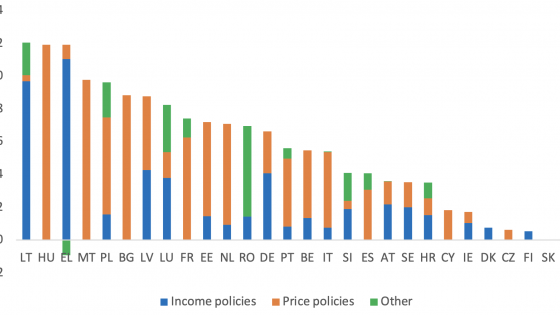

With the world gradually recovering from the economic effects of the Covid-19 pandemic, the Russia-Ukraine war is a devastating problem which threatens the already-fragile economies of the world. The January 2022 CfM survey pointed out how supply-chain disruptions caused by the pandemic have led to surging global inflation, particularly in energy prices. With Russia as a major energy supplier to European countries, the economic effects of the war have been felt severely across Europe, and the UK has been no exception. The UK CPI-H annual rate in August was 8.6% , the Bank of England August forecast had inflation peaking at 13% (Bank of England 2022), although of course, this has transpired in the past month.

Ofgem, the energy regulator in Great Britain, introduced an energy price cap in 2019 to safeguard consumers against high energy prices. The price cap limits the fee an energy supplier can charge per day, for households that are on a fixed monthly tariff, or per kWh for households on a variable tariff. In August 2022, Ofgem announced that the price cap would increase to £3,549 for an average household from October 2022 and would likely rise in the following months. Under growing public pressure, the UK government announced the Energy Price Guarantee on 8 September, to supersede the price cap. The main highlights of the scheme are:

- The Energy Price Guarantee caps energy prices at 34p/kWh for the next two years, from 1 October 2022. This is estimated to ensure that a typical household in Great Britain pays an average of £2,500 a year on their energy bill.

- The Guarantee is effectively a cap on gas and electricity unit prices and standing charges for each fuel, so actual bills will be determined by usage.

- Green levies have been temporarily removed from household bills, which will save households £150 annually.

- The government will offer equivalent support to businesses and other non-household energy users for six months.

These initiatives were launched alongside the already implemented Energy Price Discount , which gives households £400 off their energy bills over a six-month period.

In addition, the government underlined steps to boost energy supply by increasing fossil fuel supply. Among other steps, the government removed the moratorium on UK shale gas production, launched a new oil and gas licensing round, and decided to launch a review to re-evaluate meeting the net zero 2050 target in an ‘economically efficient way’ – likely to slow down the transition towards renewable sources to ease the impact on businesses.

The UK Government will pay suppliers the difference between the wholesale price for gas and electricity they pay and the amount they can charge customers. The cost of the package remains uncertain, but think tanks estimate that the cost will exceed £100 billion (close to 4% of GDP) across the next year alone. The government has ruled out funding this programme using a windfall tax on energy companies, with Prime Minister Liz Truss claiming that such a move would reduce investment in the UK and halt growth. Instead, the government will likely fund this programme through increased borrowing.

While some have praised the government for the size and scale of the scheme, it has also come under criticism for a variety of reasons. One of the main criticisms of the scheme is its dependency on borrowing and taxation for funding. The Institute for Fiscal Studies (IFS) estimates that every additional £1 households spend on energy will likely cost the government 75p over the next year, making the scheme unsustainable in the long run. Other think tanks have criticised the government’s refusal to tax energy companies for the record-breaking profits they have earned during the crisis and have argued that the money being poured into this scheme will only add to the excess profits enjoyed by oil and gas giants. Prime Minister Truss has ruled out taxing oil companies’ profits (or ‘excess profits’) to fund household support. This reverses former Chancellor Rishi Sunak’s announcement in May of an energy profits levy.

Another source of concern is that this scheme merely treats the symptoms of the problem but does not address its root cause – an energy supply shortage. Energy supply is low due to the embargos imposed on Russia, and consequently, some users of energy will have to reduce their energy consumption to address this mismatch. However, by artificially deflating the price of energy, consumers have lesser incentives to reduce their consumption (Milne 2022). With supply expected to remain short over the coming years and no decline in demand, the government’s intervention will likely have to be extended over a significant time horizon, adding pressure on its budget. The IFS further notes that if other European countries attempt to subsidise energy costs for their consumers, it could lead to a bidding war that raises the cost of support for everyone. With demand outstripping supply, there is also an increased risk of blackouts and/or a need for energy rationing.

