 3 Economic gap between equal and unequal division areas, 1926-1938

Figure 4 GDP PC gap between equal and unequal division areas, 1957-2018

Predictors of long-term development and also of a particular inheritance rule regime are smooth at the boundary, thereby suggesting that the variation in inheritance rules that we analyse is idiosyncratic and not systematically related to other drivers of growth. We find no evidence of more advantageous starting conditions for equal division areas before the Industrial Revolution with respect to agricultural productivity, general education, urban population, population density, fertility, or outmigration to the US. Hence, at a fine geographic level, our data support the hypothesis of lower levels of landholding inequality in the 19th century affected long-term economic trajectories.

Equal division of land engendered a conducive environment for innovation and entrepreneurship

By providing equitable access to land or compensatory resources, equal division areas expanded the pool of potential entrepreneurs. Our analysis reveals a higher prevalence of entrepreneurial activities in equal division regions during the period of high industrialisation in Germany (1870-1914). Specifically, the population share working in manufacturing was higher and this gap widened between 1895 and 1907. The additional employment in manufacturing is fully accounted for by particularly innovative sectors with high patenting activity, which we measure building on data from Streb et al. (2006). Patenting activity itself was also higher in equal division areas between 1877 and 1914.

The proliferation of domestic workshops in equal division farms facilitated experimentation and specialisation, fostering income growth and bolstering Germany's renowned Mittelstand – comprised of small and medium-sized enterprises. Contemporary data corroborate the enduring legacy of equal division, evidenced by the prevalence of smaller yet more productive firms and a greater proportion of entrepreneurs in equal division regions. The higher share of entrepreneurs in equal division regions today translates into a right-shifted skill, income, and wealth distribution.

Historical accounts align with our findings, underscoring the role of inheritance rules in shaping occupational choices and spurring entrepreneurial endeavours. The abundance of domestic workshops within equal division farms, coupled with the flexibility afforded by agricultural income, nurtured a culture of experimentation and risk-taking conducive to entrepreneurial pursuits. Our findings support several models in which landholding inequality may inhibit economic growth by restricting occupational choice, and in particular are consistent with Doepke and Zilibotti (2008), who argue that occupational choice played a crucial role during the Industrial Revolution and posit a concomitant downfall of the landed elite. Our evidence also supports the notion that higher landholding equality lowered the entry costs for entrepreneurs and that a proliferation of entrepreneurs then lowered the learning costs of other potential entrepreneurs (Guiso et al. 2021, see also the VoxEU column here).

Right-shifted distribution of income and wealth today

Surprisingly, the long-term prosperity engendered by equal division has resulted in a more skewed distribution of income and wealth. The last collection of the German wealth tax in 1995 (which was only levied on high net-worth individuals; see Albers et al. 2022 as well as their Vox column here) shows that equal division areas are home to about 35 more wealth-tax payers and about seven more millionaires per 10,000 inhabitants, on average. The top income decile and the top income percentile in equal division counties earned 9-14% more in 2013 than their counterparts in unequal division counties. As top income earners are business owners in Germany (Bartels 2019) and business owners typically earn higher incomes than their employees, a higher population share of business owners mechanically increases income concentration at the top. Consequently, income concentration within equal division counties is significantly higher as well, evidenced by higher top income shares in equal division regions. Our finding of higher top income shares in equal division counties supports Aghion et al. (2018) (see their VoxEU column), who document positive correlations between measures of innovation and top 1% income shares across US states since the 1980s. They argue that top incomes have increased particularly in occupations closely related to innovation such as entrepreneurs, engineers, scientists, and managers.

What turned a more even historical distribution into a more uneven distribution today? We speculate that large inheritances, particularly in the form of businesses, are more likely to persist over time, while smaller inheritances are depleted through increased consumption (Nekoei and Seim 2023). A larger portion assigned to the controlling heir of the family firm alleviates credit constraints if capital markets are imperfect and thereby expand the firm's ability to invest (Ellul et al. 2010).

Conclusion

Our study unveils the enduring consequences of land inequality, underscoring the transformative impact of inheritance regulations on long-term prosperity. Drawing on a wide range of historical and modern data, we find positive effects of equal division on long-term productivity and income. We find evidence indicating that the equal division of land spurred industrial by-employment, in particular in innovative and entrepreneurial activities. Our evidence lends support to models in which a more equitable distribution of wealth can spur occupational upgrading and the decision to become an entrepreneur (e.g. Galor and Zeira 1993, Banerjee and Newman 1993, Galor and Moav 2004). The more equal distribution of land – the key store of wealth in 19th century Germany – enabled broad parts of the population to engage in entrepreneurial activities, which provided the breeding ground for today's innovative Mittelstand and shaped Germany's industrial geography and industrial relations system (Jäger et al. 2022). Equal division of land proved to be an inclusive economic institution in the long run.

References

Aghion, P, U Akcigit, A Bergeaud, R Blundell and D Hemous (2018), “Innovation and Top Income Inequality”, Review of Economic Studies 86(1): 1–45.

Albers, T, C Bartels and M Schularick (2022), “Wealth and its Distribution in Germany, 1895-2018”, CEPR Discussion Paper No. 17269.

Banerjee, A V and E Duflo (2003), “Inequality and growth: What can the data say?”, Journal of Economic Growth 8(3): 267–299.

Banerjee, A V and A F Newman (1993), “Occupational choice and the process of development”, Journal of Political Economy 101(2): 274–298.

Bartels, C (2019), ‘Top incomes in Germany, 1871-2014”, Journal of Economic History 79(3): 669–707.

Bartels, C, S Jäger and N Obergruber (2024), “Long-Term Effects of Equal Sharing: Evidence from Inheritance Rules for Land”, CEPR Discussion Paper No. 18838.

Doepke, M and F Zilibotti (2008), “Occupational choice and the spirit of capitalism”, Quarterly Journal of Economics 123(2): 747–793.

Ellul, A, M Pagano and F Panunzi (2010), “Inheritance law and investment in family firms”, American Economic Review 100(5): 2414–2450.

Galor, O and J Zeira (1993), “Income distribution and macroeconomics”, Review of Economic Studies 60(1): 35–52

Galor, O and O Moav (2004), “From physical to human capital accumulation: Inequality and the process of development”, Review of Economic Studies 71(4): 1001–1026.

Guiso, L, L Pistaferri and F Schivardi (2021), “Learning entrepreneurship from other entrepreneurs?”, Journal of Labor Economics 39(1): 135-191.

Jäger, S, S Noy and B Schoefer (2022), “The German model of industrial relations: Balancing flexibility and collective action”, Journal of Economic Perspectives 36(4): 53-80.

Nekoei, A and D Seim (2023), “How do inheritances shape wealth inequality? Theory and evidence from Sweden”, Review of Economic Studies 90(1): 463–498.

Piketty, T and E Saez (2014), “Inequality in the long run”, Science 344(6186): 838– 843.

Streb, J, J Baten and S Yin (2006), “Technological and geographical knowledge spillover in the German Empire 1877-1918”, Economic History Review 59(2): 347–373.