Editors' note: This column is part of the Vox debate on "Lessons from Recent Stress in the Financial System"

In the banking industry, mistakes made by management can have significant external impacts in addition to individual bank problems. Therefore, it is necessary for the banking business to be regulated and the banking supervisor monitors the risks of banks. Thanks to these activities, bank crises are rare. However, systemic risks are related to the structure of the banking business model. Furthermore, there is always the possibility that one of the thousands of banks may face overwhelming risks, which can lead to doubts and problems being directed towards the entire industry.

Bernanke et al. (2019) suggest that the best solution to a crisis is to prevent it in the first place. Every crisis, even if handled well, leaves some unfavourable mark on the economy. Additionally, crisis solvers must have the necessary tools readily available. Geithner (2014) suggests several principles that should be kept in mind. First, he cites the ‘Bagehot Doctrine’ that central banks provide sufficient liquidity to the banking system against good collateral at a sufficient interest rate (Bagehot 1873). Second, he stresses the need for an emergency financing mechanism for the non-banking financial sector. Third, he acknowledges that the state may have to cover the risks related to the disaster in a deep financial crisis. The government may need to provide guarantees because private capital cannot be mobilised adequately. Expanding deposit protection was a key step on both sides of the Atlantic during the financial crisis.

He likened the financial crisis to war and the so-called ‘Powell doctrine’, which suggests that war should only be undertaken as a last resort. If force majeure is required, monetary and financial stability tools should be brought to bear. Tools may be needed for an extended time. Lastly, Geithner suggests that weak actors should be allowed to fail while at the same time, allowing the strongest actors and institutions to emerge stronger post-crisis.

"The more you commit to do, the less you'll have to do" (Timothy Geithner)

The Financial Stability Board (FSB) created the ‘Key Attributes’ principles in 2011 (revised in 2014), which have served as a guide in developing crisis resolution architecture worldwide. According to the principles in use in the EU, bank crises are addressed by resolution tools by the authorities if three conditions are met. The first condition is the bank's risk of collapse (“failing or likely to fail”). This is assessed by both the ECB's banking supervisor and the EU's authority Single Resolution Board for the largest banks in participating countries. The second condition is that there is a “public interest” in acting. The final assessment of the existence of public interest is made by the authority. The third condition is that there is “no alternative solution” that would solve the crisis without the help of the authorities. Each of these conditions must be met before the EU authority uses resolution tools. If any of these are missing, the crisis bank may be allowed to go into liquidation proceedings by the local authorities.

Events of financial instability

Financial instability is a real or expected threat to financial markets or financial institutions due to an event, which could potentially, if public authorities do not intervene, lead to problems. Recent events are a mixture of the situation, broader themes, and individual mistakes. Each event and crisis is unique, so while generalisations can be made, caution must be exercised. Reinhart and Rogoff (2009) highlighted various aspects in their famously titled book, "This Time is Different". Holmström (2015) has stated that crises are information events where the state of affairs turns from the often optimal ‘no questions asked’ state to a stage when information needs would increase. Diamond and Dybvig (1983) have shown the benefits of deposit insurance for banking and this concept has been one key element.

