Our world is already experiencing the effects of climate change. There is no doubt that decisive political action is needed to create additional economic incentives to reduce carbon emissions and promote the use of climate-friendly technologies. While there is much public discussion about government support programmes to reduce industrial emissions, households have an equally important role to play in reducing overall emissions, as their consumption is responsible for about two-thirds of annual carbon emissions in countries such as Germany. A closer look at data from the German Statistical Office also shows a clear correlation between income and the carbon footprint of households: As income rises, so do average carbon emissions. The fact that higher-income households are also larger emitters creates a reduction-redistribution trade-off for policymakers. If a climate policy provides financial incentives to reduce emissions and is financed equally by all households, then such a policy will lead to lower emissions, but is also likely to lead to redistribution from low-income to high-income households. A key question in times of high inequality is therefore whether and which climate policies will not only reduce emissions but will also be supported by the electorate.

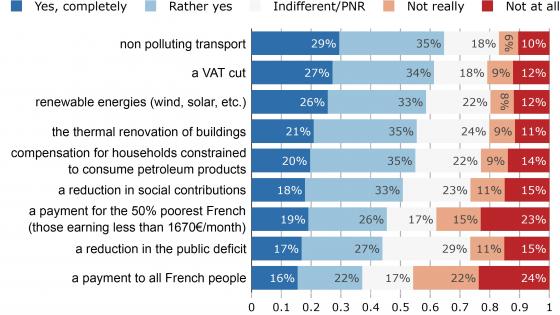

In recent years, the distributive impact of policies has become a key criterion for their political feasibility (Stantcheva et al. 2022, Furceri et al. 2021). A policy in which high-income households are net recipients of transfers and low-income households are net contributors regularly fails to gain broad acceptance and reduces the chances of the policy being implemented (Fabre and Douenne 2022). For example, consider a programme in which low-income families subsidise the purchase of electric cars by high-income households. Although such a programme would reduce emissions, it would probably be politically difficult to support because of its social impact. In general, climate policies are not well suited to address issues of redistribution, but, as we argue, they must consider the political-economic constraints on redistribution in order to be feasible. This leads to the challenge of designing policy mixes that trade off large emission reductions and their consequences for social inequalities. Quantitative answers that address this trade-off are scarce. In a recent research paper (Kuhn and Schlattmann 2024), we begin to fill this gap by providing a quantitative analysis of different tax and transfer policy mixes in terms of this reduction-redistribution trade-off.

