Climate change remains subject to heated debate, and climate change supporters and deniers support different steps of action. In the March 2023 Gallup Survey, only 39% of Americans believed that global warming poses a threat to their way of life, and only 62% of Americans believed that global warming is due to pollution from human activities. In June 2017, then President Donald Trump called global warming a “hoax” and announced the withdrawal of the US from the Paris Agreement. In 2020, Joe Biden’s presidential campaign emphasised sustainability, and on the first day of his presidency, Biden reversed the US withdrawal from the Paris Agreement.

The European Social Surveys also reveal weak levels of concern about climate change (Oswald and Nowakowski 2020). Given such widespread disagreement, how do banks reflect climate risk in their lending decisions and reconcile diverse perspectives?

In a notable contribution, Krueger et al. (2020) show with survey evidence that institutional investors acknowledge the financial implications of climate risk and believe that regulatory risks have started to materialise. Bolton and Kacperczyk (2021) find that investors require a premium for holding the stock of firms with high levels of carbon emissions. However, empirical evidence on banking behaviour is mixed. Is bank lending driven by environmental and biodiversity risk or local preferences?

Delis et al. (2018) show that banks started penalising firms for their fossil fuel reserves after the 2015 Paris Agreement. Degryse et al. (2023) find that after 2015, green banks started rewarding firms for being green in the form of cheaper loans. Carbon emissions and cap-and-trade policies have impacted bank credit supply (Antoniou et al. 2020, Kacperczyk and Peydro 2022, Krueger et al. 2020).

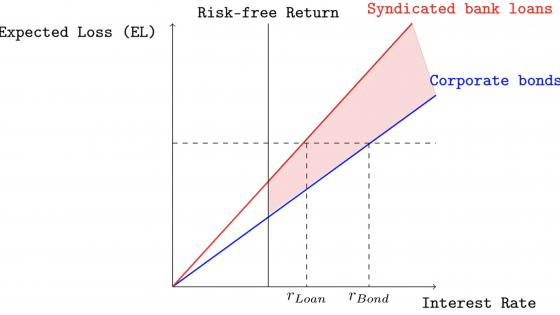

In contrast, Tsoumas et al. (2020) show that the 2013 EU Emissions Trading System resulted in a reduction of loan spreads, undermining the reduction in CO2 emissions. Beyene et al. (2021) document fossil fuel firms shifting from bond to bank financing as their stranded asset risk exposure rises. There is also evidence of regulatory arbitrage as firms move to areas with less stringent climate policies (Kabas et al. 2021, Hou et al. 2021).

Environmental risk

In a recent paper (Erten and Ongena 2023), we use syndicated loan data from the Reuters Dealscan Database and environmental risk data from the S&P Trucost Database. We document that at loan origination – and controlling for borrower fundamentals and non-price deal characteristics – weakly capitalised lenders charge higher rates to borrowers with a larger impact on water, air, and land pollution, the use of natural resources, and waste. The effects are robust to the inclusion of borrower fundamentals and non-price deal characteristics. In all our specifications, we account for the time-varying changes in green attitudes and preferences of the lender to focus on the risk channel. We then study borrower-level heterogeneity to understand the underlying mechanism behind the price response.

Role of beliefs

To gain deeper insights into what drives the price response to environmental risk, we study whether lenders consider the beliefs and preferences in the local area of their borrowers. Regulators in parts of the US that are prone to climate change denial may be less likely to enforce climate change rules as they face less political pressure. Firms that damage the environment are also less likely to face unexpected disruptions in demand from climate activists and pro-climate consumers. Our conjecture is that lenders are less likely to price environmental risk if the borrower is in a ‘climate-denier’ state. We first use the Yale Survey Evidence of Climate Change Preferences and show that there is substantial geographic dispersion in beliefs and attitudes towards global warming. Overall, we find that lenders tend to penalise borrowers for their environmental risk only in pro-climate states, suggesting that environmental risk perception in bank lending is related to local beliefs and preferences.

