Italy's political unification was accomplished in 1861 (except for the rump Papal States around Rome, which survived until 1870). Over 162 years later, large regional economic differences remain within Italy with no evidence of convergence. In fact, income in some Italian regions today is less than half that of other regions, and some regional income gaps are greater today than in 1870.

For example, in 2019, the per capita income of the Northern region of Lombardia was €39,700, but for the Southern region of Calabria it was only €17,300. To put this in perspective, the difference between Lombardia and Calabria is similar to the difference between Germany (€41,500 in 2019) and Greece (€17,500 in 2019). Thus, the variation in income per capita within Italy is as large as that within much of the euro area.

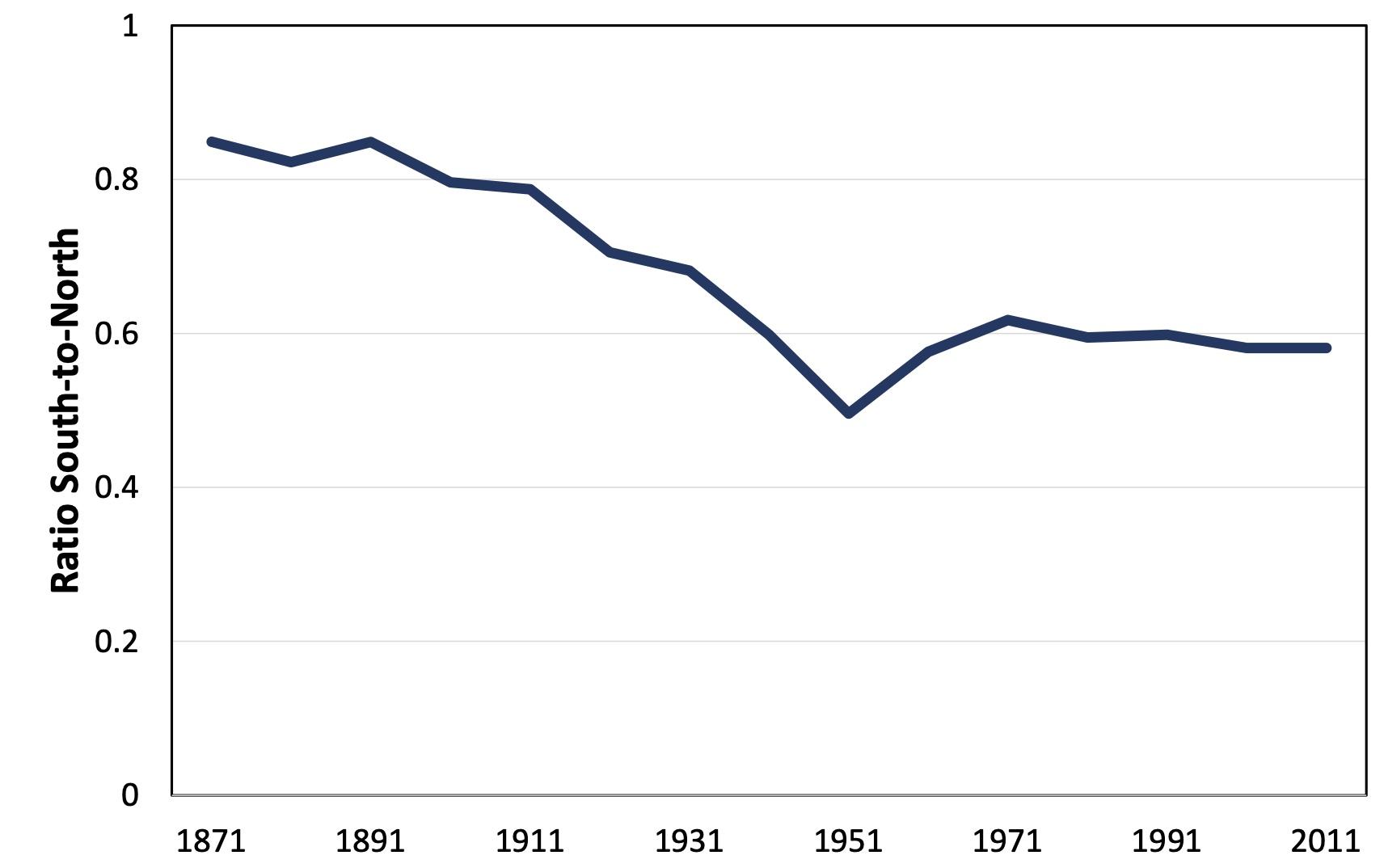

Figure 1 plots the per capita GDP ratio between Southern and Island regions (the ’South’ for short) and Central and Northern regions (the ‘North’) after the unification in 1861 using data from Felice (2019). The first 90 years of unification witnessed regional divergence: the North grew faster as it industrialised around the ‘triangle’ of Milan, Turin, and Genoa by accumulating human capital and taking advantage of the first globalization (Nuvolari et al. 2017, Gomellini et al. 2023). The process of regional divergence was particularly acute from the start of WWI to the end of WWII. The South remained largely rural, and economic policies during the Fascist period were unfavourable to agriculture.

Figure 1 Regional relative per capita GDP from 1871 to 2011

Note: Ratio of per capita GDP in the South over per capita GDP in the North. Northern regions: Emilia-Romagna, Friuli-Venezia Giulia, Lazio, Liguria, Lombardia, Marche, Piemonte, Trentino-Alto Adige, Toscana, Umbria, Val d'Aosta, Veneto. Southern regions: Abruzzo, Basilicata, Calabria, Campania, Molise, Puglia, Sardegna, and Sicilia

The decades after WWII saw a brief period of convergence, mainly in the 1950s and 1960s. The South experienced productivity increases, with large declines in the population engaged in agriculture and a sizeable outward migration, mainly toward the North and the rest of Europe, which reduced the income gap from around 50% to 40%. Also, the central government funded significant investments in the South through the Institute for Industrial Reconstruction and the creation in 1950 of the Cassa per il Mezzogiorno. However, the slowdown in economic growth at the start of the 1970s coincided with the end of the regional convergence. If anything, the South has experienced divergence compared to the North. Nowadays, the per capita income ratio between the South and the North is at the same level as in the early 1930s. This suggests that the inefficiencies and distortions that afflicted the South in the early years of the Italian unification are still present today.

