Discussion paper

DP13519 The Slope of the Term Structure and Recessions: Evidence from the UK, 1822-2016

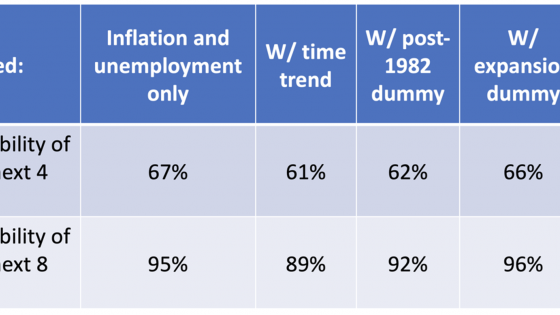

This paper investigates whether the inversion of the yield spread, with short-term rates higher than the long-term rate, has been and remains an effective predictor of recessions in the U.K. using monthly data from 1822 to 2016. Indicators of recession are constructed in a variety of ways depending on the availability and properties of the data in the pre-World War 1, inter-war, and post-World War 2 periods. It is found that, using peak-to-trough recession indicators and a probit regression model, there is reasonably strong evidence to support the inverted yield spread being a predictor of recessions for lead times up to eighteen months in all three periods.

£6.00