Think tanks have also criticised the government for their rollback on decades of climate policy by ending the moratorium on fracking and removing green levies from energy bills. Suggestions have been made to reduce dependency on fossil fuels by shifting to renewables to ensure UK’s long-term energy security, as well as to increase the energy efficiency of UK households via insulation and better architectural design to reduce energy demand in the long term.

Experts have also criticised the scheme as ‘very poorly targeted’ as it disproportionately benefits the richest households who also have the highest energy consumption. The IFS estimates that half of the giveaway will go to the top half of the income distribution. Think tanks have proposed a variety of alternative schemes to provide targeted support to the poorest households, including a price cap that depends on and increases with individual users’ consumption , payments to households based on past energy consumption, a ‘social tariff’ , and a universal provision of a fixed amount of energy at a regulated price to avoid sudden price shocks.

This month’s CfM survey asks about the government’s energy policy proposals. Panellists were first asked whether the energy price caps will leave the average UK household better off. They were then asked for the best way to address the problem of high energy costs and their impact on the cost of living. Finally, they were asked whether a windfall tax on energy should be used to offset part of the cost of the energy subsidy.

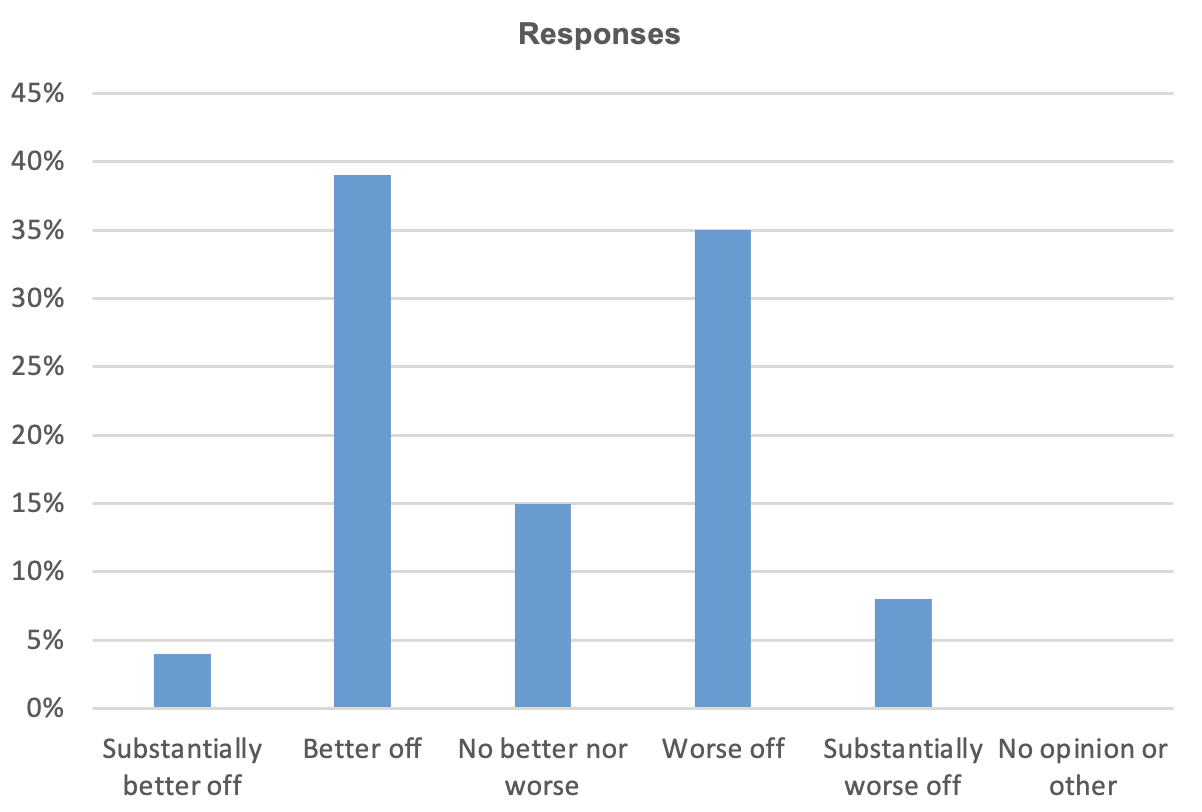

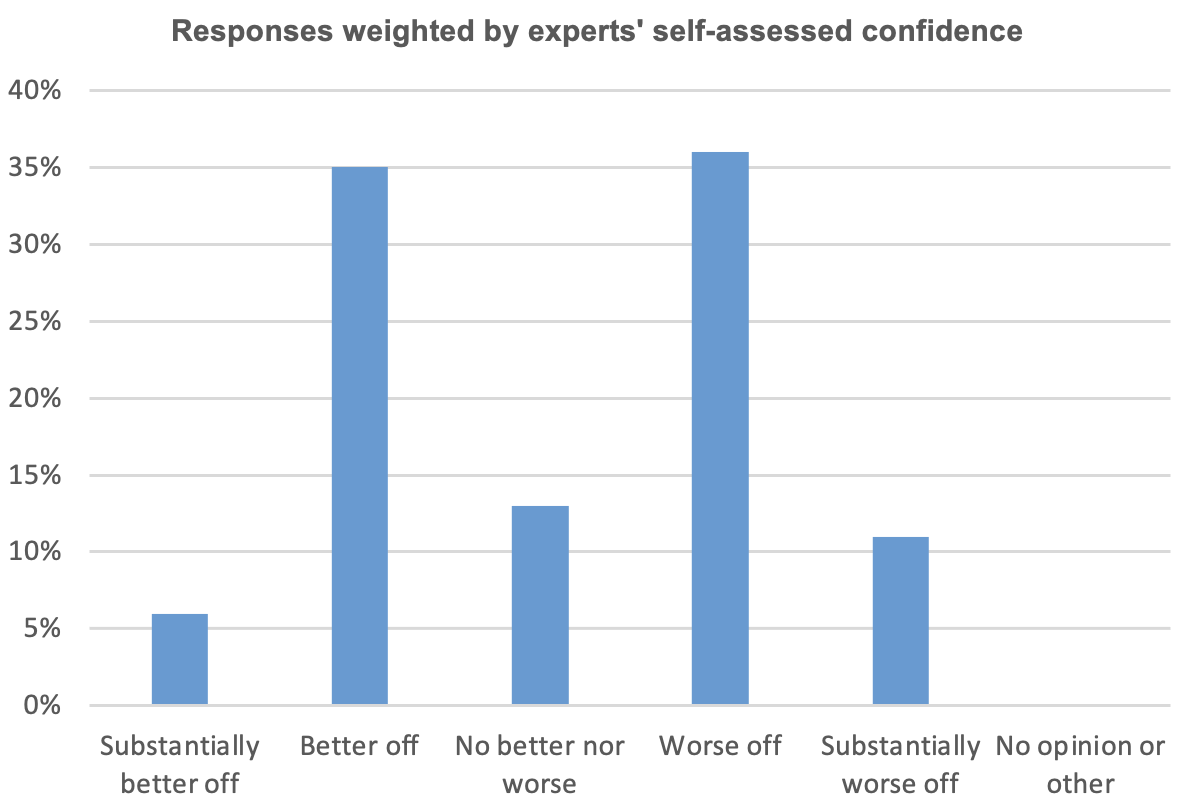

Question 1: Overall, which of the following best characterises how the government’s proposed energy policies will leave the average UK household over the medium term:

Twenty-six panel members responded to this question. They were evenly split between those believing that the policies would leave households better off and those that think the average household will be worse off (nearly 43% each). The remaining 15% thought households would be neither worse nor better off.

Several panellists agreed that although the government could have done a better job in targeting the policies, the policy would provide relief to households. Roger Farmer (University of Warwick) summarises this view: “The fact that the policy may be poorly targeted does not take away from the fact that it will substantially reduce energy bills for UK households.” This stance is supported by Nicholas Oulton (London School of Economics), who mentions that the average household is “better off this year with the cap than without any assistance at all.” He states that the cap should be thought of as a “consumption-smoothing scheme”, which would have been virtually impossible for individuals to replicate privately, and hence, was a necessary intervention.