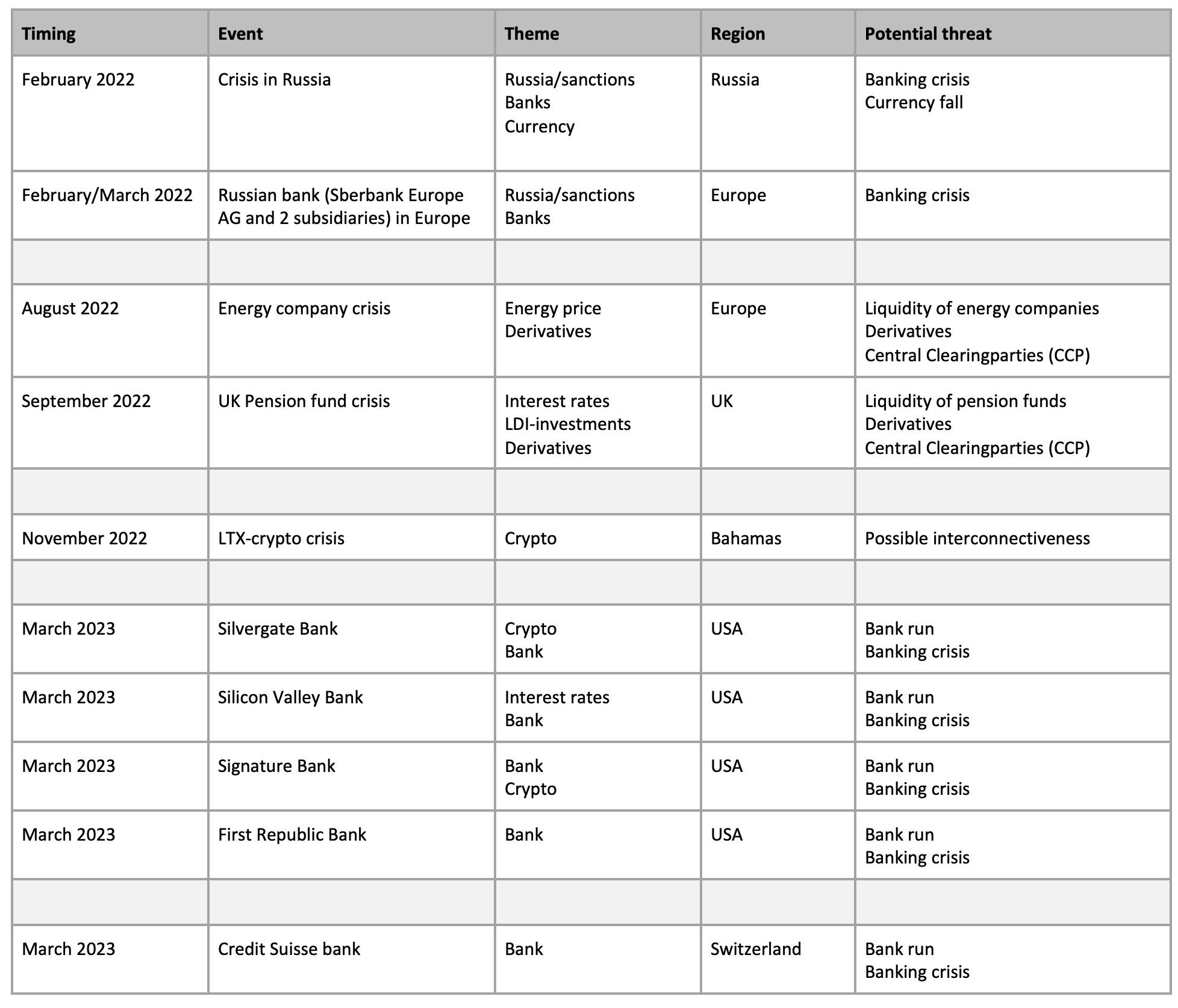

Table 1 describes the events of 2022-2023 in which financial stability was threatened. Many of these are isolated situations and many were connected to each other. It's not just about general causes and factors of the crises; each of them also involves mistakes by individual firms, which cannot be blamed on others. The financial stability crises were each potentially devastating. Each of them, without the intervention of public authorities, could have turned the current financial system upside down.

