DP13637 Covered Interest Parity Arbitrage

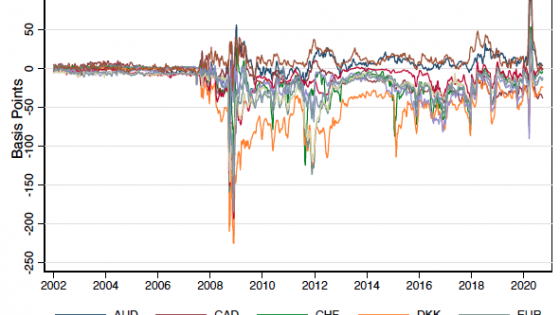

We show that it is crucial to account for the heterogeneity in funding costs, both across banks and across currency areas, in order to understand recently documented deviations from Covered Interest Parity (CIP). When CIP arbitrage is implemented accounting for marginal funding costs and realistic risk-free investment instruments, the no-arbitrage relation holds fairly well for the majority of market participants. A narrow set of global high-rated banks, however, does enjoy riskless arbitrage opportunities. Such arbitrage opportunities emerge as an equilibrium outcome as FX swap dealers set prices to avoid inventory imbalances. Low-rated banks find it attractive to turn to the FX swap market to cover their U.S. dollar funding, while swap dealers elicit opposite (arbitrage) flows by high-rated banks. Such arbitrage opportunities are difficult to scale, with funding rates adjusting as soon as arbitrageurs increase their positions.