Recent evidence shows that government purchases of goods and services are composed of many transactions heterogeneously distributed across diverse industries. Spending at the sectoral level is volatile, and it accounts for the largest part of the short-term variation in total public expenditures (Cox et al. 2023). In turn, the sectoral composition of public purchases can also vary over time, as government preferences and needs change, for instance shifting from military build-ups to healthcare expenditures, or vice versa.

Motivated by these observations, a growing number of studies delve into how the sectoral origins of government purchases influence the aggregate spending multiplier, which measures the change in GDP resulting from an increase in government purchases. Researchers have developed rich multi-sector models with input-output structures (Bouakez et al. 2023a, 2003b, Flynn et al. 2021, Proebsting 2022), showing that, among other things, the spending multiplier is higher when purchases are concentrated in industries with stickier prices, are further downstream in the supply chain, and when government demand represents a larger share of sectoral output (e.g. the aerospace industry).

This research programme emphasises the significance of sectoral linkages for the overall impact of public spending. Nevertheless, there is limited empirical evidence regarding how the supply chain propagates the effects of sectoral government purchases. The complex interconnectedness of industries, often referred to as the production network, implies that public demand originating in a specific industry affects both industries that supply intermediate inputs to the recipients (upstream effects) and those that use the recipients' output as a production input (downstream effects). Important empirical questions remain unanswered: How do changes in sector-specific spending impact employment, output, and prices in the recipient industries? What are the effects upstream and downstream in the production network? And ultimately, what are the aggregate implications?

In a recent study (Barattieri et al. 2023), we use the universe of US public procurement contracts to address these questions. Our research provides new evidence on the economic effects of procurement spending along the supply chain. In addition, we estimate the implications for the aggregate public procurement multiplier and explore how the latter varies with recipient industry characteristics.

We use the USASpending.gov database, which details all contracts awarded by the US government, including the industry producing the good or service purchased and the extent to which the contract was competitively bid. We focus on the period 2001-2019, which encompasses roughly 80 million contracts, and aggregate the data to the six-digit North American Industry Classification industry level quarterly.