Opponents of the policies argued that the policies did nothing to tackle the main cause of the crisis – an energy shortage. Ethan Ilzetzki (London School of Economics) sums up the situation: “There is simply less fuel to go around and someone needs to consume less.” He further points out that the government’s policies are “very untargeted and far too costly.” These statements are echoed by Martin Ellison (University of Oxford), who highlights the need for the UK to “adjust” to rising energy prices in the medium term. With the government funding its policies through increased borrowing, he predicts that this situation “can only make the average UK household worse off” in the medium term.

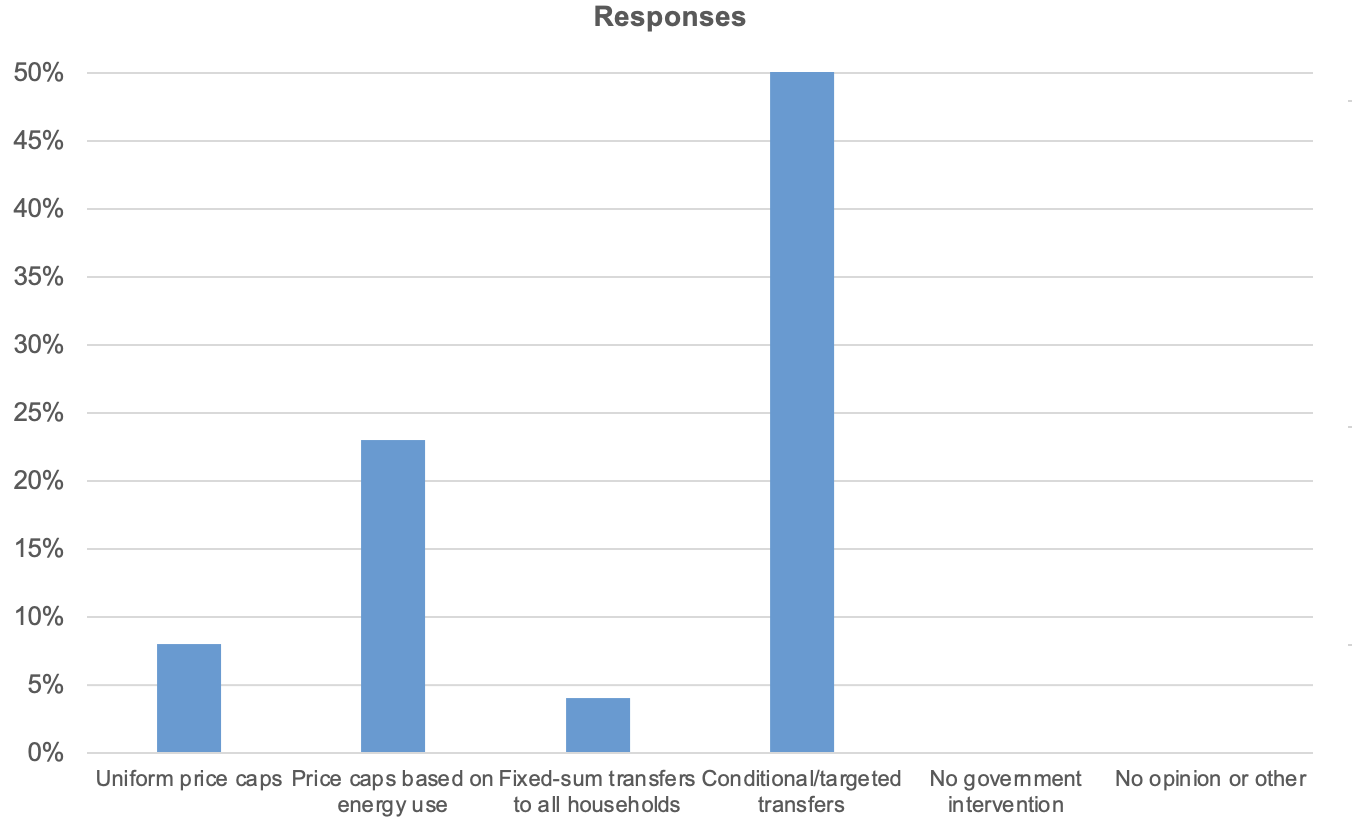

Question 2: Which of the following is the best way to address the impact of rising energy costs on household finances?