Table 1 Events of financial instability, 2022-2023

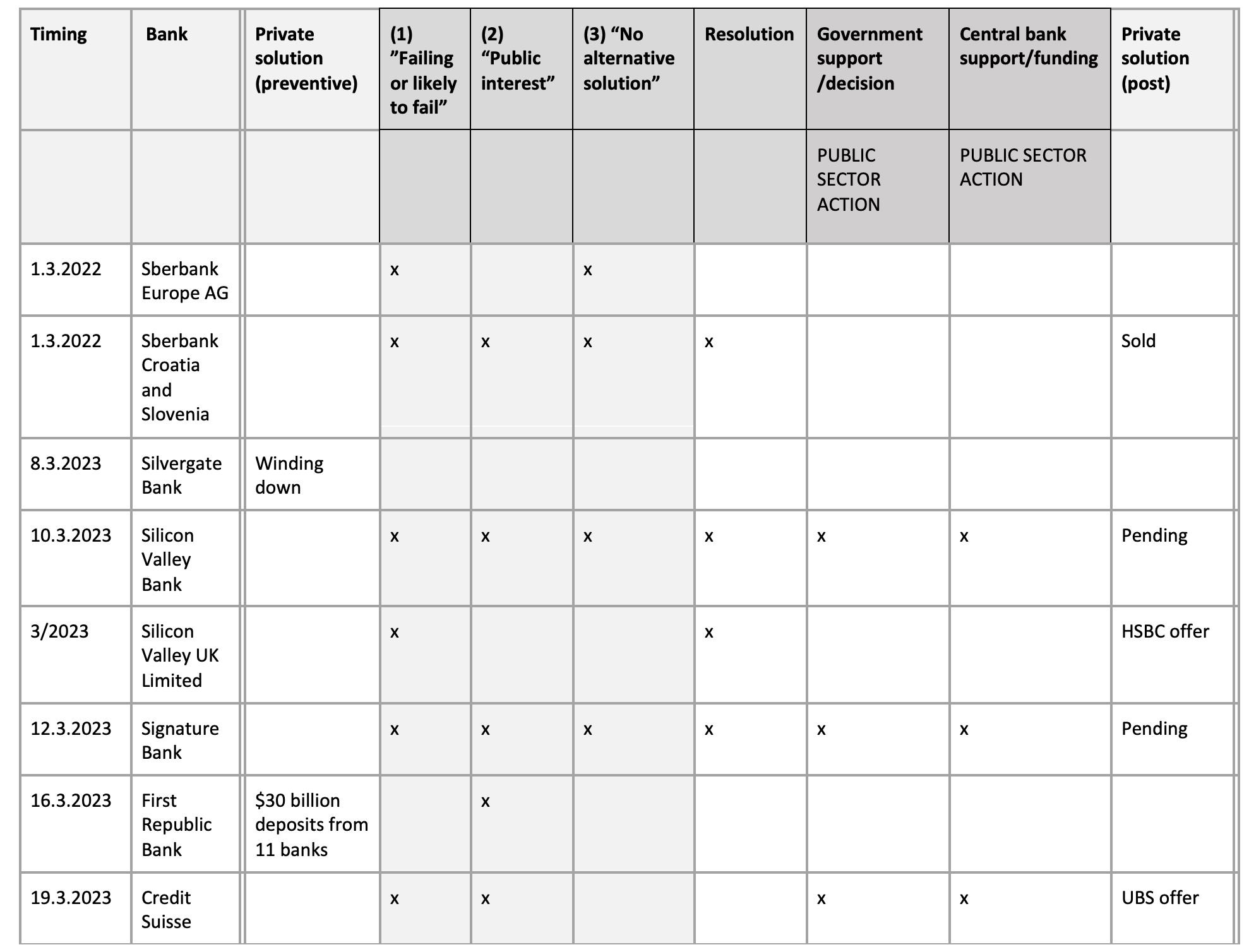

In Table 2, some events of the years 2022-2023 are described from the perspective of financial stability, using the EU’s general classification established by the BRRD Directive (2014). According to this classification, the conditions for the use of resolution for financial institutions are: (1) failing or likely to fail, (2) public interest, and (3) no alternative solution. If these are met, the authorities may solve the crisis with crisis resolution tools in accordance with the EU legislation. The framework has been used here for illustrative purposes, although only a few of them are banks in the EU region. Thus, the table serves as a reference framework for evaluating the severity of crises and the used resolution methods.

Table 2 helps to understand how widely crisis resolution tools are used in crises and to what extent the intervention of the state and the central bank is needed. In conclusion, it can be stated that the resolution tools were used in clear situations. Many times, however, certain tools may not be used. Moreover, the authority, the state, and the central bank may create a solution using additional available means.