Sectoral spending across industries

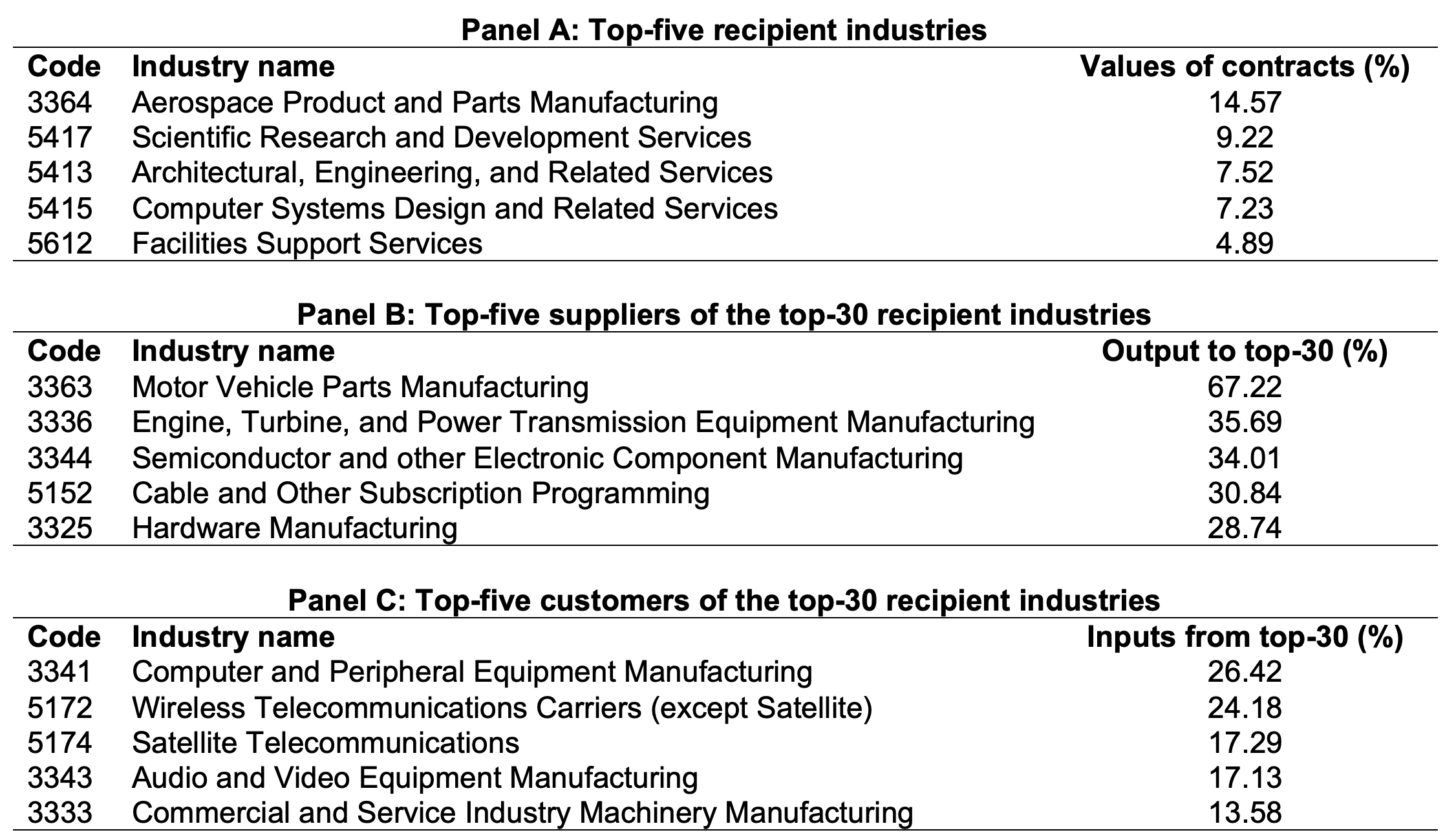

Table 1, Panel A reports the top five recipient industries of government contracts from our data. While past studies of sectoral government spending solely focus on manufacturing industries (Nekarda and Ramey 2011, Acemoglu et al. 2016), the table shows that four of the five top industries are in the service sectors. The table also indicates that government procurement is highly concentrated in a few industries, as noted by Cox et al. (2023). The top five recipient industries account for 43% of the total contract value, while the top 30 recipients comprise more than 70%. Using input-output tables from the Bureau of Economic Analysis (BEA), Table 1, Panel B reports the main suppliers of the top 30 recipient industries; Panel C reports the main customers. Both suppliers and customers encompass manufacturing and service sectors, and exposure is generally stronger for suppliers than customers.

Table 1 US government contracts, 2003-2019

Source: Barattieri et al. (2023).

The effects of public spending across industries

To study the industry-level effects of procurement purchases, we employ a two-stage estimation approach. In the first stage, we identify variation in sectoral spending that is plausibly uncorrelated with industry-specific and aggregate business cycle conditions. Additionally, to account for expected variations in public procurement due to implementation lags and long-standing contracts, we consider the extent to which contracts were competitively awarded and use financial market data measuring expected profitability. We document that, within the portion of public spending identified as unexpected and unrelated to economic conditions, several competitive contracts received media coverage around the signing date. Furthermore, the timing of several contracts coincides with events such as military expenditures for conflicts in Iraq and Afghanistan, as well as relief efforts for natural disasters like Hurricane Katrina.