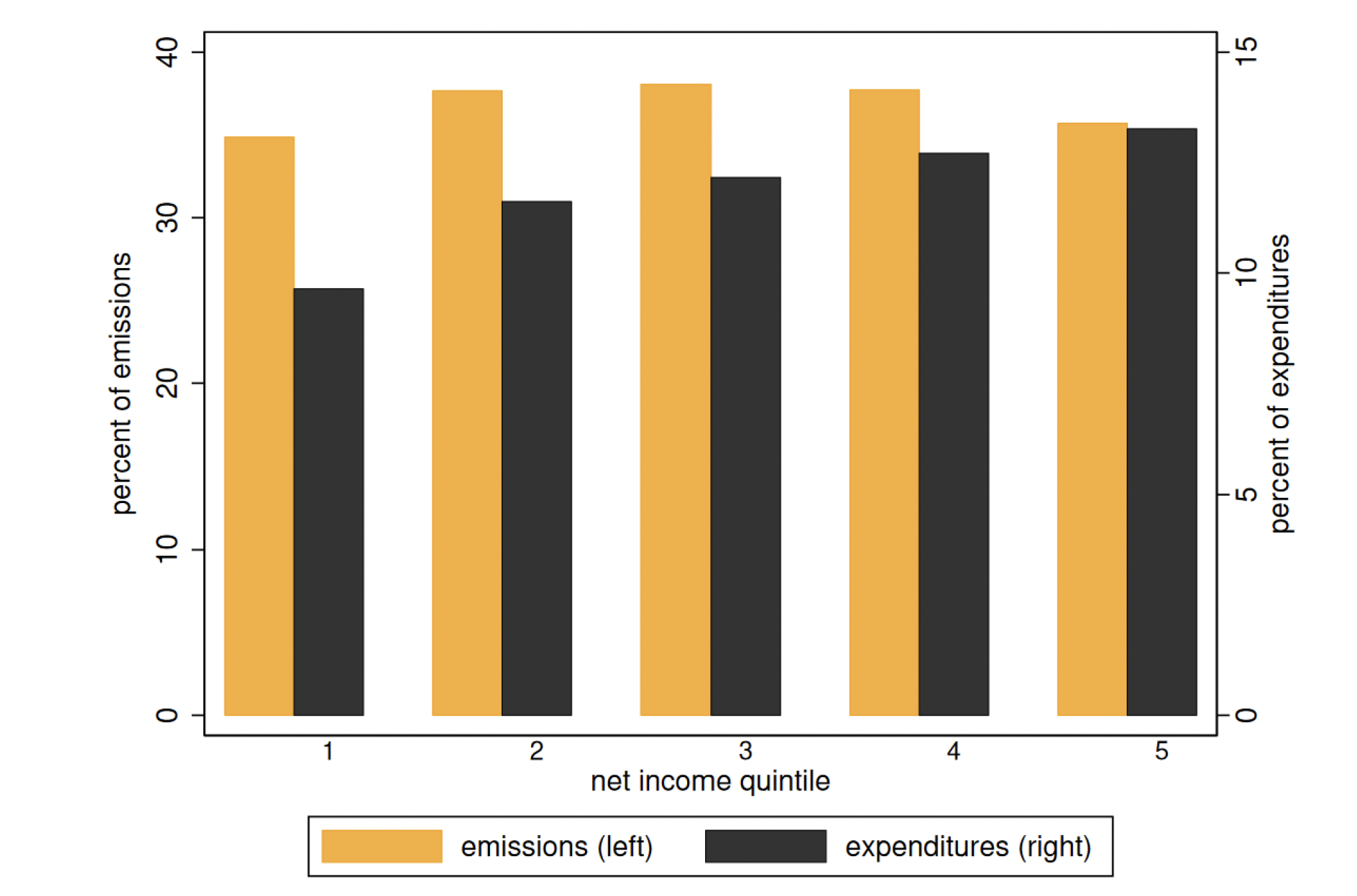

While the static trade-off is well understood, there is an additional dimension of distributional effects that has received little attention. Household adaptation to more climate-friendly technologies will not happen overnight, but households with different incomes will reduce their carbon emissions at different rates. This is because household carbon emissions are largely caused by consumption commitments, such as cars and heating systems, which households adjust only infrequently. The intertemporal dimension of the adjustment process is important because the purchase of a heating system or a car leads to a long-term commitment to natural gas, oil, or gasoline consumption that is fixed for years, if not decades, after the goods are purchased. Empirically, we document that emissions from goods with long-term consumption commitments account for 35% of the carbon footprint of German households, even though these goods account for only 10% of household expenditures. In contrast to the carbon footprint, these emission and expenditure shares do not vary with household income and this is the same for both poor and rich households (Figure 1).

Figure 1 Commitment good carbon emissions and expenditure shares along the income distribution

Note: This figure shows the share of total emissions and total expenditures for consumption commitments by income quintile. See text for details on the definition of consumption commitments. Results based on 2018 EVS data.

It has already been documented that adoption rates of climate-friendly technologies are correlated with household income (Figenbaum and Kolbenstvedt 2016). In particular, high-income households adjust their purchasing decisions more quickly. This difference in adoption rates leads to a situation where climate policies subsidise the purchase of electric cars for high-income households at the beginning of a transition period, while low-income households continue to use their internal combustion engine car but contribute to the financing of this subsidy through income or carbon taxes. The different rates of adjustment result in net transfers from low-income to high-income households. Such an outcome risks undermining the political support for carbon reduction policies. Ultimately, the climate policy that has the potential to reduce carbon emissions will not achieve a reduction because it does not find a majority due to its distributional effects.