Italy’s lack of regional convergence appears remarkable compared to other similar European countries. For example, in 1871, Spain was around 10% poorer than Italy in terms of per capita income, and its regional inequality in income per capita was 4% higher than Italy’s. In 2005, Spain was still around 10% poorer than Italy in terms of per capita income, but its regional inequality was now 49% lower (Iuzzolino et al. 2013: Table 20.1).

In a new paper (Fernández-Villaverde et al. 2023), we seek to identify the major drivers of the regional income differences in Italy using the macroeconomic approach based on the measurement of various wedges pioneered by Chari et al. (2007). This approach has gained popularity in the macro literature and identifies distortions (called wedges) affecting factor inputs and productivity. Even though the wedge analysis does not reveal the ultimate causes of the distortions, it highlights the sectors or segments of the economy where allocations appear especially problematic. We can then focus our attention on these sectors or segments with a deeper analysis that goes beyond the measurements of the wedges.

The model consists of two integrated regions. The first is representative of the Northern and Central regions. The second is representative of the Southern and Island regions. Each region in the model produces two types of goods: tradable and nontradable. The presence of these two sectors allows us to distinguish regional income differences when income is measured in actual purchasing power. This could be important for capturing the impact of national transfer policies such as pensions and public wages that, in euro terms, are about the same across regions but with different purchasing power across regions.

Another feature of the model is that tradable and nontradable goods could be produced in the official and unofficial economy. The unofficial economy – also referred to as the irregular or underground economy – plays an important role in Italy, especially in the South, because of its size. In more recent years, irregular occupations in the North are estimated to be around 11%, while in the South, they are about 20%.