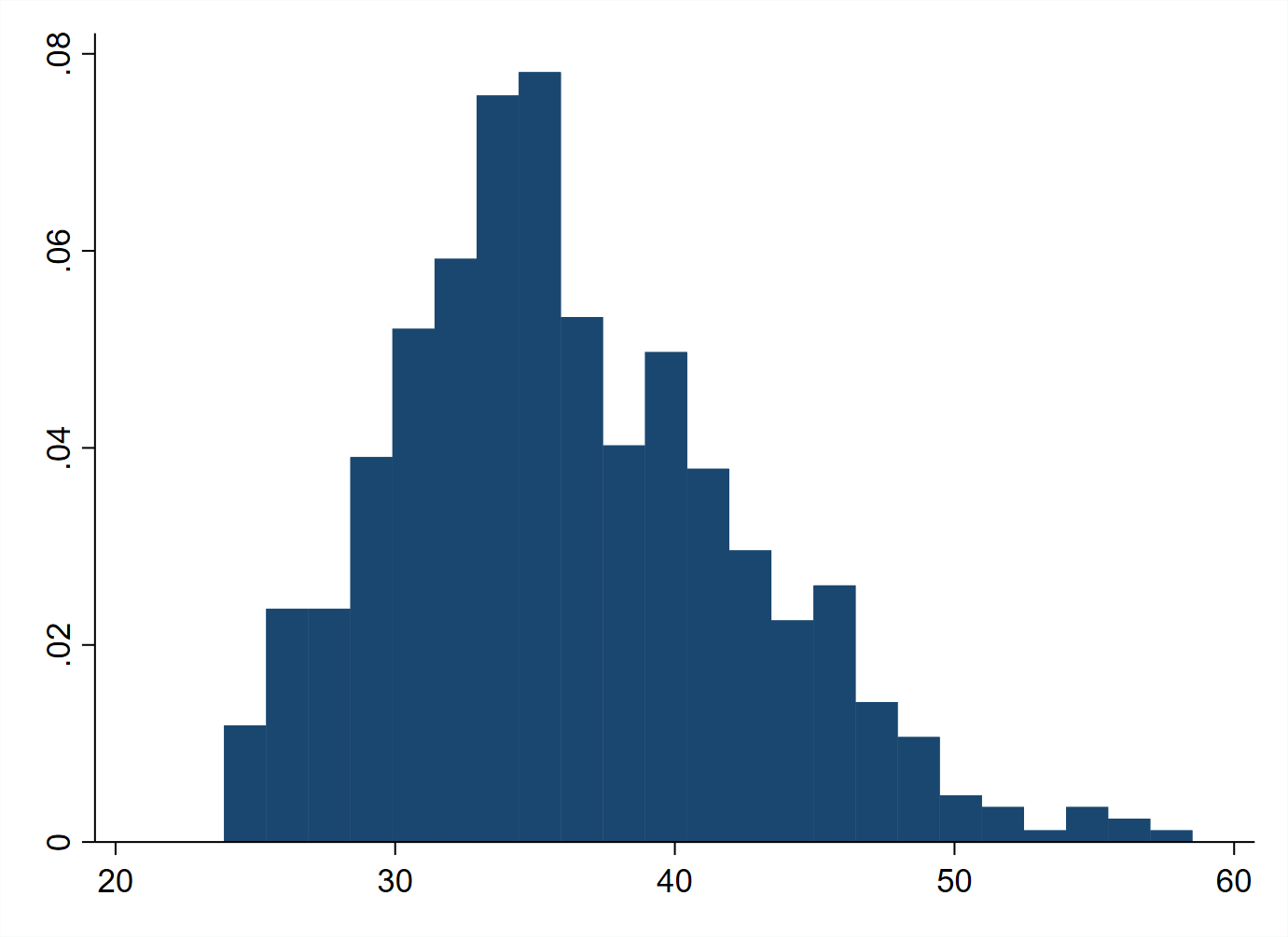

Figure 1 Distribution of climate change denial based on personal harm

Biodiversity risk

Another potential channel that may lead banks to account for environmental risks is biodiversity, which refers to the variety of life on earth, including animals, plants, bacteria, and fungi. At the 2022 UN Biodiversity Conference in Montreal (COP15), UN Assessments documented that 80% of the world’s species are threatened by economic activity, and that 40% of global land surfaces are degraded. A recent line of empirical papers has started investigating the role of biodiversity on pricing in non-banking contexts (Flammer et al. 2023, Garel et al. 2023, Giglio et al. 2023). We show that while being in a state subject to higher biodiversity risk is associated with higher loan rates, we find no evidence that higher firm-level biodiversity risk affects the price response of banks to environmental risk.