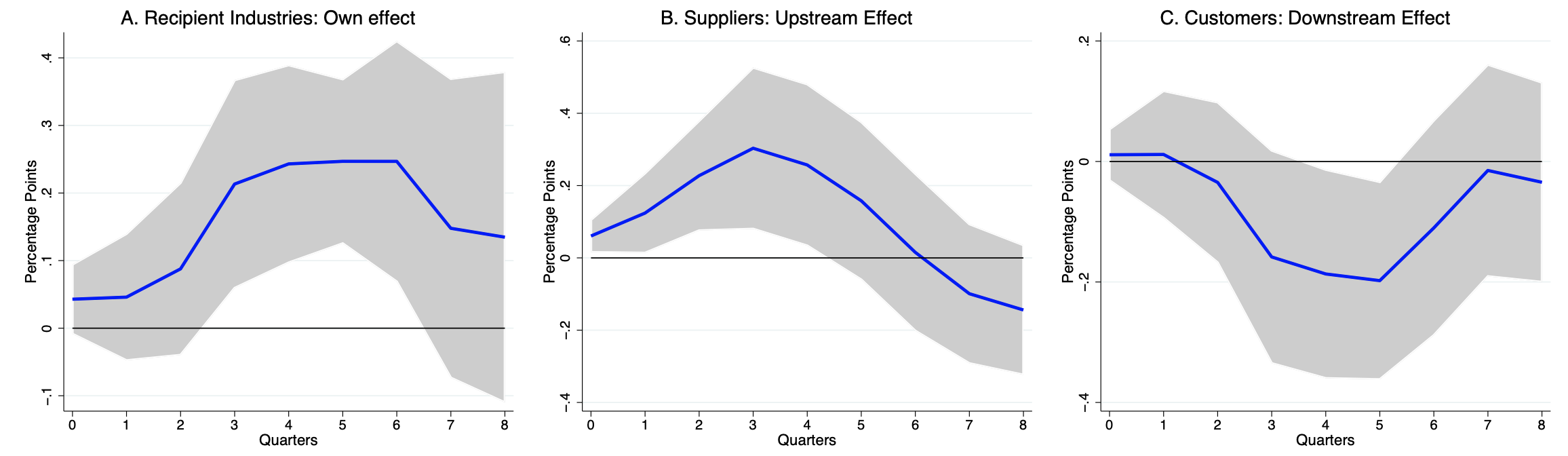

In the second stage, we use the identified sectoral spending variation to examine the dynamic effects of public spending on recipient industries, their suppliers (the ‘upstream effect’), and their customers (the ‘downstream effect’). We employ input-output tables to measure upstream and downstream exposure within the production network. As shown in Figure 1, Panel A, an increase in public spending equal to 1% of sectoral output results in a significant increase in employment in the recipient industries. The response peaks several quarters after the initial shock, underscoring the importance of estimating dynamic responses, an aspect hitherto unexplored in the literature. Figure 1, Panel B illustrates a similarly positive and significant upstream employment response. In contrast, as depicted in Figure 1, Panel C, downstream employment declines. These findings hold true also when considering industrial production (although, in this case, data availability restricts the sample to manufacturing industries only).

Figure 1 Employment effects of government procurement

Source: Barattieri et al. (2023).