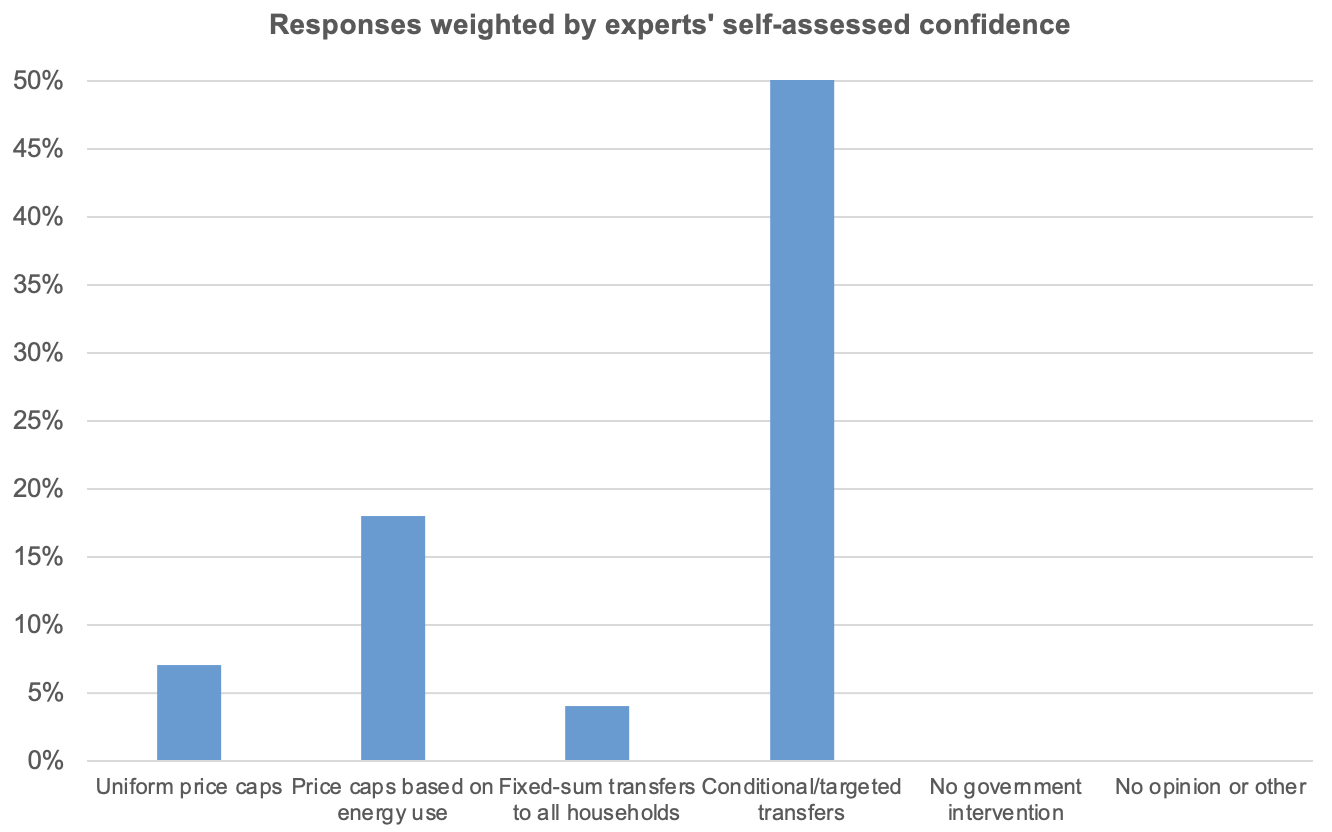

Twenty-six panel members answered this question. A majority of 65% of the panel would have preferred to allow energy prices to increase and to make conditional or targeted payments to households in greater need. An additional 23% accept the logic of price caps but would like to see them be conditional on the amount of energy consumed, to incentivise households to reduce their energy consumption. Only 8% support the government’s across-the-board price cap as their preferred policy.

Most panellists stressed the need to let the market system function without interference, and instead, support the financially vulnerable through conditional or targeted transfers. Jumana Saleheen (Vanguard Asset Management) explains that the market price should be allowed to “clear the market”, as it would ensure that people who can afford to cut energy use would reduce their demand in line with the rising prices. While this would incorporate the true price of energy in people’s choices, Stephen Millard (National Institute of Economic and Social Research) highlights the importance of protecting the financially vulnerable through the “redistribution” of wealth using conditional/targeted transfers.