Using the model and the macroeconomic data constructed by the Italian Statistical Agency (ISTAT), we measure three types of wedges that distort the optimal decisions of households and firms from 2000 to 2020: those that distort the input of labour, those that distort investment, and those that distort total factor productivity. All three types of wedges are higher in the South than in the North, which is not surprising: when looked at through the lens of the model, the fact that the South has lower income must be because the wedges in the South are higher than those in the North. But our goal is to understand which of the measured wedges are especially important for generating lower income in the South.

We conduct a battery of counterfactual exercises with our model to answer that question. For instance, we compare the baseline steady-state equilibrium with a counterfactual steady-state equilibrium in which some of the wedges in the South are set equal to their corresponding values in the North. In this way, we quantify the importance of each wedge in generating regional income disparity. We find that differences in labour and investment wedges contribute somewhat to income disparity, but the main contributors are differences in total factor productivity. In comparison with Schivardi et al. (2016), who argue that firms in the North have experienced the sharpest increase in resource misallocation since the 1990s, we see little by way of an increase in the labour and investment wedges in the North.

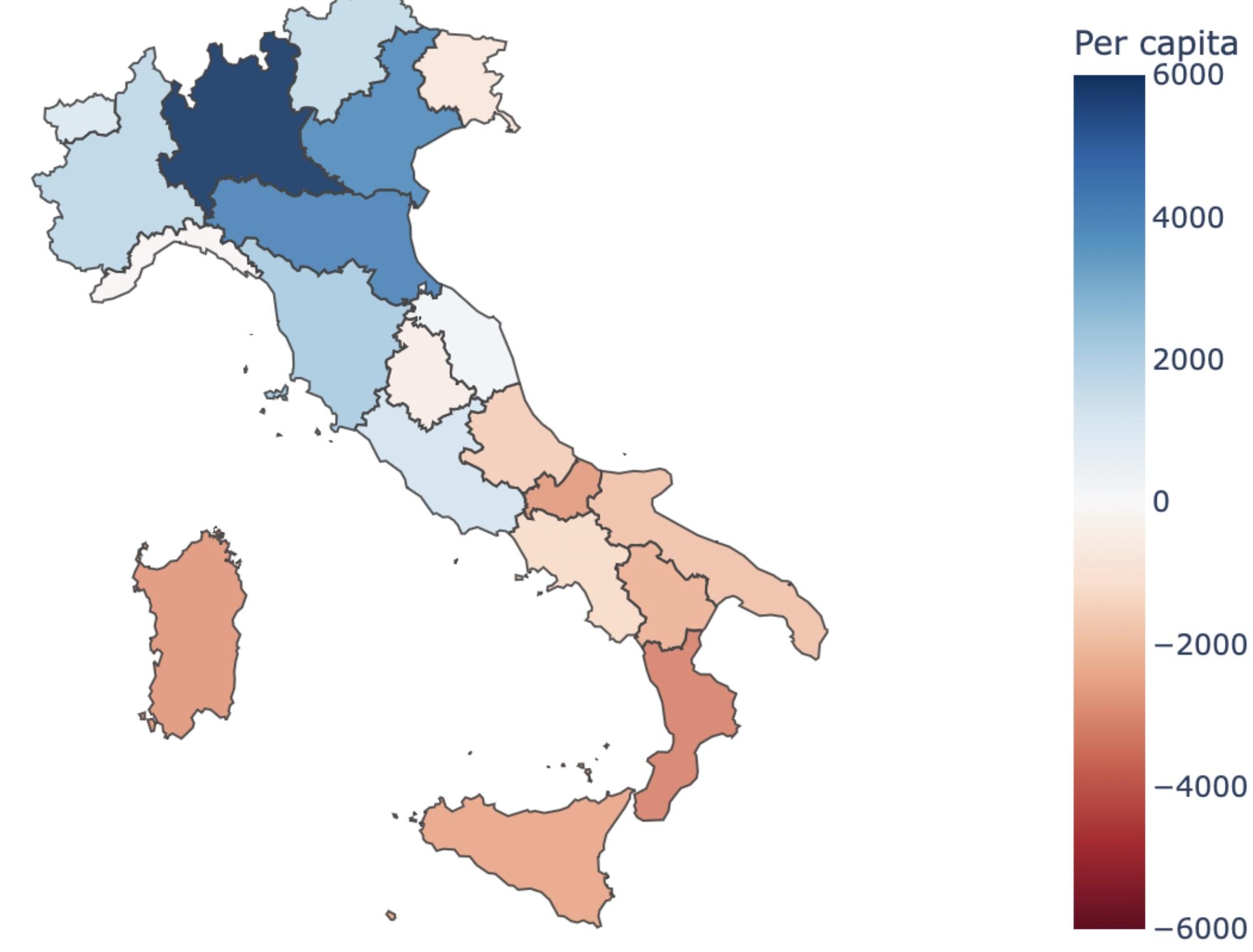

We also find that inter-regional fiscal transfers contribute significantly to regional income differences (see Figure 2). The combined contribution of productivity differences and inter-regional fiscal transfers accounts for more than 70% of the income gap between Southern and Northern regions.

Figure 2 Per capita fiscal balance in 2019 for each Italian region (in euros)

Source: Conti Publici Territoriali, which provides consolidated expenses and revenues in current and capital accounts for the whole public sector in Italy.

The finding that inter-regional fiscal transfers contribute to regional income disparities is the most interesting finding, and the intuition is straightforward. First, inter-regional fiscal transfers are large. In the baseline calibration, the size of the transfers the South receives from the North is 6.56% of the total output produced in the South. Conversely, the North pays transfers to the South that are 2.08% of the value of total output produced in the North. The elimination of these transfers has a positive income effect on the supply of labour in the South and a negative income effect on the supply of labour in the North. In the counterfactual steady-state equilibrium without fiscal transfers, the output gap between the South and the North is reduced by one-fourth.