A much-discussed proposal to address this trade-off is to combine a lump-sum transfer financed by the tax revenues of a carbon tax. The carbon tax would provide the economic incentives to reduce carbon emissions, and the transfer would counteract the redistributive effects. This carbon tax is a good example of the intertemporal distributional effect of different rates of adaptation. With a higher carbon tax, a larger proportion of high-income households will switch to technologies such as electric cars, so that after a while it is mainly low-income households that will have to pay the carbon tax. Over time, low-income households will therefore finance an increasing share of the transfers for everyone. If households adapt to climate-friendly technologies at different rates, the reduction-redistribution trade-off will be further exacerbated.

In a new paper (Kuhn and Schlattmann 2024), we study combinations of different incentive instruments, such as subsidies and a carbon tax, with different financing and transfer mechanisms. The goal is to identify a policy mix that would not only lead to significant reductions in carbon emissions, but also take into account distributional effects in order to gain broad public support. Our analysis focuses on consumption decisions for commitment goods and combines the latest available figures on household adaptation behaviour with data on income and carbon consumption to quantify the effects of different policy mixes.

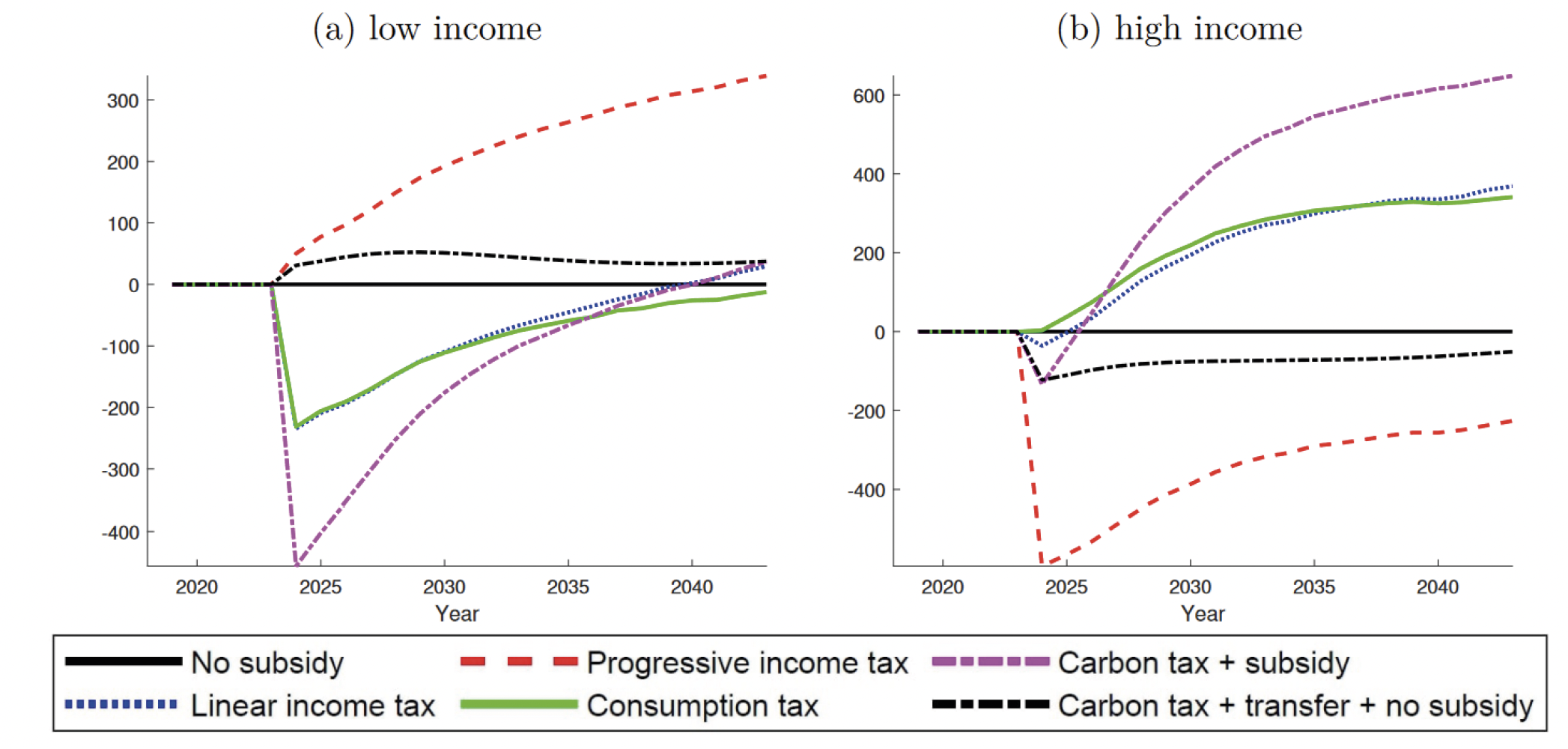

Figure 2 Net annual transfers of different policy mixes for low- and high-income households

Note: This figure shows the annual net transfers of different policy mixes. The left panel shows transfers for low-income households and the right panel shows transfers for high-income households. Transfers are in euros per year. The different policy mixes combine a percentage subsidy for the purchase prices of the modern commitment good with different financing instruments. The carbon tax + transfer + no subsidy policy mix includes no subsidy for the modern commitment good but rebates tax revenues back to households as lump-sum transfer. Tax rates for all policy mixes are set to have a balanced budget over the transition period.

Our results show that while the idea of a carbon tax combined with transfers works qualitatively, the reduction in carbon emissions is quantitatively much lower than with an alternative policy mix that includes direct subsidies. We find that the most attractive policy mix is a progressive climate tax on income to finance a proportional price subsidy for modern climate-friendly goods. The proportional reduction in purchase costs is