Jagjit Chadha (National Institute of Economic and Social Research) expressed support for an alternative policy – price caps based on energy use. He noted that this policy would not only be “progressive”, but would “encourage economies of usage”, paying for itself without increasing public debt in the long run. While supporting this policy as “the economist’s choice”, Roger Farmer pointed out that uniform price caps are “easy to understand and relatively easy to implement”, making them more politically feasible in the UK.

However, not all panellists oppose the government’s universal price cap. Nicholas Oulton describes the current situation as an “emergency”, which requires a scheme that “doesn’t unintentionally leave a lot of people unprotected”. He further notes that given more time and better technology, a “superior” policy could be designed, but the government made the best of what they had. James Smith (Resolution Foundation) expressed similar views, stating that there is “currently no mechanism” for delivering targeted interventions, which is why the government is justified in implementing blanket price guarantees.

Question 3: Should a windfall tax be used to (fully or partially) finance support to households?

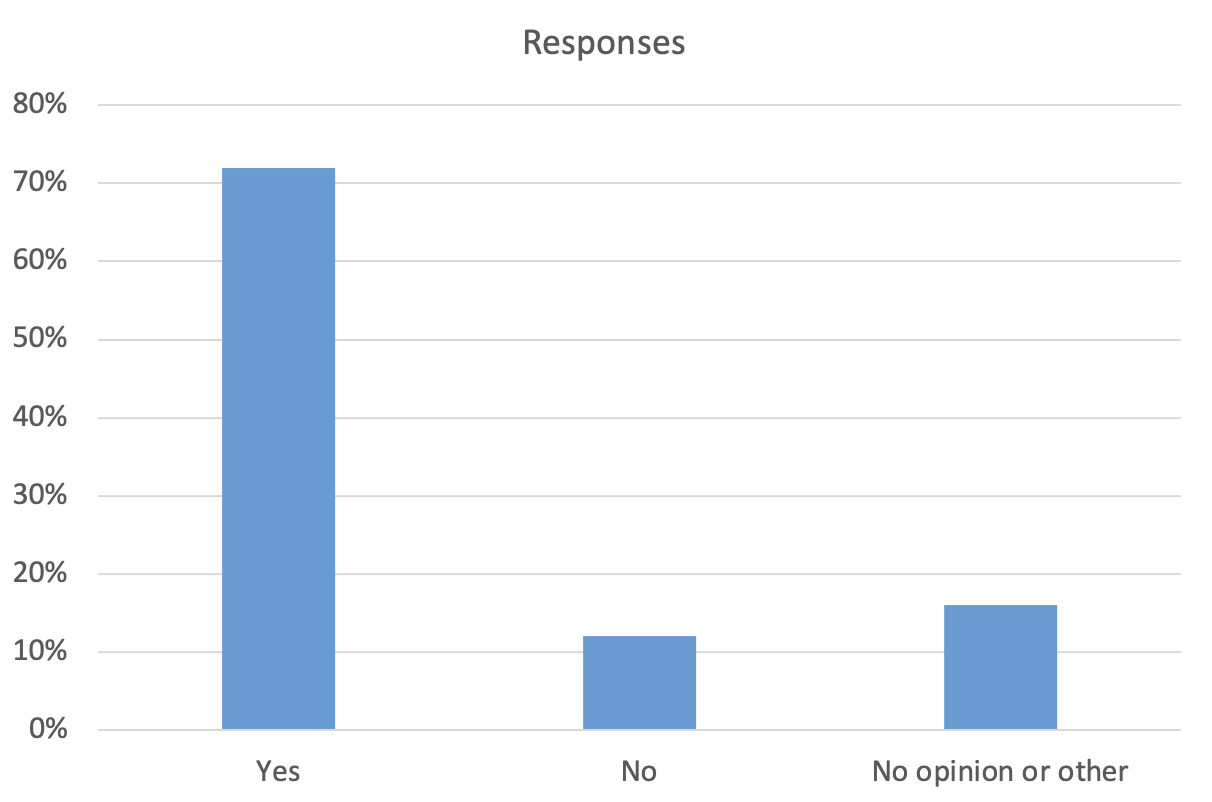

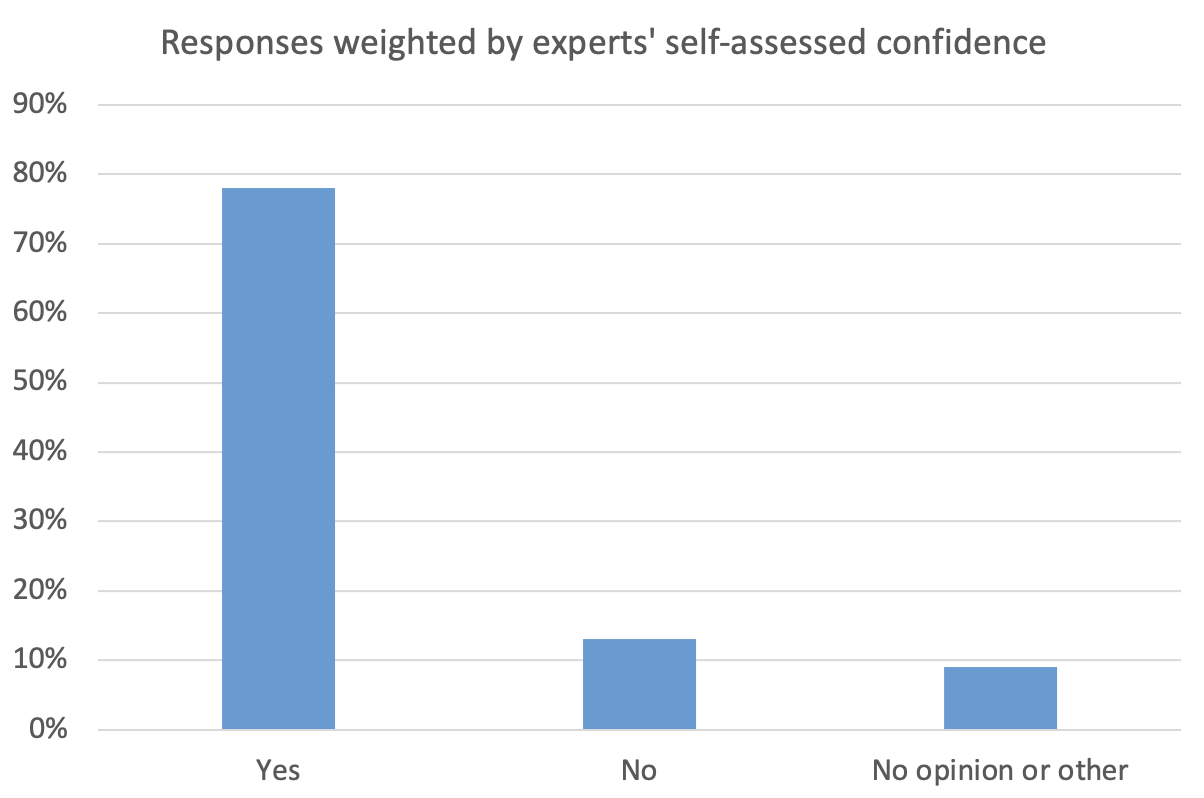

Twenty-six panel members answered this question. A majority of 72% support taxing the excess profits of energy companies.