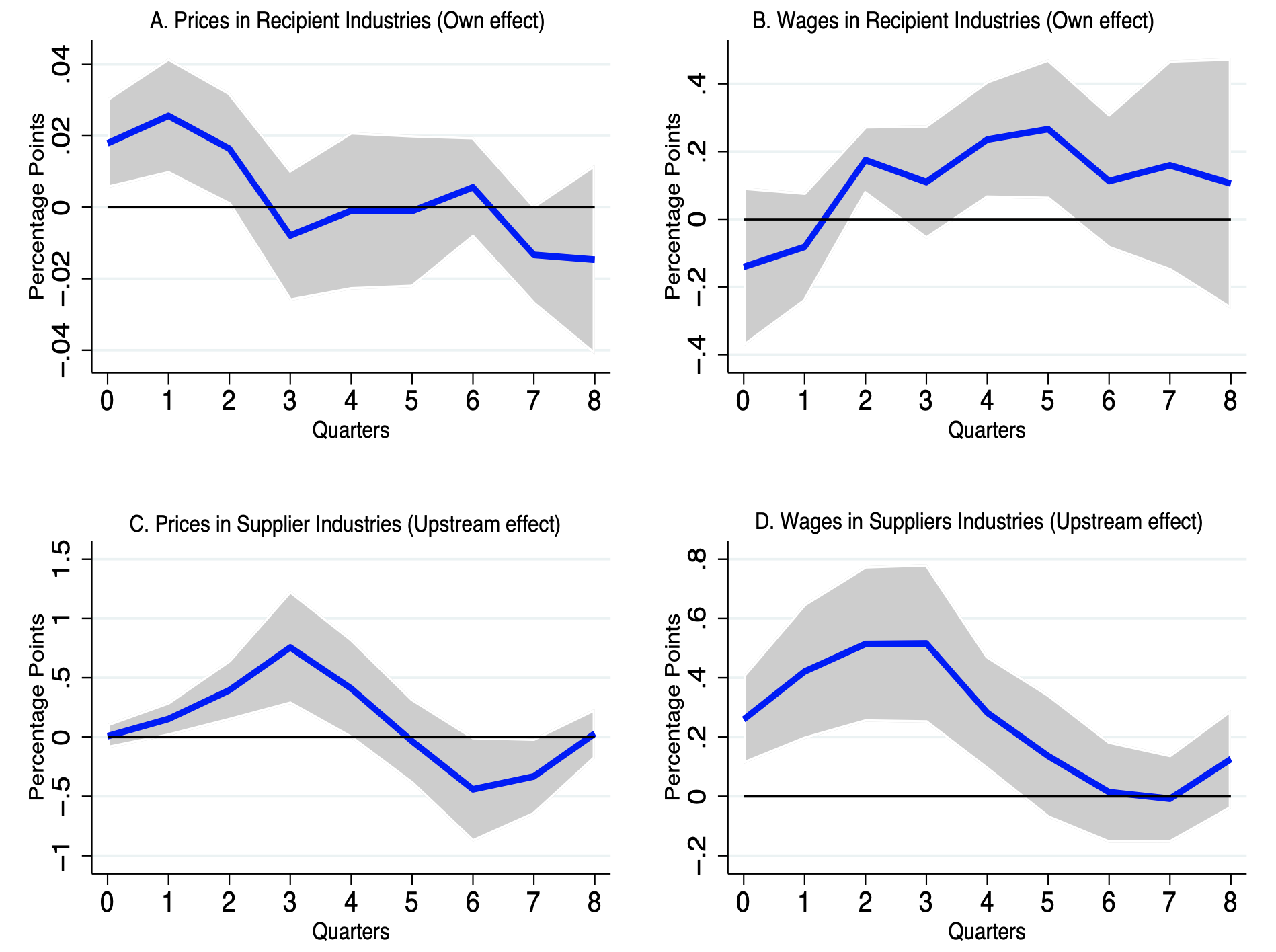

How can one rationalise the results in Figure 1? Influential theoretical work on the network propagation of sectoral shocks highlights the important role of price adjustment across sectors (e.g. Acemoglu et al. 2016). For this reason, we next turn to the effects of procurement spending on prices and wages. Figure 2, Panels A and B show that, in the recipient industries, prices and wages increase following an increase in public purchases. Panels C and D show the same results hold true in upstream industries. These findings are consistent with the textbook transmission of a demand shock. Moreover, higher prices and wages in recipient and upstream industries also provide a natural explanation for the negative downstream employment effects. Intuitively, higher upstream prices imply higher intermediate input prices downstream, lowering input demand and production. Higher wages may also adversely affect downstream employment if labour is mobile across sectors, as employees may move to industries with higher wages.

Figure 2 Price and wage effects of government procurement

Source: Barattieri et al. (2023).