Table 2 Evaluation of the selected crises in banks in the US and Europe in 2022 and 2023

Note: The EU framework for resolution of financial institutions differs from other jurisdictions and therefore the classifications used in the table are only for illustrative purposes when comparing certain characteristics of the events. Events and used tools are also impacted by specifics of financial agreements and circumstances.

The most visible of the crises in banks was the failure of the Silicon Valley Bank (SVB) (total assets $212 billion). The Federal Deposit Insurance Corporation (FDIC) announced that it would take over SVB bank on Friday 10 March 2023. The FDIC is the US deposit insurance agency whose mission is to make sure that deposits are safe and therefore created a bridge bank as the first step. The FDIC, Fed, and the US Treasury (US president) decided to apply the Systemic Risk Exception to protect all deposits at SVB and Signature Bank (total assets $111 billion) on 12 March 2023. This allowed them to enlarge exceptionally the basic principle of guaranteeing deposits only up to $250,000. The Fed also allowed certain risk-free assets to be valued at par when used as funding collateral.

In the US, the previous big bank collapse was in 2008 when Washington Mutual Bank was taken into resolution by the authorities. Troubled banks occur every year in the US banking system. In the past five years, there have been between 40 and 60 problem cases brought to the FDIC each year. The number of problem banks has decreased since the financial crisis in 2008. There hasn’t been a single problem the size of SVB since 2008. Hence, the failure of SVB was a rare event.

In Switzerland, Credit Suisse (total assets CHF 531 billion) faced severe problems in mid-March 2023. The solution was found with a package of UBS offer, government decisions, and central bank funding. AT1 securities were written down as part of the solution.

Key lessons learned

The events mentioned above posed a threat to financial stability and therefore had to be safeguarded against. Each chain of events had the potential to cause serious problems on its own, which required the intervention of authorities, the government, and the central bank to secure financial stability quickly and appropriately. The effectiveness of such measures can only be evaluated over time and from a long-term perspective. The crises were centred around the vulnerabilities present in the banking system and derivatives market.

The banking system's resolution mechanisms work, but specific cases may require tailored solutions that include government and central bank actions. However, the three largest crisis cases where authorities intervened needed specific emergency decisions by governments and central banks in the US and in Switzerland. The key lesson for the euro area from these cases is that significant government backstop arrangements and funding in resolution solutions need to be in place to safeguard financial stability. The current frameworks in the euro area and in the US ensure already that if losses incur those will be borne by the industry.

Rules and supervisory practices should be reviewed and revised, if necessary, to ensure their effectiveness. Dewatripont et al. (2023) have raised the need to develop resolution frameworks. The current architecture of the banking system needs to be re-evaluated and revised to address vulnerabilities. Reforms to the derivatives market must also be examined and updated based on the lessons learned from the crises. The next crisis will be unique, even though it may resemble previous ones, and solutions to each crisis will vary, especially in more significant crises. Financial markets adapt their behaviour based on past events, regardless of whether rules are changed or not, which means that the next crisis will be different.

References

Bagehot, W (1873), Lombard Street: A Description of the Money Market.

Bernanke, B, T Geithner and H Paulson (2019), Firefighting - the Financial Crisis and its Lessons, Profile Books.

BRRD Directive 2014/59/EU (2014), “Recovery and Resolution of Credit Institutions and Investment Firms”, 15 May.

Dewatripont, M, P Praet, and A Sapir (2023), “The Silicon Valley Bank collapse: Prudential regulation lessons for Europe and the world”, VoxEU.org, 20 March.

Diamond, D and P Dybvig (1983), “Bank Runs, Deposit Insurance, and Liquidity”, The Journal of Political Economy 91-3: 401-419.

Federal Deposit Insurance Corporation (FDIC) (2023), “Press releases March 10 and 12”.

Financial Stability Board (2014), Key Attributes of Effective Resolution Schemes for Financial Institutions, October.

Geithner, T (2014), Stress Test - Reflections on Financial Crises, Penguin Random House.

Holmström, B (2015), “Understanding the Role of Debt in the Financial System”, BIS Working Papers No 479, January.

Reinhart, C and K Rogoff (2009), This Time is Different - Eight Centuries of Financial Folly, Princeton University Press.