Most panellists believe that a windfall tax is appropriate in the current situation to support the public and prevent energy producers from earning exorbitant profits during the crisis. Simon Wren-Lewis (University of Oxford) stated that there is “no economic reason to allow energy producers to keep the gains from unusually high energy prices when their costs have not changed.” Martin Ellison (University of Oxford) further argued that there isn’t a need “to worry too much about the incentive effects of a windfall tax on energy companies.” Citing the management of UK War Loans as an example, he states that windfall taxes are a palatable option when the economy’s stability is threatened and wouldn’t necessarily lead to long-term consequences.

However, several panellists expressed their concern for the potential negative precedent that would be set by a windfall tax for future investments. Ricardo Reis (London School of Economics) summarises this, claiming that such a move would “discourage investments on energy supply for the future.” Stephen Millard reiterated this sentiment, stating that “although windfall taxes are economically efficient, if energy companies expect their profits to be subject to a windfall tax whenever prices rise, they will be disincentivised from investing.” He argues that this could have detrimental long-term consequences, as these companies will likely lead investments into green technology that will help the UK move towards net zero.

References

Bank of England (2022), Monetary Policy Report, August.

Milne, A (2022), “The Energy Crisis: Manage Quantities and Avoid Burdening Tax-Payer”, National Institute of Economic and Social Research Policy Paper 35, September.