Environmental deregulation and regulatory enforcement

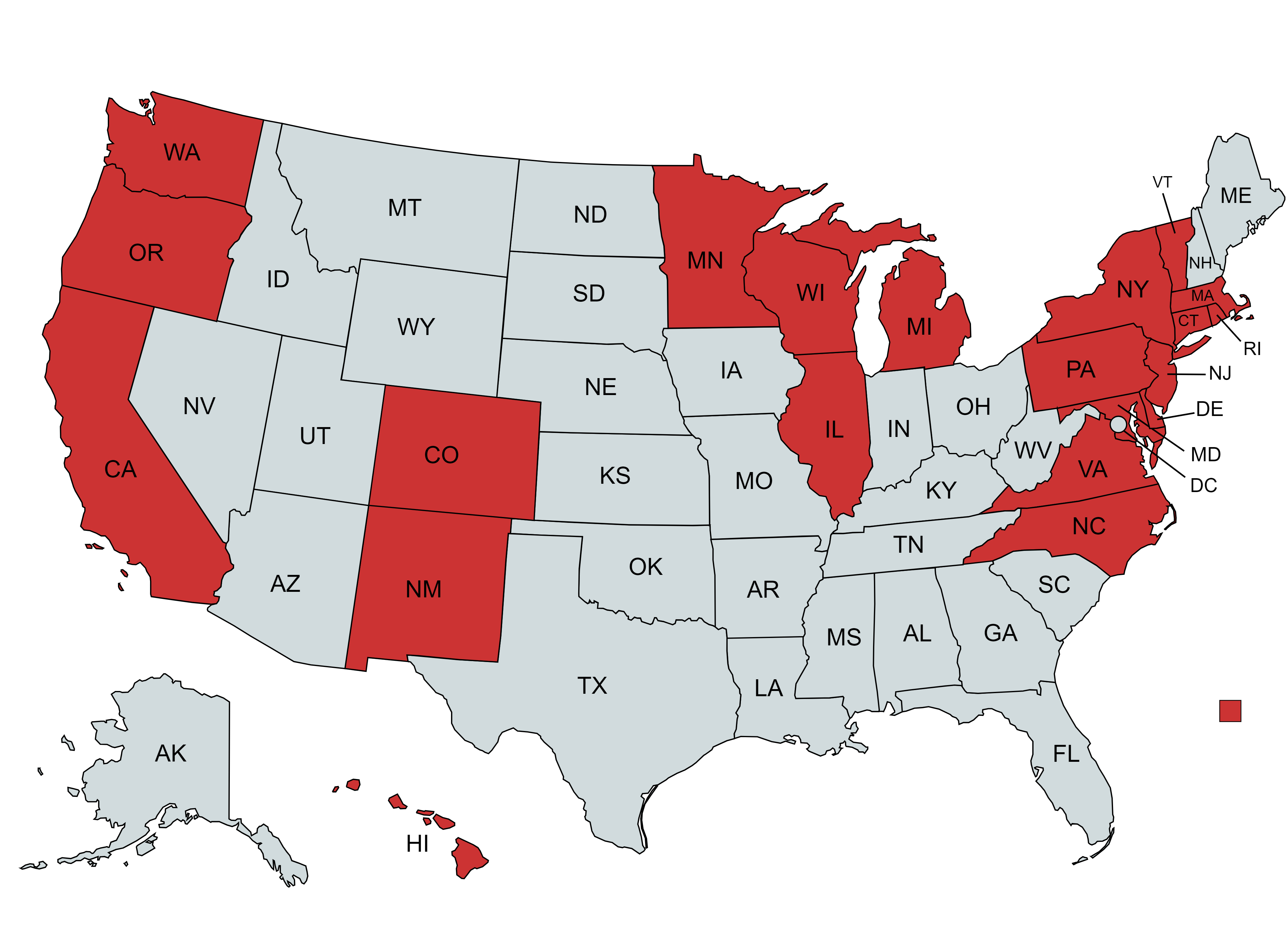

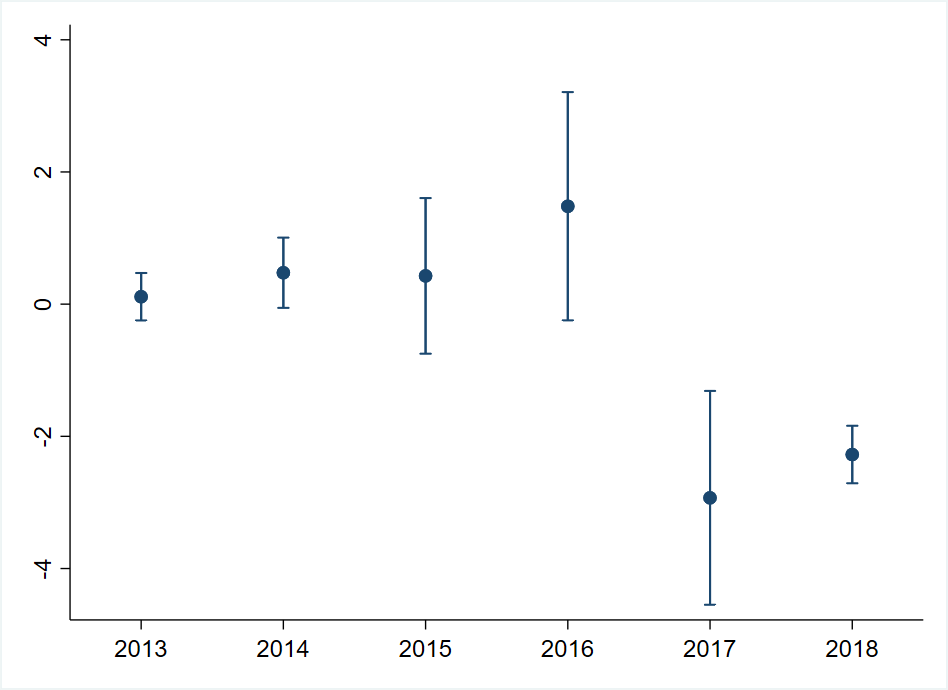

To quantify the price of environmental risk, we use Trump’s withdrawal from the Paris Agreement as a shock to the environmental risk perception of borrowers, leaving borrower fundamentals and bank characteristics unchanged. The set-up gives us a distinction between treated and untreated firms, as several cities and states unexpectedly sued the government for withdrawing from the Paris agreement, making it less likely to be enforced. It is also natural to expect states with a Republican majority to be more likely to support deregulation ex post. We find that after environmental deregulation, banks significantly reduced the sensitivity of their loan pricing to the environmental impact of their borrowers in those areas that did not sue the government for withdrawal and in Republican states. Moreover, we find that the effects appear more forcefully in climate-denier states, suggesting that the price of environmental risk depends on local beliefs and enforcement. We also show that environmental deregulation is associated with a reduction in the price of environmental risk for land and water impact, air pollution, and GHG emissions, but the effects are significant for natural resources, water, and waste.

Figure 2 States that challenged Trump-era environmental deregulation

Figure 3 Dynamic regression coefficients of the interaction term of the total impact ratio and the years before the 2017 Trump deregulation

Policy implications

Our results suggest that lenders perceive environmental risk as a material risk factor. We also show that banks only account for the salient and direct environmental impact of their borrowers, controlling for other known sources of risk and loan characteristics. This environmental rate sensitivity is concentrated on those borrowers in states where climate denial is low. An important implication of our study is that the pricing adjustments of climate transition may depend on local beliefs and enforcement rather than on rules. In a regulatory environment where firms are unlikely to face local pressure, and climate risk is seen as dubious, our paper shows that banks are also less likely to adjust their cost of credit.