Our investigation has important policy implications beyond understanding Italy's economic performance. Like many other countries, Italy has invested large funds in regional development for decades. Were these monies well spent? After 1975, the EU (at the time, still named the European Economic Community) made regional policies one of its core missions. Nowadays, the European Structural and Investment Funds account for more than one-third of the whole budget of the EU, with a forecasted expenditure of €392 billion in 2021-2027. Will these funds make a difference? Our paper's results cast doubt on the efficacy of these regional policies per se and engender a quest to look at the importance of the quality of local institutions and the political economy incentives of the allocation of funds.

The next step is to deepen the analysis to understand why the wedges (or distortions), especially those affecting productivity, are different between the North and the South. Given the growing concerns about regional inequality across Europe (Wolf and 2018), this should be the focus of future research.

References

Chari, V V, P J Kehoe, and E R McGrattan (2007), “Business Cycle Accounting,” Econometrica 75: 781–836.

Felice, E (2019), “The Roots of a Dual Equilibrium: GDP, Productivity, and Structural Change in the Italian Regions in the Long Run (1871–2011)”, European Review of Economic History 23: 499–528.

Fernández-Villaverde, J, D Laudati, L Ohanian, and V Quadrini (2023). “Accounting for the Duality of the Italian Economy”, Review of Economic Dynamics, forthcoming.

Gomellini, M, A Missiaia, and D Pellegrino (2023), “Openness to Trade and Regional Growth: Evidence from Italy during the First Globalisation”, VoxEU.org, 21 January.

Iuzzolino, G, G Pellegrini, and G Viesti (2013), “Regional Convergence,” in G Toniolo (ed.), The Oxford Handbook of the Italian Economy Since Unification, Oxford University Press, 571–598.

Nuvolari, A, M Vasta, and G Federico (2017), “The Origins of the Italian Regional Divide: Evidence from Real Wages, 1861-1913”, VoxEU.org, 6 November.

Schivardi, F, G Ottaviano, M Del Gatto, F Hassan, and S Calligaris (2016), “Italy’s Productivity Conundrum: The Role of Resource Misallocation”, VoxEU.org, 28 June.

Wolf, N and J R Rosés (2018), “The Return of Regional Inequality: Europe from 1900 to Today”, VoxEU.org, 14 March.