The aggregate procurement spending multiplier

The industry-level analysis demonstrates that sector-specific changes in public demand have heterogeneous effects along the supply chain. This result raises the question of how production linkages and recipient-industry characteristics shape the aggregate effects of public procurement. By design, industry-level estimates cannot be used to infer aggregate outcomes. Instead, we leverage the granular nature of the data and apply the granular instrumental variable (GIV) approach developed by Gabaix and Koijen (2023). In our context, this methodology identifies idiosyncratic variations in sectors that receive public spending. Our data provide an ideal setting for applying the GIV approach since a few large industries account for a significant share of aggregate spending. Since this variation is uncorrelated with the aggregate business cycle, it can be used as an instrument for changes in the aggregate of procurement contracts. For comparability with the existing literature, we estimate local projections for the GDP multiplier. The baseline multiplier estimate is approximately 0.6, aligning with recent estimates that use aggregate spending data (Ramey and Zubairy 2018). In line with theoretical predictions (Bouakez et al. 2023b, Cox et al. 2023, Proebsting 2022), we also find that sectoral characteristics matter for the size of the multiplier. Aggregate effects are larger when recipient sectors are more downstream, have less flexible prices, and the government accounts for a significant portion of the recipient's total sales.

Conclusions: Looking ahead

Our empirical results offer fresh insights into the propagation of public spending through the production network, both at the sectoral and aggregate levels. The finding that government demand can lead to employment and output crowding out in industries located downstream in the supply chain provides a rationale for targeted sectoral spending. An important consideration for future models of fiscal transmission through the supply chain is to incorporate these dynamics, as benchmark production network models typically only focus on the upstream propagation of demand shocks (e.g. Acemoglu et al. 2016). More broadly, our results confirm the importance of production networks in propagating macroeconomic policies. This subject received substantial attention in the context of recent trade tensions between the US and China (see Barattieri and Cacciatore 2023, Conconi et al. 2023, and Flaaen and Pierce 2019), the transmission of monetary policy (e.g. Ozdagli and Weber 2023), and following supply-chain disruptions ensuing the Covid-19 pandemic (Alessandria et al. 2023, Alfaro and Chor 2023).

References

Acemoglu, D, U Akcigit and W Kerr (2016), “Networks and the macroeconomy: an empirical exploration”, NBER Macroeconomics Annual 30(1): 273-335.

Alessandria, G, S Khan, A Khederlarian, C Mix and K Rhul (2023), “The aggregate effects of local and global supply chain disruptions, 2020-2022”, VoxEU.org, 12 March.

Alfaro, L and D Chor (2023), “A perspective on the great reallocation of global supply chains”, VoxEU.org, 28 September.

Barattieri, A and M Cacciatore (2023), “Self-Harming Trade Policy? Protectionism and Production Networks”, American Economic Journal: Macroeconomics 15: 97-128.

Barattieri, A, M Cacciatore and N Traum (2023), “Estimating the effects of government spending through the supply chain”, NBER Working Paper No. 31680.

Bouakez, H, O Rachedi and E Santoro (2023a), “The government spending multiplier in a multisector economy”, American Economic Journal: Macroeconomics 15(1): 209-39.

Bouakez, H, O Rachedi and E Santoro (2023b), “The sectoral origins of the spending multiplier”, mimeo.

Conconi, P, C Brown, A Erbahar and L Trimarchi (2023), “Politically motivated trade protection”, mimeo.

Cox, L, G Muller, E Pasten, R Schoenle and M Weber (2023), “Big G”, mimeo.

Flaaen, A and J Pierce (2019), “Disentangling the effects of the 2018-2019 Tariffs on a Globally Connected US Manufacturing Sector”, Finance and Economics Discussion Series 2019-086, Board of Governors of the Federal Reserve System.

Flynn, J P, C Patterson and J Sturm (2021), “Fiscal Policy in a Networked Economy”, NBER Working Paper 29619.

Gabaix, X and R Koijen (2023), “Granular instrumental variables”, Journal of Political Economy, forthcoming.

Nekarda, C and V Ramey (2011), “Industry evidence on the effects of government spending”, American Economic Journal: Macroeconomics 3(1): 36-59.

Ozdagli, A and M Weber (2023), “Monetary policy through production networks: evidence from the stock market”, Journal of Finance, forthcoming.

Proebsting, C (2022), “Market segmentation and spending multipliers”, Journal of Monetary Economics 128: 1-19.

Ramey, V and S Zubairy (2018), “Government spending multipliers in good times and in bad: evidence from US historical data”, Journal of Political Economy 126(2): 850-901.