References

Antoniou, F, M D Delis, S Ongena and C Tsoumas (2020), “Pollution permits and financing costs”, Swiss Finance Institute Research Paper, 20–117.

Beyene, W, K De Greiff, M D Delis and S Ongena (2021), “Too-big-to-strand? Bond versus bank financing in the transition to a low-carbon economy”, VoxEU.org, 4 December.

Bolton, P and M Kacperczyk (2021a), “Do investors care about carbon risk?”, Journal of Financial Economics 142(2): 517–49.

Delis, M, K De Greiff and S Ongena (2021), “The carbon bubble and the pricing of bank loans”, VoxEU.org, 27 May.

Degryse, H, R Goncharenko, C Theunisz and T Vadasz (2023), “When green meets green”, Journal of Corporate Finance 78: 102355.

Erten, I and S Ongena (2023), “Do banks price environmental risk? Only when local beliefs are binding!”, CEPR Discussion Paper 18664.

Flammer, C, T Giroux and G Heal (2023), “Biodiversity finance”, technical report, NBER Working Paper 31022.

Garel, A, A Romec, Z Sautner and A F Wagner (2023), “Do investors care about biodiversity?”, Swiss Finance Institute Research Paper, 23–¬24.

Giglio, S, T Kuchler, J Stroebel and X Zeng (2023), “Biodiversity risk”, NBER Working Paper 31137.

Hou, K, K Sehoon and S Bartram (2021), “Tackling climate change requires global policies”, VoxEU.org, 3 May.

Ivanov, I, M S Kruttli and S W Watugala (2023), “Banking on carbon: Corporate lending and cap-and-trade policy”, Review of Financial Studies, forthcoming.

Kabas, G, S Ongena and E Benincasa (2021), “There is no planet B, but for banks there are countries B to Z: Domestic climate policy and cross-border bank lending”, VoxEU.org, 3 November.

Kacperczyk, M T and J L Peydro (2022), “Carbon emissions and the bank-lending channel”, SSRN 3915486.

Krueger, P, Z Sautner and L T Starks (2020), “The importance of climate risks for institutional investors”, Review of Financial Studies 33(3): 1067–111.

Robert-Nicoud, F and G Peri (2021), “On the economic geography of climate change,” VoxEU.org, 11 October.