important to provide high-income households with a strong incentive to switch to climate-friendly technologies. A lump-sum subsidy as a less redistributive alternative is less effective in reducing emissions because high-income households with the largest carbon footprints will adapt less, as a lump-sum subsidy is less attractive when consumption goods are larger and more expensive. However, the proportional subsidy would also mean that households with higher expenditures would receive higher transfers. The progressive climate tax on income counteracts this distributional effect, as it leads to higher taxes for high-income households. The progressive tax implies that high-income households finance the subsidies for high-income households, mitigating the regressive redistribution in the household sector. There would be no redistribution from poor to rich, but rather within income groups between adapters and non-adapters. If a carbon tax replaces the progressive tax, this would lead to a greater reduction in emissions by providing even stronger incentives to adapt to modern consumption goods. However, financing the policy through a carbon tax comes at the cost of redistribution from the poor to the rich and thus jeopardizes its political feasibility, as Figure 2 shows. It shows the time path of net transfers from different policy mixes during a transition period. Calibrated to today's German economy, we find that the carbon tax that finances a proportional price subsidy is the worst in terms of redistribution. Poor households would receive negative transfers of up to €450 per year. In contrast, high-income households receive net transfers of up to €600 per year. In the case of a progressive climate tax on income, the patterns are reversed, with low-income households being net recipients and high-income households being net contributors to the policy. Nevertheless, the reduction in carbon emissions is large and the policy enjoys broad political support.

References

Fabre, A and T Douenne (2022), “Public support for carbon taxation: Lessons from France”, VoxEU.org, 1 May.

Figenbaum, E and M Kolbenstvedt (2016), “Learning from Norwegian battery electric and plug-in hybrid vehicle users”, TØI report 1492/2016.

Furceri, D, M Ganslmeier and J D Ostry (2021), “Design of climate change policies needs to internalise political realities”, VoxEU.org, 7 September.

Kuhn, M and L Schlattmann (2024), “Distributional Consequences of Climate Policies”, CEPR Discussion Paper 18893.

Stantcheva, S, A S Chico, B Planterose, T Kruse, A Fabre and A Dechezleprêtre (2022), “Fighting climate change: International attitudes toward climate policies”, VoxEU.org, 14 October.